My thought on the Retail ETF XRT as we ended last week-

“For Granny Retail XRT we first want to see her hold the 200-WMA at around 71.00. But until she makes her way back over 74.50 area, we are cautious on equities.”

Even after a decent retail sales number first thing Monday morning, Granny still struggled to stay green.

Perhaps that was the peak of spending.

Plus, if you look carefully, the spending was limited to only a few areas of the economy.

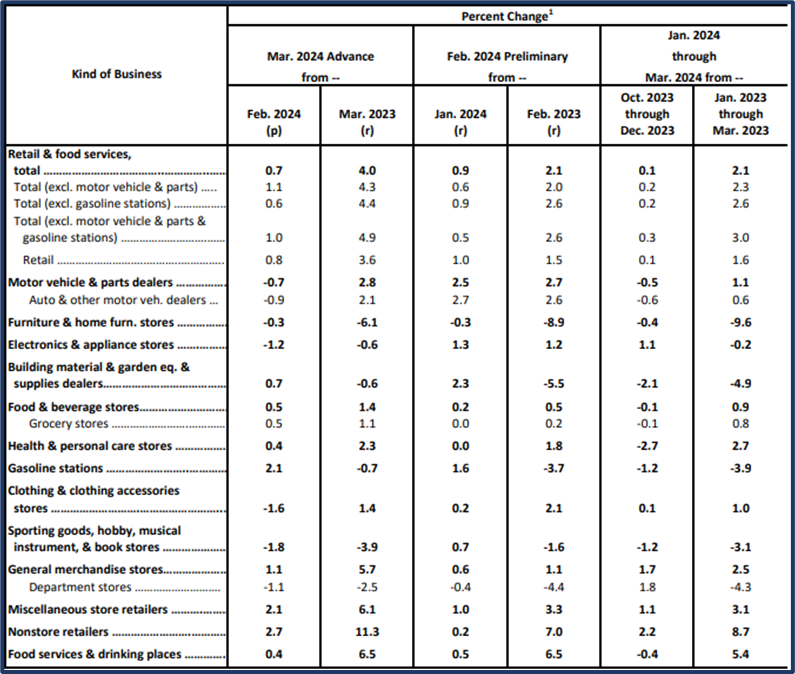

Spending for motor vehicles, furniture, electronics, clothing, and sporting goods all declined.

Gasoline stations surged 2.1% and grocery stores +0.5%.

Health and personal care stores-the whole Vanity trade theory rose.

Nonetheless, with the 200-week moving average looming at around 71.00-has the consumer finally had it?

The weekly chart shows the support at the 200-week moving average or around 71.00.

What happens if that level of support breaks?

The next likely target is around 67.00 or right where the 50-week moving average now sits.

That area also matches the January low.

Interestingly, with the 200-WMA above the 50-WMA, Granny never went out of an accumulation phase into a bullish phase.

In other words, the consumer has been ok, but not nearly as robust to say BULLISH!

At this point, headlines on geopolitics are taking center stage as far as price movements go.

What we hope for is that XRT can hold current levels and we can go back to watching for buys in companies related to our vanity trade:

- Drug companies like Novo-Nordisk

- Personal skin care companies like AbbVie (NYSE:ABBV)

- Makeup companies like ELF

ETF Summary

- S&P 500 (SPY) 500 next big support

- Russell 2000 (IWM) 192 support

- Dow (DIA) 372 the January low

- Nasdaq (QQQ) 427 support

- Regional banks (KRE) 45-50 range

- Semiconductors (SMH) 205-206 support

- Transportation (IYT) 67 pivotal with 65 bigger support

- Biotechnology (IBB) 128 support

- Retail (XRT) 67.00 next support

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 75.50 the 200 DMA