Kathy Lien is the Managing Director of FX Strategy for BK Asset Management.

- Forex: Relative Value and RBA

- NZD: Dairy Auction Tuesday

- CAD: Chinese PMIs on Tap

- Lower Yields Keeps Dollar Under Pressure

- Sterling Rebounds on Stronger Construction PMI

- EUR Receives No Support from Banco Espirito Santo Bailout

- Speculators Reload Short Yen Bets

Forex: Relative Value Trades and RBA

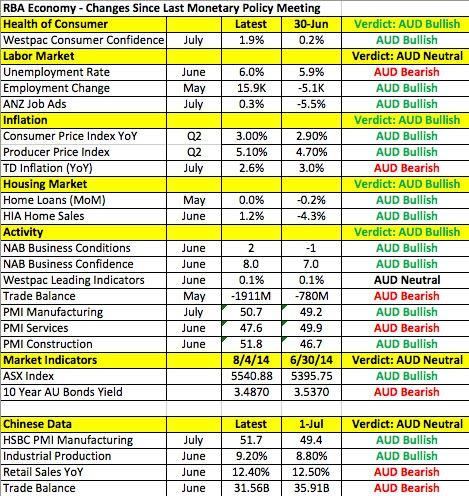

We have had a relatively quiet start to a busy week in the foreign exchange market with most of the major currencies pairs trading in narrow ranges. Last week it was all about the dollar but this week, the opportunities will be in relative-value plays. We don't have much in the way of market moving U.S. data -- Tuesday's non-manufacturing ISM number is important but less market moving than usual because it is released after NFPs. We have 4 central bank rate decisions along with a number of PMI and employment reports scheduled for release outside of the U.S. this week. The growing divergence in economic performance and monetary policy expectations between different countries will come into focus and if there are sufficient surprises in the tone of central banks or economic data, we could see big moves in currency crosses. The action was set to kick off with the Australian dollar Monday night when the RBA was slated to make a monetary policy announcement, while service-sector PMI and trade balance were also scheduled for release. On top of that, the HSBC's Composite and Services PMI reports for China were also due. After hotter-than-expected retail sales and a stronger manufacturing PMI index, the risk is to the upside on Monday night's Australian PMI services report. How AUD trades will hinge primarily on the tone of the RBA statement because interest rates will remain unchanged. According to the table below, there have been more improvements than deterioration in Australia's economy since the last monetary policy. However commodity prices are weak and the Australian dollar is strong and according to the minutes from their last meeting, economic growth is expected to be "a little below trend." If the RBA maintains a cautious tone, it could renew the decline in AUD but if the statement sounds more balanced the currency will extend its relief rally. Aside from the RBA, we want to remind our readers that Tuesday is the semimonthly New Zealand dairy auction and in recent months, the outcome of the auction has a significant impact on NZD.

Lower Yields Keeps Dollar Under Pressure

The U.S. dollar held steady or traded lower against all of the major currencies Monday with the exception of the euro. Treasury yields continued to fall, giving investors very little reason to buy the greenback. There were no U.S. economic reports released Monday and for the most part, investors ignored this morning's comments from Federal Reserve President Lacker. He said the market may be underestimating the pace of Fed tightening, which is true because according to the Fed's projections, the first rate hike should be in June 2015 but futures are pricing in only a 57% chance of that happening. More specifically, futures contracts show a 62% probability that rates will be 0.75% or lower by the end of next year, which is less than the 1.13% median prediction from the FOMC in June. However as a non-voting member of the central bank this year, Lacker is simply stating the facts and not making a judgment that will affect the Fed's monetary policy plans. This should be a quiet week for the U.S. dollar. The only piece of market moving data is Tuesday's non-manufacturing ISM report. Although economists are looking for faster growth, the disappointing non-farm payrolls report on Friday puts the odds in favor of a softer release. Traders should keep an eye on U.S. yields this week because they will determine how the dollar trades but in all likelihood relative value will play a more important role in the performance of currencies.

