There are a couple of types of trading which appear to generate ungodly sums of profits (at least judging from the advertisements) – – FOREX and options trading. My personal experience with both of those has been bad enough to swear off them both years ago. Indeed, pretty much all options traders get their body parts handed to them in short order.

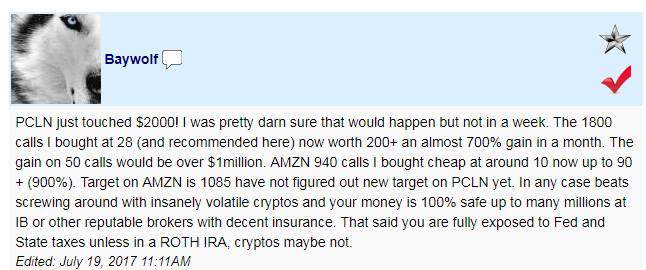

Some folks, however, fare better, and our own Baywolf shared this success story with the group:

A cool recap, to be sure, and congrats to Baywolf. For me, though, a hundred such tales would not be tempting enough to lure me back. I’m content fighting it out over fractions of a percentage point day to day.

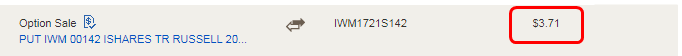

Last month, however, I did a just-for-the-hell-of-it options trade, which I hadn’t tried in ages. Well, more precisely, I had done a QQQ trade for a profit a little beforehand, and it had been years since I had placed any options trade at all. So I followed up this success with a purchase of another put:

That was on June 13th. Not long after – – the 22nd, I think it was – – I got out of the position with a profit of something like 25% or so. I distinctly remember telling myself that I was going to retire again permanently from options trading. I had two successes, but a little voice in my head told me enough was enough, and to just close the account, which I did.

As you can see from the chart below (green arrow=buy, red arrow=sell)……THANK GOD. I got lucky, Slopers.

So after closing my account and taking out the $12,000 in it, I still tracked the “would have been” value (the options still haven’t expired). So, umm, here’s where it’s at now:

This only reaffirms my commitment. Forex………not for me. Options……….not for me. I’ll just take my pinpricks of pain by shorting equities, nice and simple.