US markets finished sharply higher overnight as the Street had its strongest performance of the year. Strong retail sales numbers boosted sentiment and put aside worries from the abysmal NFP from last week.

The strong retail sales numbers supports the notion the NFP was an out layer and we can go back to the positive sentiment we have had the last couple of months. US retail sales came in at 0.2 percent after rising 0.4 percent the prior month. This is an encouraging sign after the NFP showed that only 74,000 new jobs were created in December. This was less than half the estimated 200,000. Thanks to a shrinking job force, the unemployment rate also came down and is below seven percent at 6.7 percent.

STOCKS

The DJIA was up 115.92 points to close the day at 16,376.86. The Blue Chip was led by Intel (NYSE: INTC) which jumped nearly four percent after brokerage house upgrades. The S&P 500 rose 19.68 points, a 1.1 percent jump with technology and energy sectors leading the way. The Nasdaq Composite was up 1.7 percent r nearly 70 points to close the day at 4,183.01.

Asian and Pacific Rim markets are mostly higher following the US markets.

The Nikkei is currently up 1.7 percent as it has regained half of yesterday’s three percent beating. The Nikkei is tracking a weaker yen as the USD/JPY is currently at 104.36, coming off its one month high near 102.85.

The Shanghai Composite is down 0.6 percent as sellers continue to dominate in this market. Investors are digesting a slew of economic data as Chinese bank lending and the money supply each missed forecasts. The Shanghai continues to trade around a five month low set on Monday.

The ASX 200, in Sydney, is up 0.4 percent so far today after its biggest one day loss in three months yesterday.

CURRENCIES

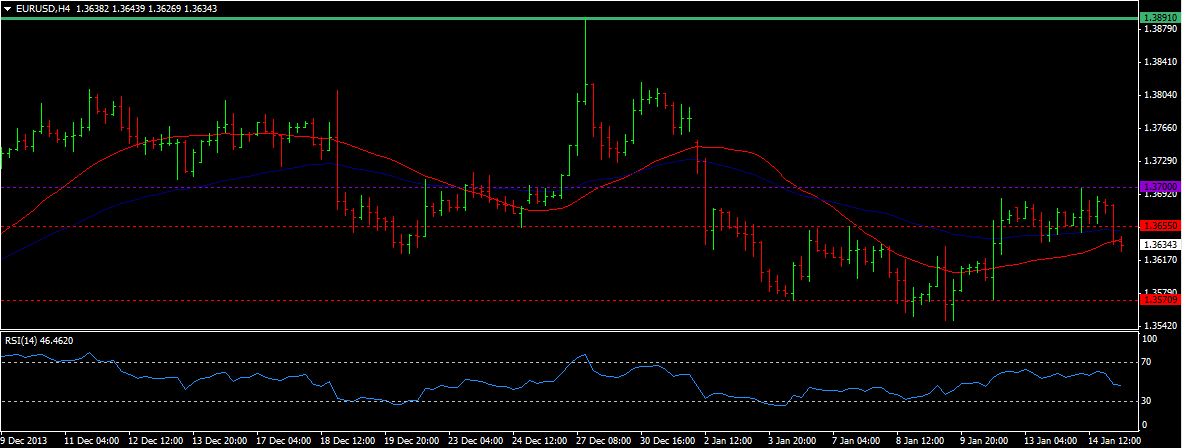

EUR/USD (1.3634) was rejected at the congestion area around 1.3650/90 once again. We see weakness only on a move below 1.3550. For now we can expect to rally back to 1.37/25 while above 1.3550/70 area.

USD/JPY (104.36) has recovered from 102.85 rather nicely. We are keeping hopes alive of a nice rally to target 107. First we must crack 105.50/60 area for this to happen. GBP/USD (1.6420) we are still trading sideways like we have been for almost a month. We seem to be stuck between 1.66 and 1.6340. Still, the recovery from 1.48 looks valid, and we can test the upside of this range at 1.66 again soon.

COMMODITIES

WTI Brent (106.31) is weak as we are seeing an expansion of product from Libya. Overall we are ranging from 106.01 to 108.00. If we break below 106, we turn bearish. WTI Crude (92.60) rose after the retail sales number. Look for some sideways movement from 91 up towards 93.25 before a break higher. Overall we remain bullish above 90. Gold (1240.60) fell sharply after reaching a high near 1256. We are now testing 1245 again. Should we bounce back above 1250, then we can target 1275. A fall below 1235 can see a dip to 1225.

TODAY’S OUTLOOK

At 8:30 EST the US will release the PPI as well as the Empire State Survey. This evening at 5:45 EST, Dennis Lockhart will talk about the economy and economic policy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Retail Sales Boosts Stocks

Published 01/15/2014, 05:37 AM

Updated 05/14/2017, 06:45 AM

Retail Sales Boosts Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.