Retail stocks have had a rough 12-months, as they have lagged the broad market by a large percentage? SPDR S&P Retail (NYSE:XRT) has been stronger than the broad market over the past 60-days. Will that trend continue? Could the upside out performance, pick up speed?

The answers to these questions could have a ton to do with what XRT does at current levels, see chart below.

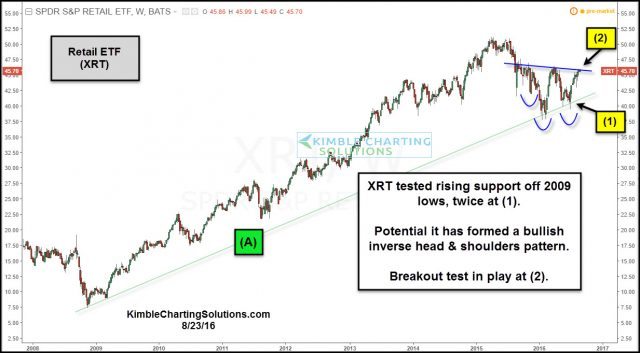

XRT’s weakness earlier this year, brought it down to test rising support (A), which so far has held on two different tests of support at (1).

It is possible that XRT is forming a bullish inverse head & shoulders pattern.

Even if the pattern read is incorrect on our part, it is testing a key resistance/breakout level at (2).

If XRT can breakout at (2), it would be a positive price event and could well attract buyers to this lagging sector.