Advanced Auto Parts (NYSE:AAP) had a great run higher when the narrative was that people would keep their cars for 20 years in the height of the financial crisis and its nascent recovery. As the economy improved, investors did not seem to notice with car sales rising that Advanced Auto Parts kept going up. Oh, well.

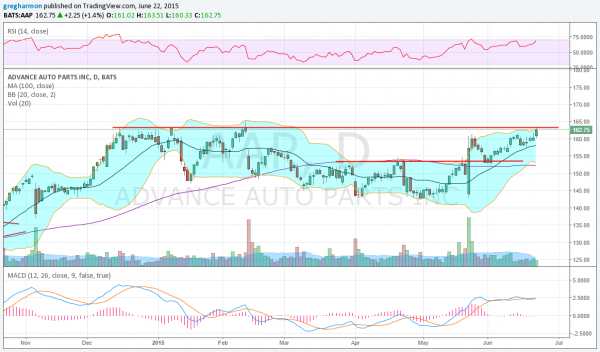

The stock hit a peak in December 2014, and started sideways for a month. It took a sharp pullback in January and recovered to that prior high, but could not continue. From then, the stock drifted lower for the next 4 months. For the third time in a row, the earnings reports (you can see the dates from the volume spikes) turned price around.

Since late May, it made a higher high off of the report, then pulled back and held over the short term prior resistance. Now it is moving higher again and testing the prior high. The pullback did a lot to repair and energize the chart. The RSI reset lower and then marched back up to the bullish range, and the MACD pulled back and consolidated before the recent change higher.

A break of resistance carries several different potential targets for a technician, but each looks to 170. There is a Measured Move, Cup and Handle, and an Ascending Triangle. I like it when patterns line up together with reinforcing indicators. It is almost like a mechanic went through the chart and cleaned and repaired everything.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.