We need to talk about “financial independence” for a second. It’s one of those catch-all terms you see a lot in financial-industry marketing, for good reason: it means completely different things to different people.

Maybe your idea of financial independence is having a bit of extra income on the side, to go with a regular job you love. Or maybe you want to work only on the projects you like, without the unreasonable boss and 9-to-5 grind. Heck, maybe you want to clock out completely.

Me? I’m a big fan of picking projects I want to do—and I’ve accomplished that in my forties, thanks to the 8%+ yielding investments I want to take you on a guided tour of today: closed-end funds (CEFs).

CEFs’ High Yields + Years of Compounding = Financial Independence

No matter where you are on the idea of financial independence, CEFs really should have a place in your portfolio. Their high payouts are key to building wealth fast, thanks to the magic of dividend reinvestment and compounding.

The problem for most folks is that they’re stuck with the meager 1.6% yield the average S&P 500 stock pays. And reinvesting a payout that small just doesn’t make compounding work quickly enough to get us to our own specific dream of financial independence.

We need bigger, sturdier payouts. This is what the best CEFs offer in spades—thanks to them, I achieved the financial independence I craved. And you can, too.

CEFs Give Us Big Dividends and Expert Management—at a Bargain

CEFs hold the same blue-chip stocks—think market dominators like Apple (NASDAQ:AAPL), Visa (NYSE:V) and Alphabet (NASDAQ:GOOGL)—you likely own now. That’s our first big advantage here, because we can essentially keep the stocks we already hold.

Another thing to keep in mind is that the CEF market is much smaller than the ETF space. As I write this, there are about 500 CEFs out there, and many of those have been around for a decade or longer.

The smaller size of the CEF market works in our favor: at 500 funds, we can be sure there’s a CEF—more likely a group of them—that’s perfect for our investment goals. At the same time, the CEF market isn’t so big as to attract the attention of institutional investors. That’s great—more deals in the bargain bin for us to choose from.

The beauty of this is that we can still profit from the expertise of the bigger players through CEFs, which are issued by banks and asset-management firms. These are companies you likely know, like Prudential and BlackRock (NYSE:BLK), as well as less-well-known firms like Nuveen and PIMCO, which each manage over a trillion dollars in assets.

And before we get away from the idea of bargains, there are plenty to be had here, thanks to CEFs’ discounts to net asset value (NAV).

It’s another way of saying that, unlike ETFs, CEFs generally can’t issue new shares to new investors after they’ve been launched. The end result is that these funds can (and often do) trade at different levels than their per-share net asset value (or NAV). More often than not, they trade at a discount.

That makes our play straightforward: wait for a CEF to trade at an unusual discount to NAV, then buy and “ride along” as that discount swings back to “normal.” Which is just the sort of opportunity waiting for us in the fund we’re going to dive into now.

GAM Gives Us Top Stocks and Big Payouts—for 82 Cents on the Dollar

The General American Investors Company (GAM) is a CEF that perfectly illustrates how these funds can lead to financial independence (however you see it!). GAM trades at a 17.9% discount that’s scraping lows not seen since March 2020.

GAM is one of the oldest CEFs in the US, having been founded in 1927. The fund doles out profits from its portfolio of large-cap U.S. stocks—including top holdings Google, Apple and Microsoft (NASDAQ:MSFT)—to investors as dividends.

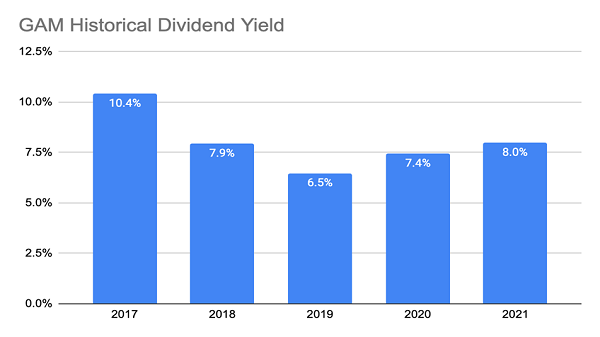

Source: CEF Insider

As you can see above, GAM was paying an average of 8% per year in the five years prior to the 2022 pullback, way more than the S&P 500’s current 1.6%. That’s because GAM, while investing in many of the same companies, actively translates the gains and income it books on its portfolio into cash dividends for investors.

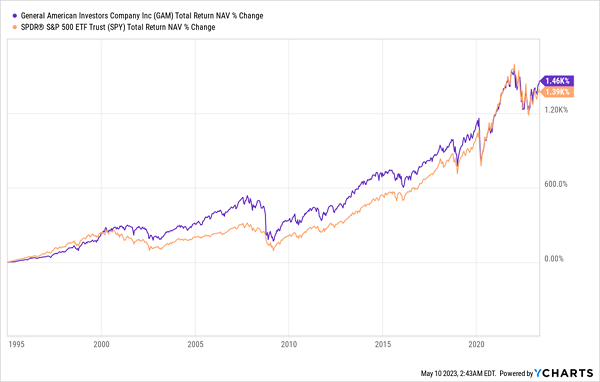

That makes for a dividend that does move around a bit (this explains why GAM only paid out $1 in dividends in 2022, for a 2.5% yield, though this should return to more normal levels as stocks recover). And since GAM invests in S&P 500 stocks, it has a similar track record as the S&P 500 going back decades.

GAM Takes Stocks’ Returns and Turns Them Into Cash

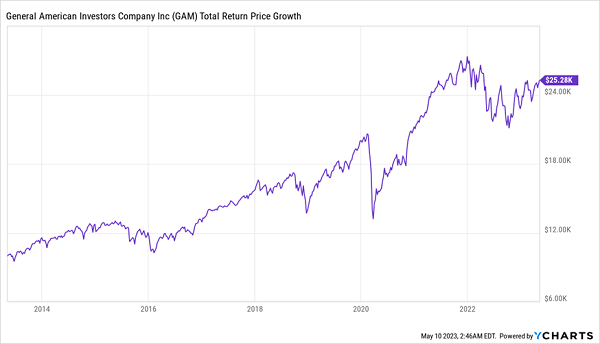

Over the last decade, GAM has returned 9% per year on average. Investors who started with $10,000 in the fund just a decade ago now have seen that initial investment rise to $25,280 in value, as measured in total returns.

That’s all thanks to compounding, and the cash flow that CEFs like GAM deliver makes them uniquely powerful tools to harness compound interest. While CEFs can’t get you to retire tomorrow if you have nothing saved, they could help you retire years earlier than you’d be able to otherwise.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."