One day you find yourself at a fairly boring cocktail party in town. You've had a couple of drinks and just as you are about to sneak out of there, a gentleman with a bushy mustache you've met earlier (and for the life of you, can't remember his name) approaches. "So Sarah," he says, "I hear you are in finance." You know what's coming now; he's going to be looking for some stock tips. Well, just tell him "AAPL" - maybe he'll go away. But to your astonishment he asks a strange question. "Sarah, which fixed income asset class has had the best returns over the last couple of years?" All of a sudden you notice a bunch of other people staring your way, fascinated by this unusual question. But you know the answer because you've analyzed your fixed income ETFs.

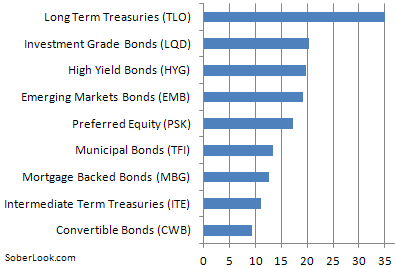

Fixed income asset class returns over the past two years as measured by the corresponding ETFs (in parenthesis):

Your answer is "Long term Treasurys, of course. A 35% return over the past couple of years." Now more people at the party are listening. "Yeah," you tell them. "Equities only did 23%, under-performing Treasurys". The gentleman with the mustache takes another drink, and after staring at you for a while asks another strange question. "So Sarah, since you know so much about fixed income, tell me which asset class has been the most volatile in the last couple of years?" Now you start thinking back to your ETFs and you want to say High Yield bonds. But then you remember the pain you took on the TLO short roller coaster after Bill Gross "suggested" it.

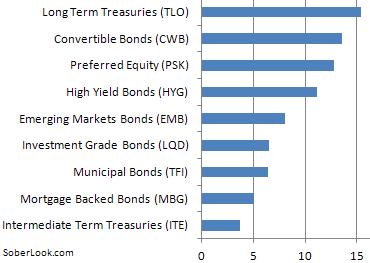

Fixed income asset class annualized daily volatility over the past two years:

And it comes to you: "Also long-term Treasurys. The most volatile fixed income asset class in the past two years." The people standing around you are quite surprised. Someone says "How can that be?" But you remember your volatility chart and answer - "That's right, long-term Treasurys experienced over 15% annualized volatility. The next most volatile asset class was convertible bonds - only because these bonds have an equity-like component."

Now more people from the party have surrounded you to learn all they can about fixed income (they must all be Baby Boomers thinking about retirement). And you figured you look like a hero having recalled all this cocktail trivia. And just as you get ready to triumphantly exit, the mustached man, having clearly had one too many, asks in a loud voice: "Hold on there, Sarah. One last question."

Now you have a decision to make. You walk out and feel pretty good about your knowledge of fixed income or you stay and answer one last strange question, risking being embarrassed. But you stay because this has become a challenge. "OK Sarah, here goes," he says. "Which fixed income asset class has had the best performance on a risk-adjusted basis in the last couple of years?" You think to yourself - this guy has lost his marbles. But now you can't just walk away - too many people at the party want to hear your answer.

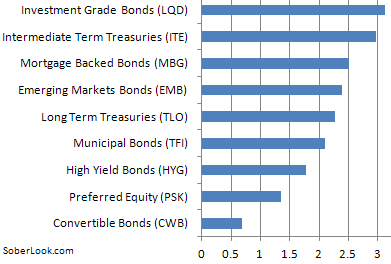

So you try to do some quick arithmetic in your head dividing the returns by the volatility numbers (the poor man's Sharpe ratio). You keep getting an answer that doesn't seem very intuitive - long-term Treasury returns on a risk-adjusted basis actually weren't that great. A few other asset classes come to mind that did considerably better. You give the a short answer: "Mortgage bonds and corporate bonds outperformed Treasurys on a risk-adjusted basis." People are now duly impressed.

Two year returns over the annualized volatility (rough ranking of risk adjusted returns):

You leave the party, redo the math, and satisfy yourself that you knew the answers (except for the fact that intermediate Treasurys also did quite well on a risk-adjusted basis). But now you know you are absolutely ready for the next cocktail party - no matter how strange the questions are (or the people for that matter).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Remembering Fixed Income Asset Classes At A Cocktail Party

Published 04/09/2012, 02:10 AM

Updated 07/09/2023, 06:31 AM

Remembering Fixed Income Asset Classes At A Cocktail Party

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.