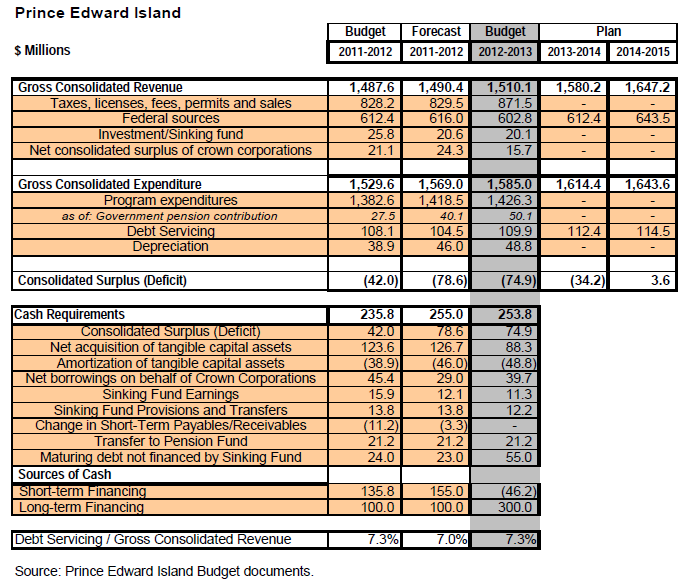

Highlights- For the 2011-12 fiscal year that just ended, the estimated deficit is $78.6 million (5.3% of revenues), or $36.6 million more than was budgeted last spring.

- For 2012-13, the budgeted deficit is $74.9 million (5.0% of revenues).

- A three-year fiscal plan now sets the return to budget balance to 2014-15, one year later than projected last year.

- The Government announces its intention to enter into negotiations with the Federal Government on sales tax harmonization with an effective implementation date of April 1, 2013.

- Expense growth is curbed over the three-year fiscal plan.

- Economic growth is assumed at 1.4% in 2012 (estimated at 1.5% in 2011).

- The 2012-13 financing requirement is budgeted at $253.8 million, a touch lower than the estimated $255 million in 2011-12. Long-term borrowing is expected at $300 million as short-term borrowing will be reduced.

The budget tabled today by Finance, Energy and Municipal Affairs minister Wesley J. Sheridan acknowledges that the Province is facing fiscal pressures that, if left unaddressed, would increase the deficit to $150 million or more in the foreseeable future. A three-year budget plan wants to correct the path so as to reach a balanced budget in 2014-2015. This is one year later than what was projected in last year’s budget.

Last year, expense growth targets were missed. Program expenses are forecast to be 2.6% over budget, or $35.9 million. Employee benefits accounted for $15.6 million (40% over budget), the bulk of the increase coming from government pension contribution. Expenditures of the community services and seniors department were $6.8 million over budget (7.4%) while agriculture costs were up $5.3 million (13.8%). Revenues from liquor sales, golf and other fees were down $5.5 million.

The government faces three sources of fiscal pressure. The first source is the changing global economy. Prior to the recession, the government contributed $8 million a year toward pensions. Since then, the poor performance of equity markets forced the government to increase its contribution to $40 million last year, and it expects to contribute $50 million this year. Also, corporate revenue still has to recover from the recession ($43.3 million in 2006-07 against $40.9 million projected for 2012-13).

The second source of pressure is the rising cost of health care, which has grown 7% annually between 2007-08 and 2011-12. The third source of pressure is the fiscal capacity of the province which makes it rely on federal transfers for 41% of its revenues last year, a proportion that is projected to decrease slowly in the next three years.

The three-year budget plan has to address these fiscal pressures and the resulting structural deficit. According to the plan, funding for health care will increase by 4.1% in 2012-2013 and growth will be capped at 3.5% in the two subsequent years, education expenditures will increase by 1.8% this year with no further increases in the next two years and expenditures in most other departments will be reduced between 3% and 5% this year and will hold the line in subsequent years.

In order to increase revenues, the government wants to increase its sales tax base by moving to a Harmonized Sales Tax as of April 1, 2013. The plan allows for a reduction from 15.5% to 14% of the federal-provincial combined tax rate. Under the three-year plan, revenues are expected to increase 1.3% in 2012-13, 4.6% in 2013-14 and 4.2% in 2014-15. Almost half of the increase in the third fiscal year is projected to come from federal transfers. Expenses are expected to increase 0.9% in 2012-13 and 1.8% in each of the next two years. This is necessary in order to balance the books in 2014-15.