Summary:

- Carlos Ghosn, the creator of Renault-Nissan-Mitsubishi Alliance has been arrested under suspicions of breaching Japanese Financial Laws.

- This development caused collapse of Renault (PA:RENA), Nissan and Mitsubishi Stocks prices stirred speculations about Alliance Ventures future and put Renault-Nissan possibility of future merger in jeopardy.

- I believe it provides great buying opportunity to acquire Renault and Nissan shares at discounted price.

- Moreover, links between those enterprises are too strong to break due to Carls Ghosh’s arrest due to common interest and joint investment in future projects, reinforced by significant stake of Renault Group in Nissan.

Monday’s news about arresting Carlos Ghosn and Greg Kelly took investors by surprise. But not only ordinary shareholders were surprised. Renault and Mitsubishi boards of directors also learned that their CEO was detained at Tokyo airport after the fact.

According to Nissan press release Carlos Ghosh, long serving head of Renault Nissan and Mitsubishi triumvirate, alongside with Nissan Senior vice President Greg has been accused of breaching Japanese financial laws by underreporting theirs compensation and performing “numerous other significant acts of misconduct […] such as personal use of company assets.“

This news plunged Renault, Nissan and Mitsubishi shares prices. to theirs 52-week lows. Renault shares took the biggest hit, collapsing by 14.5% down to € 56.22, price level not seen since October 2015, soon after the news hit the market. Nissan and Mitsubishi also took the hit, diving by 6.8% and 8.6% respectively, following by further drops on Tuesday. Koji Endo, from SBI Securities even predicts, ”There will be a big negative impact for Nissan's sales, profit and share price, It could even be at the level before Ghosn came to Nissan 20 years ago.'' Others predicts end of the project to merge French and Japanese automaker, or even cancelling the whole alliance, stressing, that “the Renault stock price reaction is so strong because Ghosn is seen as `pivotal' for any potential collapse of the Renault-Nissan structure.”

(source:marketwatch.com)

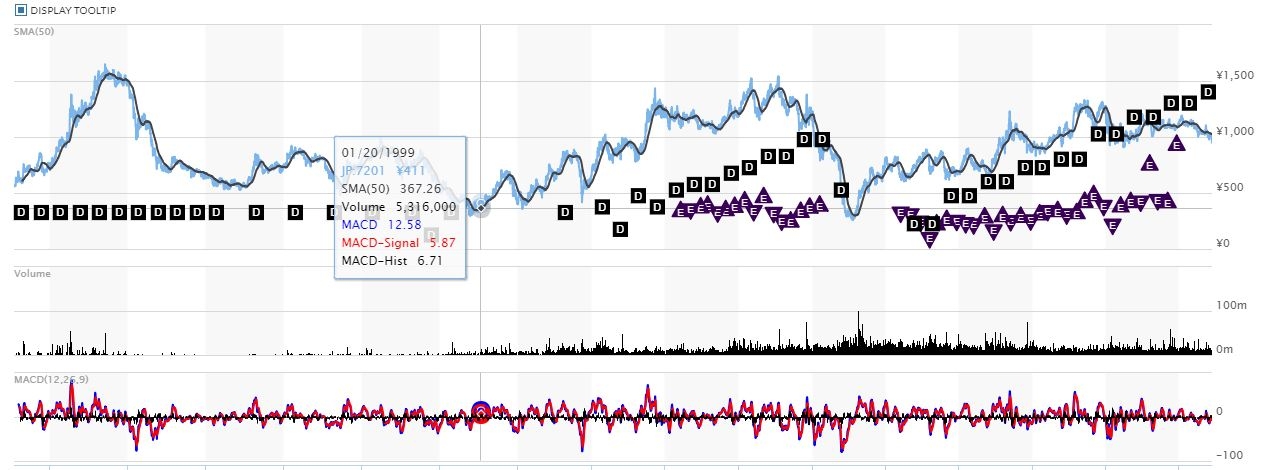

Quick check of Nissan share price back in 1999 brings us information that its shares back in the days when Carlos Gosh joined Japanese automaker costed little over ¥ 400. Now, one must ask a question: What chances are for going back to such levels? Or perhaps we see clear overreaction and opportunity to buy the shares of one of the members of the alliance at the discount?

