ReneSola Limited (NYSE:SOL) has completed the construction of six utility-scale projects in UK last month. These projects, with a combined capacity of approximately 26 megawatts (MW), have also been connected to the country’s grid. They are located in Carlam Hill Farm (Yorkshire), North Wales, and Monmouthshire.

ReneSola was responsible for the design and construction of the projects, all of which are powered by the Virtus II modules. The company will further provide ongoing operation and maintenance services.

Global Expansion Initiatives

With a consistent focus on expanding operations globally, ReneSola has established its presence in countries like Australia, France, India, Canada, UK and Japan among others. Also, the company continues to benefit from a steady flow of contracts from both domestic and international customers.

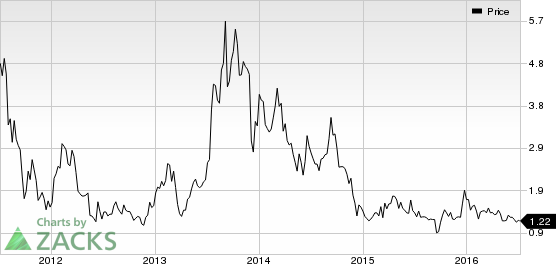

RENESOLA LT-ADR Price

Last month, this China-based company announced its plans to construct 107 MW of solar projects across the U.S. states of California, Massachusetts, Minnesota, and North Carolina.

Again, in May, it had formed a partnership with UCK Group, a leading Turkish solar energy solution provider, to develop a pipeline of solar projects in the country with a total installed capacity of 116 MW.

What’s Ahead for Renewable Energy?

We note that increasing awareness of the drawbacks of fossil fuels is spurring the demand for renewable sources of power generation, particularly solar. Per a U.S. Energy Information Administration report (EIA), total renewables used in the electric power sector are expected to increase 13% in 2016 and 3.3% in 2017. Generation from renewables, other than hydropower, is forecasted to grow 14.5% in 2016 and 8.9% in 2017. Solar energy will constitute 1.2% of the total U.S. utility-scale generation in 2017, indicating immense room for growth. Other solar companies are benefitting from the boom as well.

Bigger Picture

Going forward, Asian countries like China, Japan and India are particularly likely to witness a phenomenal rise in solar energy usage. Chinese solar module manufacturers such as JinkoSolar Holding Co., Ltd. (NYSE:JKS) and Trina Solar Limited (NYSE:TSL) among others are expected to benefit significantly from this surge in demand.

We note that ReneSola, the Zacks Rank #1 (Strong Buy) company, has been undergoing a series of changes, shifting ways from being a solar product manufacturer to a multi-faceted participant across the value chain.

Notably, ReneSola is gradually transitioning toward downstream operations while scaling back its module business. According to ReneSola's Chief Executive Officer, Xianshou Li, the latest projects maintain its track record of having a strong competitive advantage in developing downstream projects.

A Stock to Consider

Another favorably placed stock in the same space is 8point3 Energy Partners LP (NASDAQ:CAFD) , sporting the same rank as ReneSola.

TRINA SOLAR LTD (TSL): Free Stock Analysis Report

RENESOLA LT-ADR (SOL): Free Stock Analysis Report

JINKOSOLAR HLDG (JKS): Free Stock Analysis Report

8POINT3 ENERGY (CAFD): Free Stock Analysis Report

Original post

Zacks Investment Research