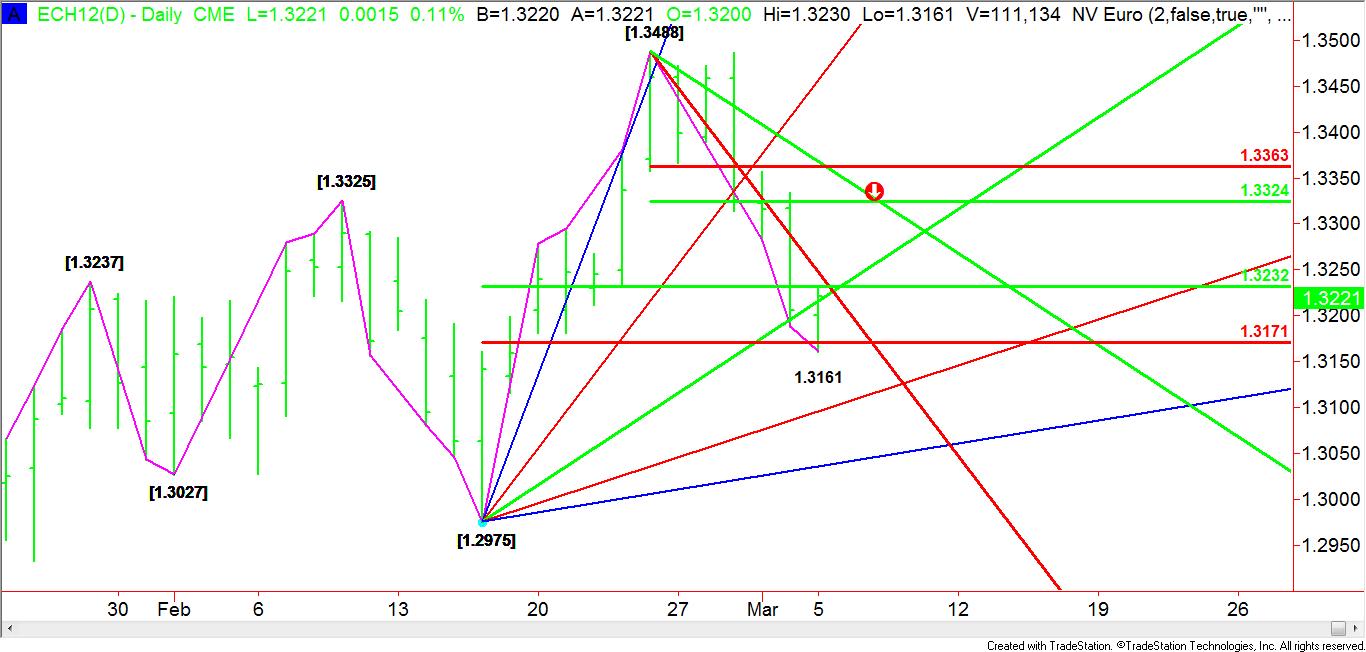

After breaking through an uptrending Gann angle this morning at 1.3215, the March Euro continued to break until it found support near a Fibonacci retracement level at 1.3171. The actual low was 1.3161. The subsequent rally has put the Euro in a position to regain the 50 percent price level at 1.3232.

In addition to the 50 percent price level, downtrending Gann angle resistance drops in at 1.3248, making 1.3232 to 1.3248 a “loose” resistance cluster. Breaking through this cluster will put the market on the bullish side of the uptrending Gann angle at 1.3215.

If the Euro can continue to hold this angle over the next two days then the single currency will be in a position to test a downtrending Gann angle from the 1.3488 top at 1.3328 on March 7. This price is important because it will form a resistance cluster with another 50 percent price level at 1.3324.

With little conviction on either side of the market, the Euro was able to reverse its earlier downtrend to post a slight gain. Earlier in the trading session, traders were pressuring the Euro in reaction to the news that China was planning to slow its growth this year. This news drove down demand for higher yielding currencies.The subsequent turnaround in the Euro is being credited to short-covering and light bottom-picking ahead of Greece’s planned debt holder’s swap and the U.S. monthly Non-Farm Payrolls report on Friday.

Traders may have to endure choppy two-sided trading this week according to the chart pattern since the Euro is trading between a pair of retracement zones. In addition, uncertainty ahead of the U.S. employment report may cause institutional traders to remain on the sidelines until they receive some clarity.