To answer these questions, I am going to start investigating chances for dismantling alliance and for abandoning idea of merging Renault and Nissan into united multinational car giant.

Future of Renault-Nissan-Mitsubishi Alliance:

Divorcing is always a difficult task, especially when there are three parties involved. It is even more challenging if such act would be performed in a time of big transformations. Currently auto industry goes through volatile times facing numerous disruptions starting from moving towards future propelled by electricity instead of oil, introducing autonomous driving and ride sharing ideas into life, not to mention other, more futuristic scenarios, such as transforming whole cities, and in a process modes of transport and the methods how transport is going to be used.

The alliance has addressed those problems by creating alliance 2022, where all participants share costs for developing such ideas, and cooperate in four core business functions: Engineering, Manufacturing and Supply Chain Management, Purchasing and Human Resources, which, accordingly to the alliance, resulted with € 5.7 billion of synergies in 2017 alone. Such savings cannot be ignored by anyone, and in fact it seems it would be very difficult for Nissan or Renault to absorb back such costs, since it represents half of their cumulative net income for year 2017. Recent activities of the alliance only reinforce ties between Renault, Nissan and Mitsubishi. Only in October and November, Alliance venture signed multiyear agreement with Google (NASDAQ:GOOGL) for equipping vehicles with intelligent infotainment based on Android system, which would be operated by voice and could use any application form Google Store. Another deals finalised recently was participating in funding round for WeRide.ai, Chinese start-up focused on in L4 autonomous driving technology, investing in Transit, multimodal transportation app, and developing advanced lithium-ion (Li-ion) battery technology, which will enable recharging a car within 5 minutes.

All these investments fits well with the Alliance 2022 strategy to become a “leader in robovehicle ride-hailing mobility services and a provider of vehicles for public transit use and carsharing.”

As we can see the ambitions are high and not Renault nor Nissan can afford to reach such goals alone, thus having mutual interest in coopetition.

Such view seems to be shared across the alliance, at least in Nissan and Renault. Accordingly to Yahoo (NASDAQ:AABA) sources “The alliance of carmakers Renault, Nissan and Mitsubishi will be difficult to manage without chairman Carlos Ghosn, who is facing financial misconduct allegations in Japan, Mitsubishi Motors Chief Executive Osamu Masuko said on Tuesday.” Such statement has been straightened by Mitsubishi press release where we can read “It is to be proposed to the Board of Directors to promptly remove Ghosn from his position as MMC's Chairman of the Board and Representative Director.” My guess is that since Mitsubishi has been introduced to the alliance recently, it has yet to wait to see its positive impact on company performance. Nissan, from other hand, while promptly announcing that proposal for a vote for new CEO will be considered on Tuesday, reaffirmed investors that alliance would not be affected by the allegations but “the board of directors of all three should work closer together.'' This sounds like a firm commitment to the alliance but cast shadow of a doubt to Nissan willingness to commit itself to merger with Renault.

This stance is partially shared with Renault Group, which released note that Carlos Ghosn while “temporarily incapacitated, remains Chairman and Chief Executive Officer.[…] The Board will meet on a regular basis under the chairmanship of the lead independent director to protect the interests of Renault and the sustainability of the Alliance.” While in preceding note stressing that “Groupe Renault ensures on a daily basis the efficiency of its partnerships within the framework of the Alliance and is particularly focused on the consolidation of the Renault Nissan Mitsubishi Alliance”. Such commitment to preserving the alliance is shared with French government, Renault’s biggest shareholder, which contacted its Japanese counterparts to put additional pressure on alliance member to stay within triumvirate.

So, while Nissan and Renault seem to not consider dismantling the alliance, Mitsubishi stance is more unclear, however Nissan, having 34% shares of Mitsubishi should have enough power to keep whole alliance intact. But will it want to proceed to a merger with its French counterparts?

