The Granny Indicator has been reliable.

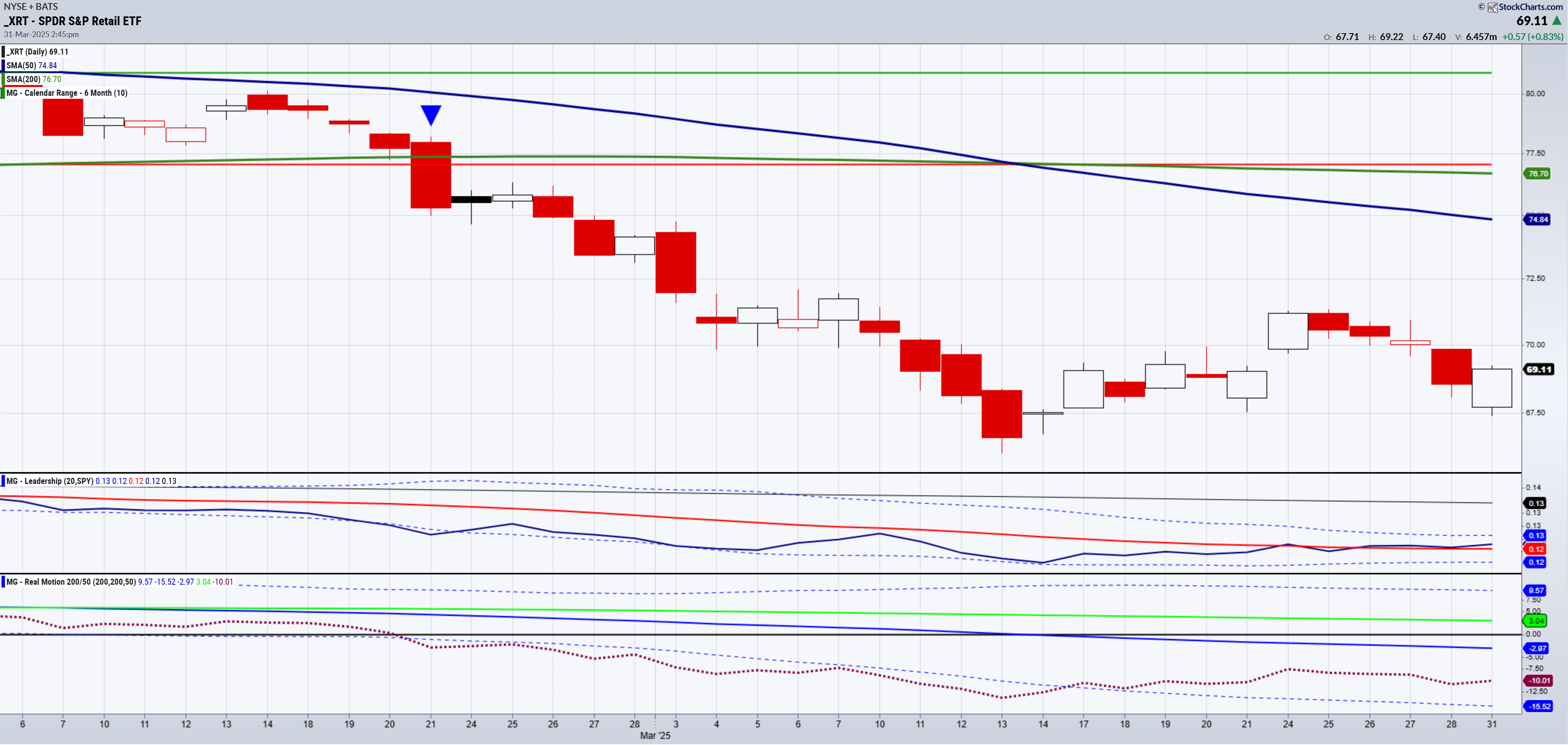

In late January, early February, while everyone was still so bullish, Granny XRT failed the high if the January 6-month calendar range and then the 50-daily moving average.

The slope on that MA went negative, and the price continued to sink.

