The Renzi Risk

Overnight, traders sidestepped the OPEC meeting and US employment report risks while opting to focus on the Italian Senate reform referendum instead, which will take place on Sunday. Trump reflation trade has taken a temporary respite after massive waves of risk on trade engulfed the markets over the past couple of weeks. Focus now pivots to political risks in Europe with the upcoming Italian referendum for PM Renzi this weekend. Not surprisingly, the US and European equities have retreated from recent highs, and the US Treasury curve has flattened on unity with the global equity market reversal.

Traders are sitting tight awaiting new US fiscal stimulus signals while positioning for the anticipated month-end selling pressure on the USD. However, until those US stimulus measures are salient, traders will continue to tread cautiously as political risk comes to the forefront.

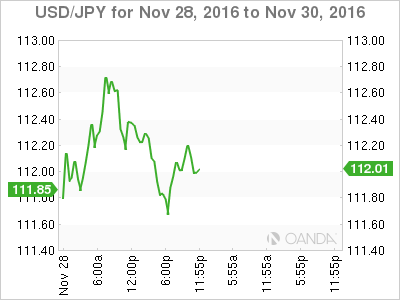

Japanese Yen

The week started with a massive correction, as a combination of positioning and speculative overextension on the current narrative caused a wicked backlash to USD/JPY long specs. The lack of liquidity likely amplified corrective moves, amid swirling OPEC headlines and confusion over election recounts. Traders are respecting yesterday’s reversal and are not rushing back to reinstate long USD just yet, awaiting noteworthy US fiscal stimulus clues, while hedging potential fallout risk from this weekend’s constitutional referendum in Italy. In the meantime, USD/JPY will track the US Treasury yields.

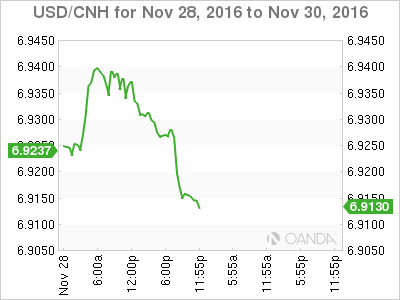

Chinese Yuan

The market is trading on the back of broader USD movements while waiting for additional US stimulus signals, in the meantime, the Trump reflation trade remains in consolidation. Overall fixing is in line with market expectations.

ASIA EM

MYR traders are dealing with the fallout of what may later be viewed as a policy error by BNM; considering their current view to offshore NDF markets, which appear to be penalising foreign investors for doing little more than price exploration and hedging.

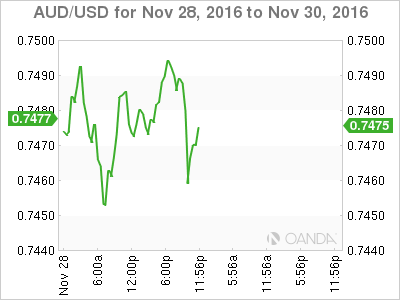

The Australian Dollar remains buffeted by higher copper and iron ore prices and traded close to 0.7500 in early London before retreating. Speculative Chinese money remains the primary driver in base metals flows as the China retail crowd stockpiles ahead of an anticipated Trump fiscal boom.

US Treasury yields are easing as European political risk rises over the upcoming Renzi Referendum, yet with commodity prices bubbling, the AUD is looking like a beautiful oasis over the short term.

Overall, commodity currencies finished the day well supported by higher oil prices. Oil traders are feasting on a smorgasbord of headline rumours and innuendos, perhaps hoping for a positive outcome from the OPEC meeting.