- Back-to-school shopping season underway

- Another record year of spending expected

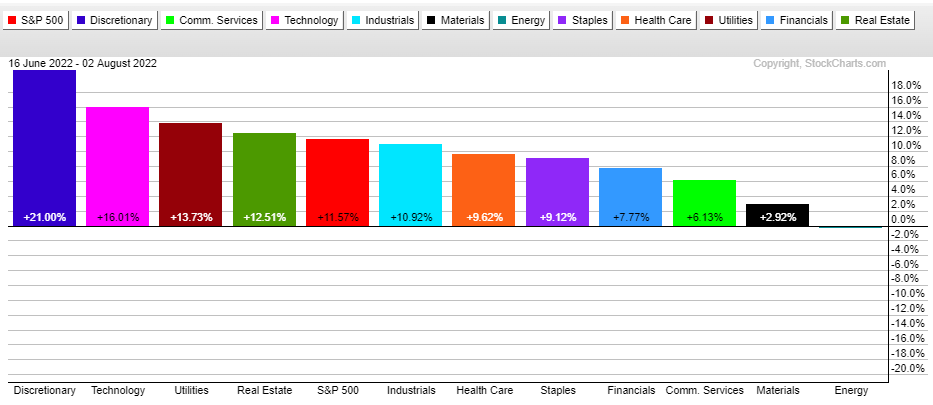

- Consumer Discretionary sector performed best since the market low

The back-to-school shopping season is in full swing as kids gear up to return to the classroom and as college students embark on the fall semester. The National Retail Federation (NRF) issued its annual seasonal outlook a few weeks ago. The trade group expects solid spending among families across the country. According to the survey, families expect to dole out $864 in advance of the school year, on average. For college-related expenses, $1,199 was the average figure.

Big Spending

The winter holidays and Christmastime is, of course, known as the biggest shopping period annually, but few realize that late July and August is the second biggest spending season of the year. So, this handful of weeks is critical for retailers big and small. What makes right now also particularly important is that Q2 retail earnings hit the tape in earnest in less than two weeks.

Retail Price Action

For background, since the June 16 low in stocks, the Consumer Discretionary sector leads the overall market. It’s not an entirely rosy picture on the consumer front, though. We’ve already heard a profit warning from Walmart (NYSE:WMT) earlier during the reporting period.

Sector Returns Since June 16: Discretionary Leads

Source: Stockcharts.com

Mixed Retail Sales Trends, Downbeat Expectations

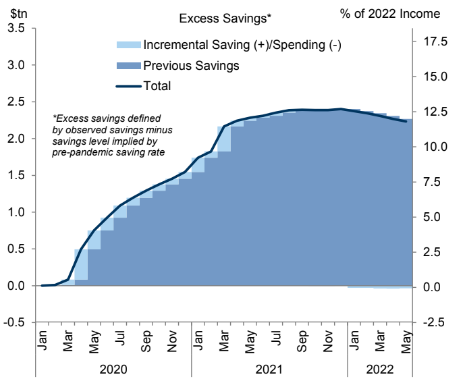

Moreover, the latest retail sales figure for June revealed a 1% gain, but that was driven mainly by high inflation. Core retail sales increased by just 0.4%. Analysts at Goldman Sachs expect further declines in spending growth over the back half of the year and in 2023. Still, the bulls can point to more than $2 trillion in excess savings for American consumers right now. Perhaps a chunk of that will be deployed ahead of the school year.

Americans Still Have a Cash War Chest

Source: Goldman Sachs Investment Research

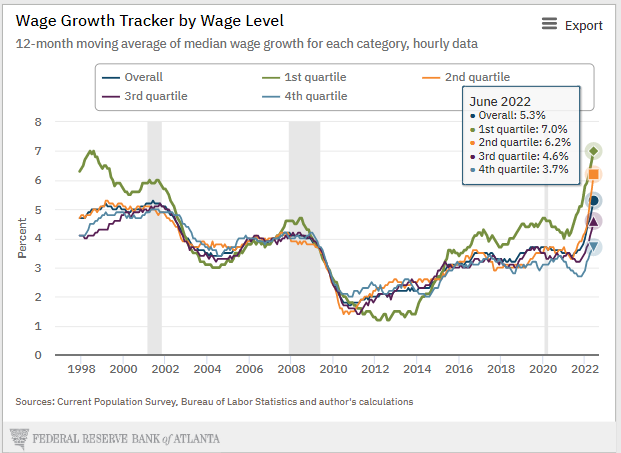

A Tale of Two Consumers

The tone so far is that the families on the high-end of the income scale are doing just fine according to card data and spending trends. The lower quintile of income earners has pulled back on discretionary spending as inflation takes a bite out of purchasing power. The upshot is that wage gains, according to the Atlanta Fed, are best among the lower-income tier.

Income Growth Best Within the Lowest Quartile

Source: Federal Reserve Bank of Atlanta

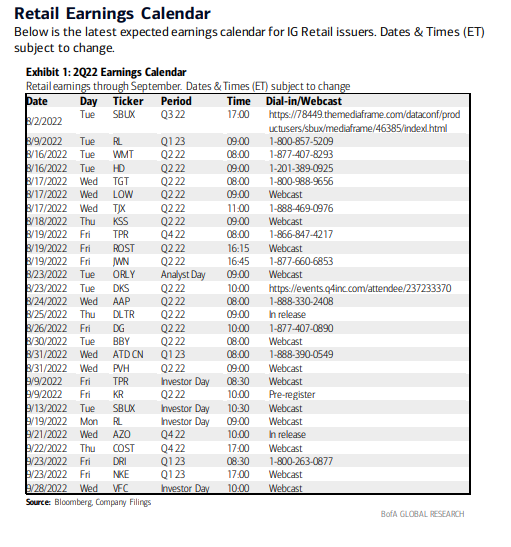

Earnings Roundup

The earnings calendar lights up with many major firms reporting second quarter results in the coming days and weeks. Starbucks (NASDAQ:SBUX) kicked things off on Tuesday this week with a solid report, beating Wall Street expectations as demand for cold drinks buoyed the company. The real activity does not begin until Tuesday, August 16, when Walmart and Home Depot (NYSE:HD) report. Then comes Target (NYSE:TGT), Lowe’s (NYSE:LOW), and TJX (TJX).

Retail Earnings on Tap

Source: Bank of America Global Research

Strength in Dollar Stores?

I will be particularly interested to see what the dollar stores have to say about the state of the consumer. The Wall Street Journal recently profiled families trading down to dollar store dinners amid the tough inflationary environment. Dollar Tree (NASDAQ:DLTR) and Dollar General (NYSE:DG) issue Q2 earnings reports on August 25 and 26, respectively.

The Bottom Line

The back-to-school period is a key time on the calendar for retailers. Families spend significant amounts on electronics, clothing, shoes, and furnishings before that highly anticipated first day of class. Retail earnings are also on tap to wrap up a busy earnings season. The Consumer Discretionary sector has strong momentum right now, but a major hurdle will be this month’s key profit reports.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.