With very little news out overnight, we’ve got the market picking through the damage the USD has done this morning and anticipating where it needs to jump back into the action as the ECB and US employment report rolling over the next two days.

The only economic data point of note overnight was the slightly disappointing Australian GDP number for Q4 for those of us interested in the ancient past of last quarter’s economic growth. Meanwhile, the Australian AiG construction survey dipped to a very weak 35.6 and has been below 50 since June of 2010. That’s a spectacular run for a survey of this kind. Also overnight, we had a Chinese response to a US trade bill that was aimed at maintaining import duties on products the US deems are over-subsidized by China. China said the bill is “not consistent with US law” or WTO rules. The arena of trade protectionism becomes an interesting one as China tries to transform its economy in coming years.

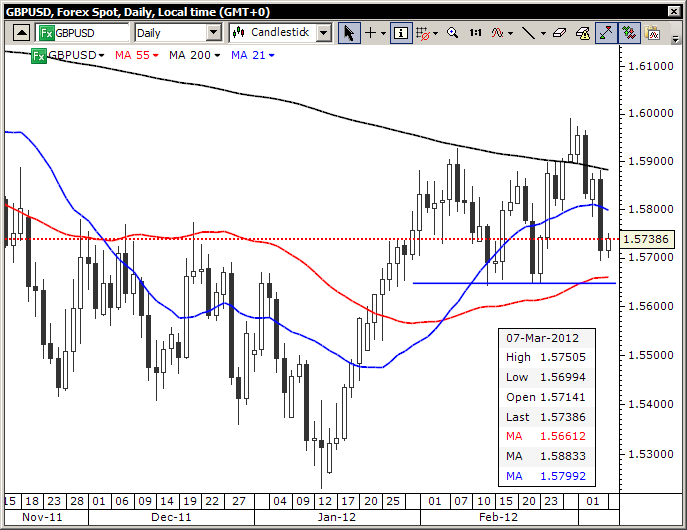

GBP/USD

GBP/USD suffered ugly damage yesterday, confirming that the recent break of the 200-day moving average was a false one. By the end of the week, we will get an idea of whether the pair will simply continue to be very volatile within a range or if it is set for a lower test of 1.5500 or beyond if the 1.5650 area support gives way. Note that the 1.5800-ish area was a neckline of a head and shoulders formation on the hourly charts. GBP/USD" title="GBP/USD" width="687" height="530">

GBP/USD" title="GBP/USD" width="687" height="530">

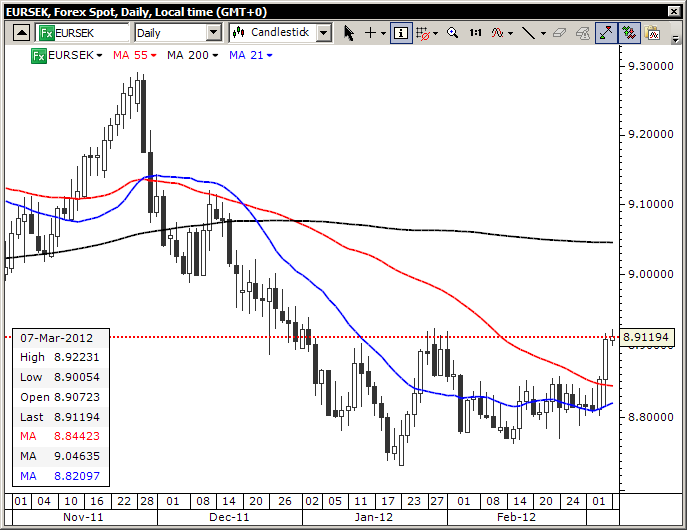

EUR/SEK

Scandie traders were in for real volatility yesterday, as the Scandies proved to be the G10’s weakest currencies yesterday, an especially interesting development as it belied the notion that they could serve as Their Achilles heel? While they both have solid balance sheets, their critical weakness in times of market stress are their lack of liquidity. SEK is the weaker of the two and this 8.93 area looks important in EURSEK, with a break possibly triggering a run on the 9.05 200-day moving average if this risk sell-off deepens. Watch out for Riksbank governor Ingves out speaking later. EUR/SEK" title="EUR/SEK" width="687" height="530">

EUR/SEK" title="EUR/SEK" width="687" height="530">

Further panic or consolidation?

Elsewhere, the market is looking around and dusting itself off after volatility reared its ugly head yesterday in a fashion we should all be familiar with in ever-upward-grinding-no-real-retracement markets like we saw since mid December. Asymmetric volatility is a signature of markets dominated by the carry trade – though actually during the windows of time when a volatile sell-off develops, two-way volatility potential increases, as initial bounces are often equally vociferous once the selling recedes. The JPY crosses are likely to remain the highest beta plays in the shortest term.

Looking ahead

Today, we have German factory orders up at 11:00 and the US ADP employment change data, which last time around fell far short of the non-farm payrolls data, though the previous month’s ADP number was an outlier to the strong side, so the two taken together. The market doesn’t know what to do with the ADP survey lately. Please see Macro Mads’ post on today’s numbers.

Tomorrow, we have the ECB, which may do a simultaneous hawk/dove act by continuing to discourage the notion that there will be further long term LTRO’s on offer any time soon (very high odds), while at the same time setting the market up for further interest rate cuts (even odds). The former is largely priced in, the latter – if the ECB makes interest rate cut hints – is not priced in.

Busy Asian session ahead!

Look out for the RBNZ out tonight at 2000 GMT. The market has actually priced in 25 bps of tightening for the next 12 months. The kiwi has rebounded smartly as AUDNZD selling came in yesterday, but the RBNZ has a rather high bar if it is to encourage the market’s rather stretched view on the hawkish case. Also in Asia, watch for the Japanese trade data and how the market reacts after the sharp correction in JPY crosses. Finally, the Australian employment report is up tonight and a weak one could see the AUDUSD testing its key structural support at the 200-day moving average (just above 1.0400).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Retracement Guessing Game Ahead of ADP, ECB & NFP

Published 03/07/2012, 05:41 AM

Updated 03/19/2019, 04:00 AM

Retracement Guessing Game Ahead of ADP, ECB & NFP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.