The angst may already be fading away.

Last week, I chronicled the carnage across the stocks of home builders that erupted in response to the Republican plan for tax reform that includes a reduction in the cap on the mortgage interest deduction. The sell-off that likely had roots in the extreme displeasure emanating from the National Association of Home Builders (NAHB). Now one builder has stepped forward to brush off the dust: KB Home (KBH).

In the company’s investor presentation today (November 7, 2017) – cleverly named the KB Home Returns-Focused Growth Plan Update Conference Call – management explained that its ASP in California is not significantly above the tax plan’s $500K cap. Moreover, $500K homes are not a “majority” of its business. Indeed, management emphasized that it is “not overly concerned.” These claims came in response to an analyst question during Q&A. Management chose not to discuss the potential implications of the tax plan during the presentation. I think this conference call was one of the FEW times I have heard a home builder that sells homes in a richly priced market reassure investors that its pricing is not all that high!

KBH’s target customer in most markets is not likely to be impacted by the tax plan. KBH focuses on first-time home buyers who have been about 60% of deliveries over the last 10 years. KBH targets affordability for the median household income of its served submarket.

KB Home (KBH) broke out ahead of its investor conference call. Post tax plan sellers were never able to break the stock down out of its previous range of consolidation.

At the same time KBH downplayed its expensive price points in California, the company reaffirmed its bullishness on its Californian market. The inland areas in particular are so strong that they are driving ASPs downward. This dynamic tells me that the California housing market has likely entered a new phase where the strong economy ignited strong housing demand from households looking for more affordable places to live.

Overall, KBH delivered a strong and encouraging presentation. KBH started by reminding the audience of its significant progress over the last three years:

- Deliveries +47%

- Housing Revenues +74%

- Home Building Operating Income +79%

- Pretax Income +119%

- Diluted EPS +133%

- Net Debt to Capital -540 basis points

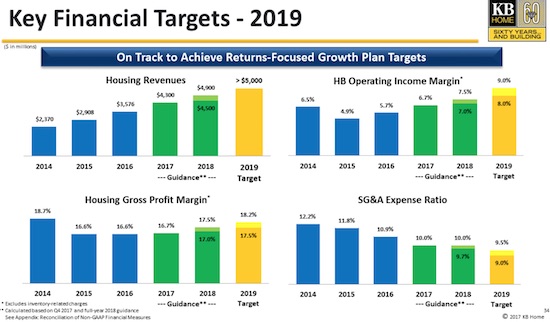

The strength of KBH’s business is summarized in the following chart showing the company’s relatively steady march to meeting its 2019 financial targets.

KB Home (KBH) is making solid progress on its overall financial targets.

While KBH celebrated its ability to exceed targets in recent quarters, the company declined to speculate on whether it will continue to do so.

Here is the company’s set of guidance for the first quarter and full year of 2018…

- Housing revenues: $840 – 900M (Q1 2018), $4.5 – $4.9B (2018)

- Average Selling Price (ASP): $385-395K, $395-$405K

- Housing Gross Profit Margin: 16.0-16.5%, 17.0-17.5%

- SG&A Expense Ratio: 11.7-12.0%, 9.7-10.0%

- Home Building Operating Income Margin: 4.3-4.7%, 7.0-7.5%

- Tax rate: ~39%, ~39% (does not include any speculation on tax reform)

- Average Community Count: Down low single digits, Flat to slightly down

More evidence of receding angst

Elsewhere in the housing market, several key home builders joined KBH in leaving behind last week’s post tax plan selling: D.R. Horton (DHI), LGI Homes (LGIH), and Pulte Homes (PHM). LGIH reported earnings yesterday, but there was no discussion about the potential impact of the tax plan on LGIH’s business. LGIH has a Texas-heavy business at 48% of closings in the latest quarter. The Southwest is 16% and the Northwest is 14% of Q3 closings.

D.R. Horton (DHI) faded from its high of the day but managed to close at a (marginal) new all-time high.

LGI Homes (LGIH) has forgotten all about the tax plan as it rallied to a new all-time on an impressive post-earnings 5.1% gain for the day.

Pulte Home (PHM) is trickling higher away from last week’s temporary drop.

Net-net, home builders are showing promise in that sellers have generally failed to follow-through on Friday’s angst. The iShares US Home Construction ETF (ITB) almost completed a third straight day of gains on its way to re-entering its uptrending upper-Bollinger Band (BB).

The iShares US Home Construction ETF (ITB) seems ready to leave behind the angst of the tax plan and return to its uptrending Bollinger Band (BB) channel.

On the negative side, M.D.C. Holdings (MDC) made a new post-earnings low as it closed below critical support at its uptrending 200-day moving average (DMA). I was looking for this support to hold to give me a reason to buy this significant dip.

M.D.C. Holdings (MDC) continued its post-earnings (and post tax plan) sell-off with a break of 200DMA support.

Be careful out there!

Full disclosure: long KBH call and put options