Renewi PLC (LON:RWI):

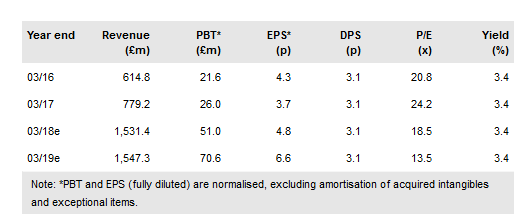

A review of onerous UK municipal contracts (flagged on 12 February) has quantified net exceptional costs totaling £73m (including c £49m for three long-term ongoing PFI operating contracts, the remainder for exiting two other operations). There is no change to our headline estimates or any material impact on group net debt or annual cash flows as a result. These actions will allow investors to re-focus on the important merger integration program, now entering its second year and continuing on track. By the time this completes in FY20, Renewi’s P/E rating will have reduced to 11.0x at the current share price.

Taking a prudent view on longer-term contracts

The larger exceptional charge portion relates to longer duration contracts. In effect, future profit expectations have reduced and long-term contract accounting requires the full life impact to be recognised and discounted back. The resulting onerous contract provisions for Wakefield (to 2038) and Barnsley, Doncaster and Rotherham (BDR, 2040) equates to £30m and £27m respectively. If one assumed these changes were evenly spread over the remaining term, this would equate to an annual provision release of £2.5-3.0m, though we would expect it to be larger in earlier years, tapering down towards the end point. These revised expectations have been driven by operational experience at the facilities (both now into their third year of operation) and changes with regard to market offtake conditions and certain subsidies. Separately, a £3m favorable contractor settlement at Wakefield and a £5m provision release relating to Cumbria (2034) from improved operational performance together represent credits that partly offset the larger charges.

To read the entire report Please click on the pdf File Below: