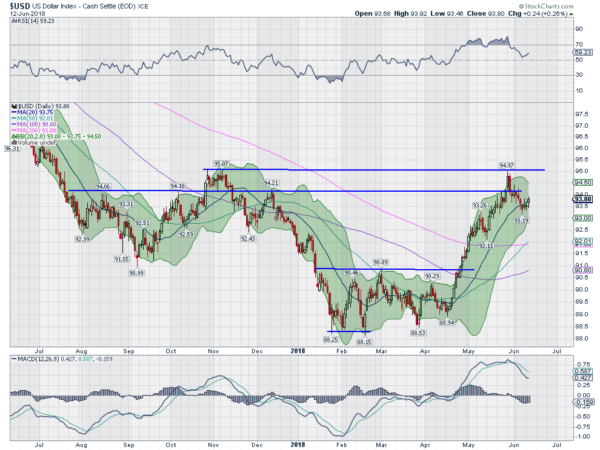

The US dollar has had a strong run higher off of a base this spring. But that seemed to have ended with a top in May. It had jumped to the November high and pulled back fast. This was interpreted as a double top by many and a reversal in the greenback. But that may not be the case.

First, the price would need to fall back below the base to confirm a double top. Obviously that is a long way from where it is now and no one needs a 15% correction to confirm that price is moving lower. So let’s focus on the the near term, in which the price action actually looks pretty solid and to the upside.

The chart above shows the run higher and then a pullback to the 20-day SMA. Since then it has held and yesterday started a move higher. This is a classic bull flag pattern. Digestive price action after a long move higher. Bull flags are said to fly at half mast, meaning the move into the flag would equal the move out of it. That would give a target to 99.50.

Momentum has also held up. The RSI is moving back higher after resetting. The reset did not even make it to the mid line. The MACD has pulled back too, and is still falling. But it is positive. There is also a Golden Cross in the chart. The 50 day SMA is crossing up through the 200-day SMA, another bullish signal. With the Bollinger Bands® squeezing in it may be time for the next leg up to begin. Renewed strength in the dollar.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.