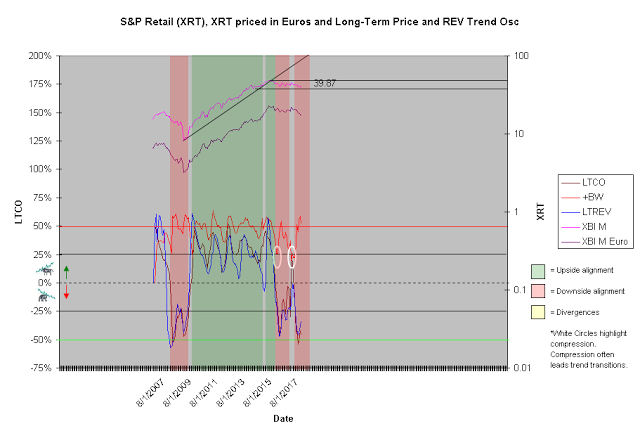

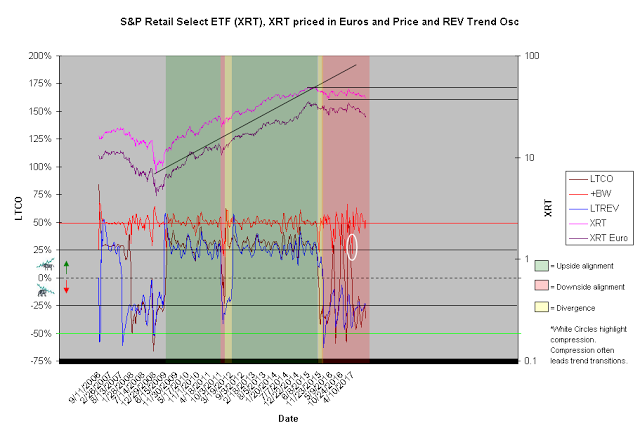

Investors chasing short-term strength in retail should consider the following: (1) the retail stock trend has been aligned down since February 2017, a total of 7 months; the averaged aligned down impulse has been 17 months since 2006 (chart1), and (2) retail stocks have been underpeforming the broader market since 2015 (chart2). Smart money won't chase until chart1 and chart2 transition from red to green boxes. In fact, smart money sees the red boxes more as a negative impact to future economic growth than any potential for an unexpected reversal.

Chart1

Chart2

Headline: Retail stocks surge in relief rally as earnings come in better than feared; Abercrombie & Fitch (NYSE:ANF) soars 15%

Retail stocks are rallying on Wall Street again.A slew of quarterly earnings reports this week from a mixed bag of companies has sent some retail stocks soaring to new highs. It's a welcome narrative amid chatter about declining sales, falling foot traffic, store closures and bankruptcies.

"We're starting to see a bifurcation of the retail landscape," Greg Portell, head of A.T. Kearney's retail practice, told CNBC in an interview.