Yesterday’s focus on inflation passed without too much of a hitch with both Eurozone and US measures of consumer prices matching their respective expectations. Despite this, the market took the US figure as a slight disappointment and marked the USD down from its recent strength. This was despite the 0.3% increase in the monthly basket being the biggest rise since June 2013. Our hopes of a better than expected core reading didn’t come off either and remains only slightly above the stagnation mark.

Another reason why the USD may be slightly offered as we enter the weekend is the Martin Luther King holiday on Monday and a desire to take profit before a 3-day break.

That being said, the USD pressure on the GBP has continued and will do so into this morning’s retail sales report. Messages from the high street have been mixed as to how good the Christmas shopping season was, with some retailers reporting bumper profits and others profit warnings. Today’s retail sales number for the month of December should definitively show us. Inflation readings from December earlier this week pointed to a decent amount of price cutting going on in food sales which may have a negative effect on overall sales value.

The latest wage data from the UK is not due until next week but I’ll bet all the money in my pockets that won’t see wage increases close to that 4 year record low CPI figure released on Tuesday. And herein lies the rub: real wage decreases cannot sustain a retail led recovery unless there is a significant increase in credit lending which, in turn, does not make for a sustainable foundation.

Recent numbers suggest that if we rebased UK growth to 100 at the beginning of 2010 then the services sector would be around 5.0% higher now with manufacturing and construction both around 4.0% lower; such is the contribution to UK GDP of the services sector – around 70% – that GDP is up around 3.5% since 2010. A slip in services leaves little room for error elsewhere.

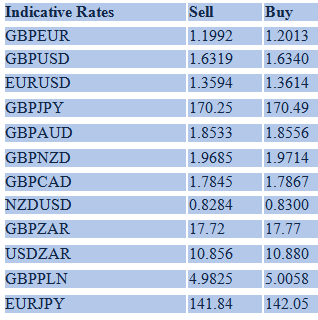

Sterling hasn’t had the best start to the year as data has erred on the side of disappointment more so than it did towards the end of 2013; a miss on retail sales will see GBPUSD below 1.63 for the first time in a month and will end GBP’s recent pop against the euro and other higher-beta currencies. The number is expected to rise by 0.3% and is out at 09.30 GMT.

The data surprises have been negative here in the UK as much as they have been positive in the US and that follows in our positive expectations for today’s consumer confidence report. A month so far that has seen only one disappointing data point – albeit Non-Farm Payrolls – and a strong retail sales report should allow the University of Michigan consumer confidence measure to move higher. The figure is due at 14.55 GMT.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Retail Sales Could Push Cable To 1-Month Lows

Published 01/17/2014, 06:05 AM

Updated 07/09/2023, 06:31 AM

Retail Sales Could Push Cable To 1-Month Lows

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.