Reliance Steel (NYSE:RS) posted a profit of $103 million or $1.40 per share in the second quarter of 2017, up around 2.1% from $100.9 million or $1.38 per share a year ago. Earnings per share topped the Zacks Consensus Estimate of $1.38.

Reliance Steel recorded net sales of $2,475.2 million, up around 12.3% year over year, coming ahead of the Zacks Consensus Estimate of $2,416.1 million. The company witnessed strength across automotive and aerospace markets along with higher pricing levels in the quarter, which contributed positively to earnings.

Overall sales volume rose 1.9% year over year while average prices per ton went up 10.5%.

Financials

Reliance Steel ended the quarter with cash and cash equivalents of $146.5 million, up roughly 25.7% year over year. Long-term debt increased roughly 18.1% year over year to $1,990.1 million. Cash flow from operations was $15.2 million during the first half. Net debt-to-capital ratio was 30.7% as of Jun 30, 2017, down from 33.4% as of Jun 30, 2016.

Reliance Steel did not repurchase any shares during the second quarter. It had 8.4 million shares available for buyback under its existing share repurchase program at the end of the quarter.

Outlook

Moving ahead, Reliance Steel remains carefully optimistic regarding activity levels of business in the third quarter due to normal seasonal patterns. The company anticipates current demand to remain steady except for decline in shipping volume owing to customer vacation and shutdowns schedules in the third quarter. As a result, the company expects tons sold will be down 3% to 5% in third-quarter 2017, compared with the previous quarter. Average selling price for the quarter is expected to be flat to up 3% from the second quarter. The company expects earnings for the third quarter in the band of $1.15 to $1.25 per share.

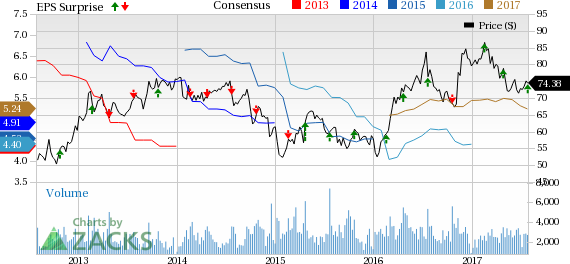

Price Performance

Reliance Steel has lost 5.6% of its value in the last three months versus the 1.2% gain of its industry.

Zacks Rank & Key Picks

Reliance Steel currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Reliance Steel & Aluminum Co. (RS): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research