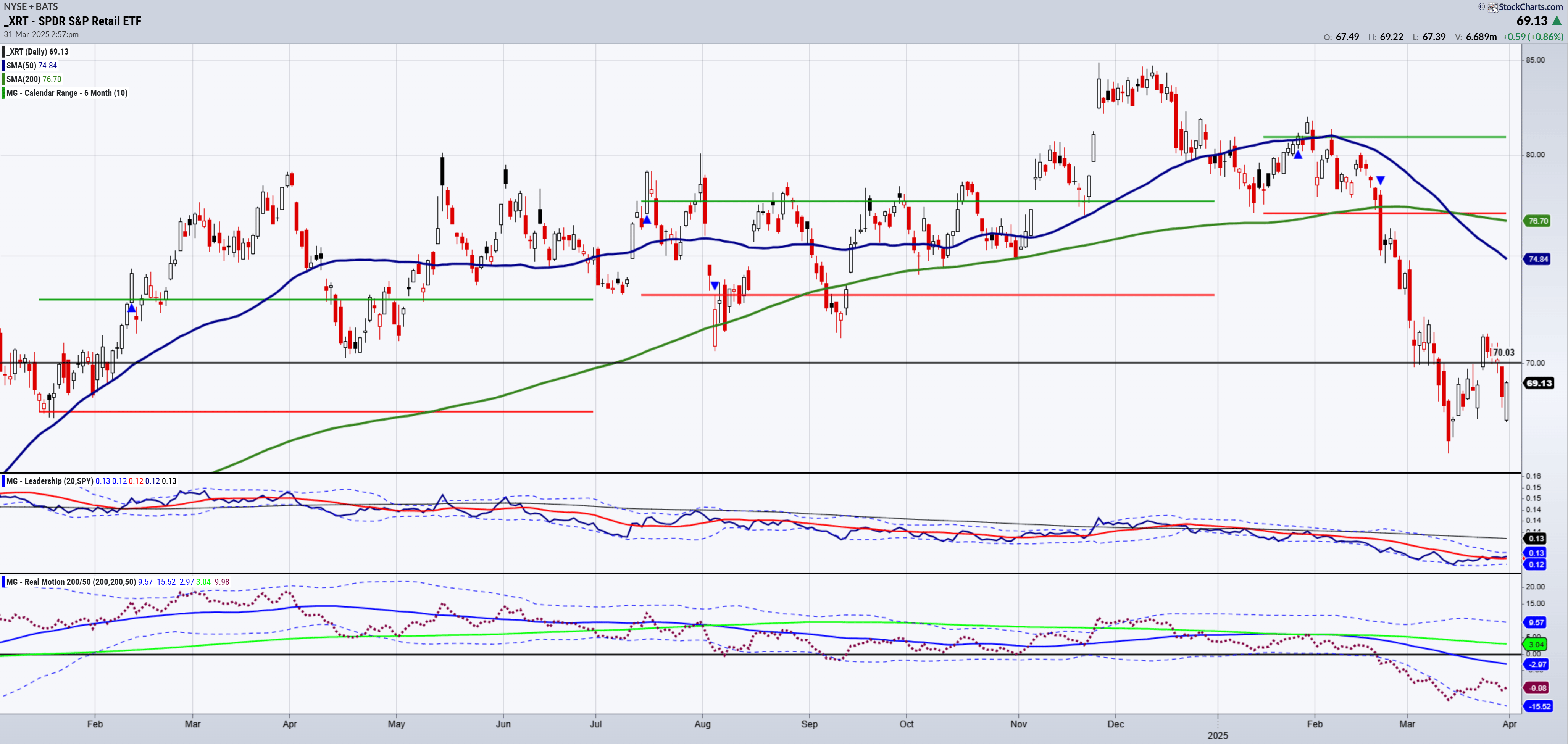

One of the worst-performing sectors, retail is a great barometer for the market and economic sentiment.

On March 13th, XRT traded down to a low of 66.07, a price not seen since December 2023.

Now, at the end of the first quarter and ahead of April 2nd tariff announcements, the low was 67.39.

And as you can see from the chart, Grany went green.

However, is this the bottom or just another buy-the-dip, short-covering rally that won’t last?

Note the Leadership indicator. Today, XRT outperformed the SPY for the first time since last November.

On Real Motion, though, momentum shows no real divergence.

If you look at the price, the black horizontal line is an interesting pivotal area.

Going back to February 2024, then moving to April 2024, now March 2025, $70 has been a reliable line in the sand.

XRT looks better above there and not so healthy below.

That is the first hurdle.

The second hurdle is $72, where the 23-month moving average or measure of the 2-year business cycle lives.

For now, we are at least hopeful that Granny has returned to shop.

However, in the current bearish phase, we know that short covering and premature buyers cause whipsaws.

What we do know is that if XRT has stopped the bleeding, then the original predictions for 2025 are still intact.

Pain first quarter, better the second quarter, then a 3-5% gain for the SPY by year’s end.

But let’s not get ahead of ourselves.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) Made a new yearly low and bounced- real? 575 still sits overhead

Russell 2000 (IWM) 200 pivotal

Dow (DIA) Back over the 50-WMA or 417 now support

NASDAQ QQQ) Made a new yearly low and bounced-real? Patience

Regional banks (KRE) 55-60 the trading range to watch

Semiconductors (SMH) 205 monthly support held

Transportation (IYT) 63 support held

Biotechnology (IBB) Broke down harder and did not recover-130 has to clear

Retail XRT) 70, then 72 resistance