Sterling Rebounds on Stronger Construction PMI

Sterling experienced its strongest rally against the U.S. dollar GBP/USD in 14 trading days. While this may sound impressive it doesn't say much when the actual gain was less than 50 pips. A stronger-than-expected Construction Sector PMI index triggered the rally but the 62.4 reading represented a slowdown from the past month's levels. Construction sector activity remains strong and any reading above 60 is very healthy but in order for a more meaningful relief rally to occur in sterling, we need an unambiguously positive report that would renew expectations for earlier tightening by the Bank of England. The most important report from the U.K. this week will be Tuesday's PMI Services and Composite index -- these numbers will determine whether GBP/USD falls to fresh 6-week lows or rises back above 1.69. Based on the slowdown in manufacturing and construction activity along with the fall in consumer confidence, the risk is to the downside but given how deeply oversold GBP/USD is, an upside surprise would have a larger impact on the currency. According to a group of independent economists that make up the Shadow Monetary Policy Committee (SMPC), the central bank should raise interest rates by 50bps immediately. While it is far too soon for the central bank to raise rates, this indicates that despite the unevenness of recent U.K. data, leading economists believe it is time for the BoE to consider tightening monetary policy. Investors on the other hand won't be convinced that this is a possibility until economic data starts to improve and that is when sterling will experience a stronger rally.

EUR Receives No Support from Banco Espirito Santo Bailout

To the surprise of many investors, the euro received no support from the Banco Espirito Santo bailout. This morning, the Bank of Portugal injected close to 5 billion euros into BES to avoid a collapse of the country's largest bank. The size of the bailout was larger than expected and should have lifted euro because it reduces the risk of spillover and avoids disrupting the global financial markets. Also, the Portuguese government will be providing most of the funds, limiting the burden on other European nations. If Portugal let BES collapse the uncertainty would have a triggered widespread sell-off in European assets. Therefore their decision to rescue BES should have provided relief to the currency. However based on the price action of the euro and the steep decline in Portuguese, Italian and Spanish bond yields, investors are not convinced that this will be the end of Europe's banking troubles. ECB President Mario Draghi could touch on the region's banking troubles in his post monetary policy press conference this week. The ECB is expected to leave interest rates unchanged but given the low level of inflation we expect the central bank to maintain a dovish bias and continue to talk about the need for additional stimulus. Even though producer prices rose 0.1% in the month of June, on an annualized basis, PPI fell by -0.8%. Revisions to the Eurozone's composite PMI index and retail sales are on the calendar for Tuesday.

Speculators Reload Short Yen Bets

With no major U.S. or Japanese economic reports released over the past 24 hours, USD/JPY traded in a narrow 33-pip range. The currency pair tested the 103 level last week but the lack of follow through put it right back into a 101 to 103 trading range. If 10-year U.S. Treasury yields remain under pressure and below 2.5% this week, we expect USD/JPY to drop to 102 and possibly even 101.75. Yet this would represent nothing more than a natural correction after the strong gains experienced in the last 2 weeks. According to the CFTC's latest IMM report, the recent rally in USD/JPY drew speculators back into the short Yen trade. For the first time in 3 weeks, speculative short yen positions increased on the back of rising U.S. yields and weakening Japanese data. If Treasury yields bounce and Japanese data continues to surprise to the downside, we could see more traders revisit the long USD/JPY trade. The PMI composite index was scheduled for release Monday night and a softer reading would add to the countless number of Japanese economic reports that have missed expectations over the past month. While one month of softer data does not constitute the beginning of a new trend it will be something the Bank of Japan watches closely. The BoJ is widely expected to leave monetary policy unchanged later this week but the minutes may show less optimism. Since the sales tax was increased in April, the central bank was confident that the economy would be able to withstand the negative implications. For a while it appeared that they were right but now investors are getting worried that growth is starting to slow and more stimulus could be necessary.