Nearly 2 years ago I discussed the longer-term view for the stock indexes, Treasuries, the US dollar and other assets in a series I called The Longer Outlook. In it, the specific discussion around the US dollar focused on what has been a 7-year cycle in its trends. At that time, a new 7-year cycle had just begun 6 months earlier in July 2014.

We know now that the initial run higher that was evident by January 2015 stalled there. Since January 2015, the Dollar Index has moved sideways in a channel between a value of 92.5 and 100.5. Nothing exciting, despite a lot of excitement in the world markets. The Index just shook it off and held its own waiting. But waiting for what?

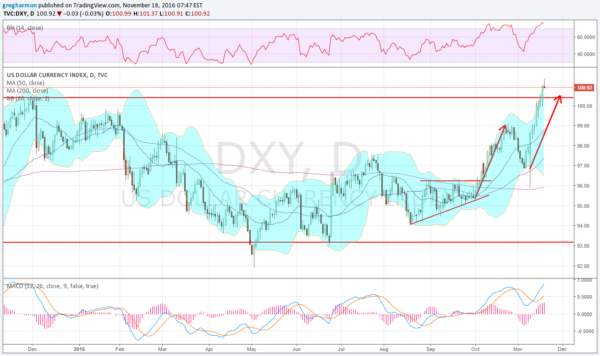

When the US dollar started to move higher after the election, I noted that based on technical factors, it looked ready to test the top of the range. And since then it has, and then some. As I write, it has pushed up through the top of the consolidation channel as seen in the short-term chart below. On a short-term basis, it now looks overbought and is running out of momentum to move higher. This can correct through a short-term pullback or even sideways action. What would be significant is if it continues to hold over the top of the channel through month end.

Ending the month over the channel would confirm a breakout and even a hold at the top of the channel will show strength heading into December. Continuation in December would be a confirmation of a break of the range and resumption of the move higher. And with a break over 101.51, the 61.8% retracement of the move lower from 2002 to 2008, set a target of a full retracement to 120 in the Dollar Index. There would also be a Measured Move to the upside to 115.50, when comparing to the move into the consolidation zone.

And there remains the target from the symmetrical triangle break out to 104.50. So you have several targets, or potential profit-taking points along the way. But the evidence is building that the 7-year cycle is resuming. In hindsight many will attribute this to a Trump win. But is probably worth remembering the weakness in the euro and the yen, coupled with a virtually assured Fed rate hike as a backdrop.