March Personal Consumption Expenditures (PCE) released this past week suggest that the consumer is returning to the consumption trough. Many pundits are convinced a consumer driven recovery is beginning to grab hold. Per Christopher S. Rupkey, Chief Financial Economist for the Bank of Tokyo – Mitsubishi UFJ:

But the real surprise was consumer spending, which was stronger than our own estimates and hopes, rising 2.9% and thus contributed 2.0 percentage points to GDP. Consumption in February was only running about 1.6% on a rolling 3-month average basis, but the retail sales data for March released on April 16 was stronger with upward revisions and now real consumption is up close to normal at 2.9%.

During the housing bubble years consumer spending was 3.3%, 2.8%, and 3.2% in 2004-06, respectively. It is important to note that it was not just car purchases in the first quarter; consumers also purchased more nondurable goods and services. Household heating services was depressed in Q4 2011 due to the warm winter weather.

Consumer spending looks to be broadening out from just car & light truck sales which have moved up a lot already from 12.5 million in Q3 2011 to 14.5 million in Q1 2012. We expect consumer spending to continue to rise this year, close to a 3.0% rate, as it is supported by better consumer sentiment readings and an improved outlook for the labor market as shown by the Conference Board survey saying fewer consumers think jobs are hard to get.

The “recovery”, until the end of 2011, was driven primarily by goods production with the consumer weakly playing a supporting role. The major driver in 1Q2012 GDP was the consumer.

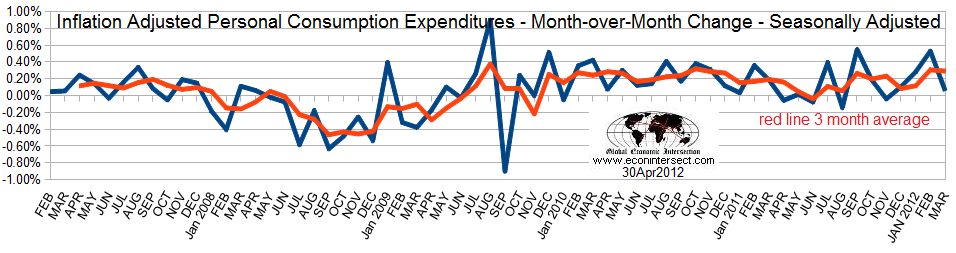

The question on the table: Is consumption here to stay? In the Econintersect analysis of PCE, the following chart was included, based on the BEA’s annualized monthly estimates. (Stated differently, these are numbers the BEA analytically guesses the annual consumption would be if all months in the year were like the current month.) From this graph, it appears that consumption is trending up using a 3 month rolling average to smooth out this very noisy index. This graph tends to support the suggestion that consumption is strengthening. From my vantage point, I am not a lover of seasonally adjusted data as the New Normal is rife with unexplainable data oscillations that never occurred before the recession of 2007. Seasonal adjustments work well when your data series is consistent every year.

From this graph, it appears that consumption is trending up using a 3 month rolling average to smooth out this very noisy index. This graph tends to support the suggestion that consumption is strengthening. From my vantage point, I am not a lover of seasonally adjusted data as the New Normal is rife with unexplainable data oscillations that never occurred before the recession of 2007. Seasonal adjustments work well when your data series is consistent every year.

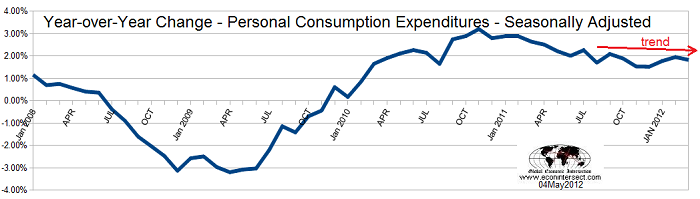

Historical consistency is not real world in our New Normal. Year-over-year trends allow a better understanding of the dynamics.

In the above graphic, the “less good” consumer growth downtrend is clearly showing. One might argue that the less good trend is subsiding, but it is impossible to argue based on the current data that consumer consumption’s rate of growth is improving. What has happened is that the other green shoots have yellowed, and only consumer consumption remains with any sort of solid green.

Debate about what lies ahead is fodder for the pundits. It is possible to identify many headwinds, and a few tailwinds. My usual argument is that 2% annual economic growth is almost no growth, but the USA economy is in an unusual position of a 4+ year depression which does not carry much room for additional contraction. In real terms, per capita spending (as measured by GDP) remains 2% below January 2008 levels.

My opinion (not fact or fact based analysis) is that consumer spending growth will stabilize around 2% per year, and can grow faster if the economy can consistently grow jobs at over 2 million per year. Spending is relative to people having jobs. For me, it always has been and always will be about jobs.

Other Economic News this Week:

The Econintersect economic forecast for May 2012 shows moderate growth. There was some improvement in the government pulse point, but degradation in some of our transport related pulse points. Overall, the pluses and minuses balanced out.

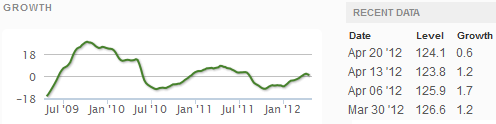

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

This week ECRI’s WLI index value declined for the third week in a row to 0.6 – after the previous twelve weeks of index improvement. This index is now showing the economy six month from today will be as bad as it is today.

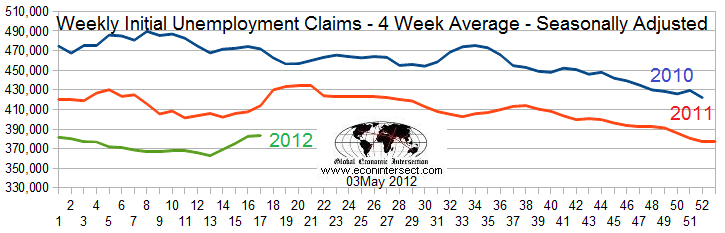

Initial unemployment claims essentially decreased from 388,000 (reported last week) to 365,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose from 381,750 (reported last week) to 383,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this past week which contained economically intuitive components (forward looking) were rail movements and the transport portion of the Jobs report. Rail movements this week were good if one ignores coal.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: Evergreen Solar and Hawker Beechcraft.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Return Of The Consumer?

Published 05/06/2012, 12:34 AM

Updated 05/14/2017, 06:45 AM

Return Of The Consumer?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.