Nissan-Renault Merger.

Recent events, accordingly to Bloomberg Intelligence auto analysts Michael Dean and Gillian Davis might results with “merger will likely be kicked even further down the road if the alleged allegations against Renault CEO and Nissan Chairman, Carlos Ghosn are proven.'' An article published on Tuesday, 21th in Financial Times agrees with the Bloomberg specialist’s prediction pointing out, that its sources revealed that Carlos Ghosh has been planning merger of Renault-Nissan and recent developments might be caused by coup d’état performed by opposing forces in Nissan structure. The reasons for such putsch could be

found in Nissan senior employees’ unwillingness to entrench Nissan second-trier status caused by Renault’s stake in the company equals to 43.4% of share ownership. Ousting Carlos Ghosh, big proponent of such merger, could give a chance for Nissan to remain an independent car manufacturer. Such vision can be understood by looking at the market value of both companies. While Renault Group is worth $19.7 billion, Nissan is much bigger player, being valued at $35.7 billion. However, if resistance to the merger would be a sole reason for ousting Mr. Ghosh, Renault should have enough voting power to appoint new Nissan CEO, who would continue Mr. Ghosh mission of joining two companies together. There is also possible third option, an enemy takeover of the company. To do so Renault would need to acquire 6.7% of Nissan shares which are valued at current market price of 2.4 billion US dollars, therefore within reach of the Renault. Understandably French company prefers to choose more cost-effective option and avoiding further conflict by pursuing more amiable solutions.

Most recent development suggests such outcome. On Thursday 22th of November Nissan sent a filling to Japanese equivalent of SEC, where it announced that Carlos Ghosh and Greg Kelly has been removed from their positions and changed its status from “representative directors” to “directors”. This action does not differ much from aforementioned Renault decision to appoint Tierry Bollore as a CEO on temporary basis, while stating that Carlos Ghosh is “temporarily incapacited, but remains Renault Group’s CEO. In latest video release, Tierry Bollore reaffirms that Renault stays focused on its mission and will do everything to preserve interests of Group Renault and sustainability of the alliance. It seems that this video has been targeted to investor as well as to Renault partners, that nothing has changed in terms of pursuing towards merger, with or without Carlos Ghosh.

Keep calm and buy the dip.

As we could see, recent drama is more of a noise that anything that would impact NissanMitsubishi-Renault long term future. This, however, pushed shares prices of all members of the alliance down, thus creating buying opportunity.

Renault at this very moment is making dirt looking expensive, being traded at 3.4 P/E, 0.3 Price to Sales and 0.5 Price to Book Value. Such pricing should suggests expectations of sudden collapse of the company, but when we look at the last financial metrics such as revenues (58.7bln vs 51.2 in previous year, increase of 14%) and net profits (5.114 bln vs 3.54 bln in 2016 increase of staggering 45%) which in 2017 reached all time high, such valuation can be only attributed to increased uncertainty about future of the alliance and to heavy penalty imposed by private investors on French Group for French government involvement in the company.

On the other side, recent quarter has been disappointing in terms of sales, when French group has been adversely affected by American embargo on Iran, and financial turmoil in Turkey, Italy and Argentina, its big market, which has been partially offset by increased revenues from Russia, group’s second biggest market. Such changes reduced third quarter revenue by 6% down to 11,5 billion euros. This, however, has not affected Group goals for

year 2018. In latest presentation of financial results Board of directors reaffirmed Renault guidance for the whole year, which are: increase Group revenues (at constant rates), maintain operating margin above 6% and generate positive operational free cash flow.

We cannot forget also that this year company has increased dividends by 12.7% up to €3.55 per share, bringing to investors nice yield 6% of yield with very comfortable 29% payout ratio.

If we add most likely share price appreciation when recent battle dust will settle and investors will see unchanged landscape, then I believe that courageous investor shall be rewarded with double digit return of investment in short term and/or safe and generous income generator for people who looks for diversifying their retirement portfolio away from US market, while increasing median yield in their portfolios.

Author is Long Renault.