Without any apparent breakout opportunities on the daily chart, traders are likely to rely on precise support and resistance levels to trigger their trading opportunities.

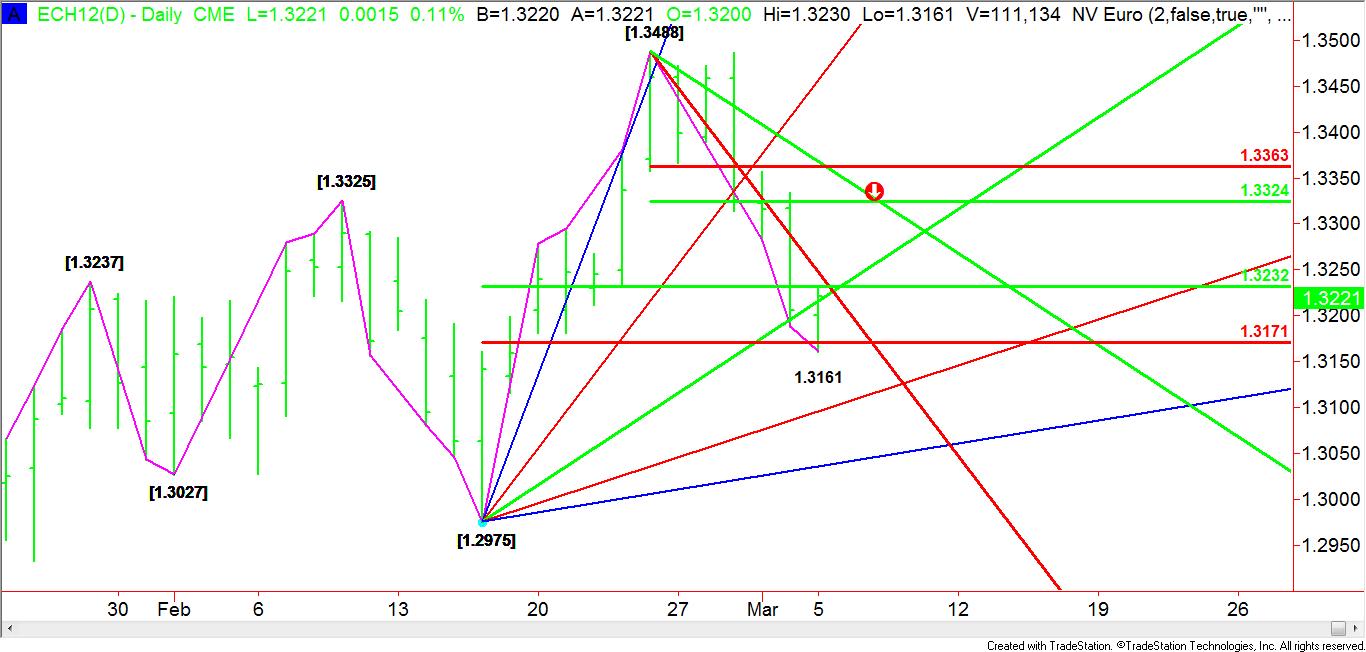

In addition to the 50 percent price level, downtrending Gann angle resistance drops in at 1.3248, making 1.3232 to 1.3248 a “loose” resistance cluster. Breaking through this cluster will put the market on the bullish side of the uptrending Gann angle at 1.3215.

If the Euro can continue to hold this angle over the next two days then the single currency will be in a position to test a downtrending Gann angle from the 1.3488 top at 1.3328 on March 7. This price is important because it will form a resistance cluster with another 50 percent price level at 1.3324.

With little conviction on either side of the market, the Euro was able to reverse its earlier downtrend to post a slight gain. Earlier in the trading session, traders were pressuring the Euro in reaction to the news that China was planning to slow its growth this year. This news drove down demand for higher yielding currencies.The subsequent turnaround in the Euro is being credited to short-covering and light bottom-picking ahead of Greece’s planned debt holder’s swap and the U.S. monthly Non-Farm Payrolls report on Friday.

Traders may have to endure choppy two-sided trading this week according to the chart pattern since the Euro is trading between a pair of retracement zones. In addition, uncertainty ahead of the U.S. employment report may cause institutional traders to remain on the sidelines until they receive some clarity.

Without any apparent breakout opportunities on the daily chart, traders are likely to rely on precise support and resistance levels to trigger their trading opportunities.