Power supplier Southern Company (NYSE:SO) reported fourth-quarter 2017 earnings per share (excluding certain one-time items) of 51 cents, above the Zacks Consensus Estimate of 46 cents and the year-ago profit of 30 cents. The outperformance stemmed from strength of its retail unit and lower operations and maintenance costs.

The Atlanta-based utility’s quarterly revenue – at $5,629 million – came higher than the fourth-quarter 2016 sales of $5,181 million and also beat the Zacks Consensus Estimate of $5,408 million.

Overall Sales Breakup

Southern Company’s wholesale power sales jumped 36.4%, while retail electricity demand strengthened amid favorable weather conditions. This brought about an upward movement in overall electricity sales and usage. In fact, total electricity sales during the fourth quarter was up 10.5% from the same period last year.

Southern Company’s total retail sales improved 4.1%, with residential, industrial and commercial sales up by 8.6%, 3.5% and 0.9%, respectively.

Expenses Summary

Southern Company’s operations and maintenance cost decreased 3.6% to $1,565 million but the utility’s total operating expense for the period – at $4,835 million – was up 5.2% from the prior-year level.

Zacks Rank & Stock Picks

Southern Company – one of the largest generators of electricity in the nation along with the likes of Exelon Corp. (NYSE:EXC) and Duke Energy Corp. (NYSE:DUK) – currently retains a Zacks Rank #4 (Sell).

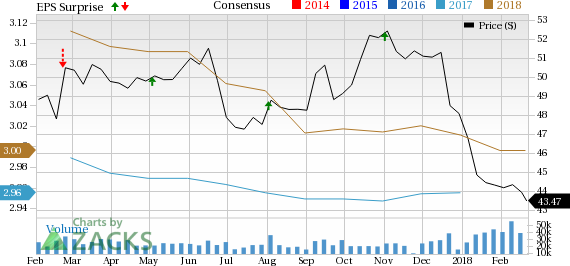

A better-ranked player from the same industry would be CenterPoint Energy, Inc. (NYSE:CNP) that sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CenterPoint Energy, based in Houston, TX, is a domestic energy delivery company that provides electric transmission & distribution, natural gas distribution and competitive natural gas sales and services operations.

The 2017 Zacks Consensus Estimate for this utility is $1.33, representing some 14.7% earnings per share growth over 2016. This year’s average forecast is $1.48, pointing to another 11.6% growth.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Exelon Corporation (EXC): Free Stock Analysis Report

Southern Company (The) (SO): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Original post

Zacks Investment Research