“Growth begins when we begin to accept our own weakness.” - Jean Vanier

I've been watching the performance of Real Estate Investment Trusts (REITs) in recent days and have noticed that there has been quite a bit of weakness kicking in. The timing of the underperformance seems to be coinciding with President Obama's 2013 budget proposal, which includes a provision to raise the dividend tax substantially for high-income earners. While it is unlikely the proposal goes through, near-term fear over changing tax treatments to dividend stocks could explain why leadership appears to have ended in income-producing REITs.

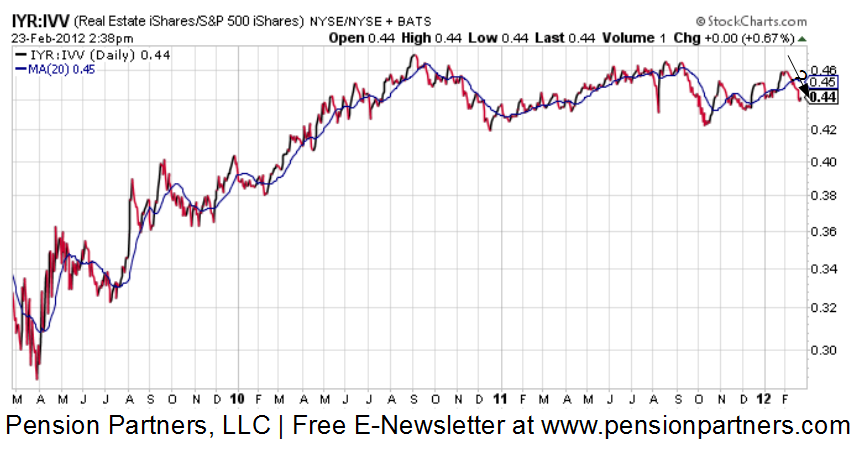

Take a look below at the price ratio of the iShares Real Estate ETF (IYR) relative to the S&P 500 (IVV). As a reminder, a rising price ratio means the numerator/IYR is outperforming (up more/down less) the denominator/IVV.

It is curious to see that the ratio peak of around 0.46 which has been hit two other times in the past three years is right around when the budget proposal was announced, with a sharp sell-off in those shares. Because REITs pay out a substantial portion of their earned income in the form of dividends, the move directly impacts investor sentiment in the industry. The trend down in underperformance appears to be fairly early, with more room lower to go. This remains a good area of the market to watch though should an overreaction occur to the budget proposal to increase dividend taxes, particularly if the idea gets scrapped.

Either way, weakness in REITs and income-oriented areas of the market are consistent with the idea of reflation I keep stressing. For those unfamiliar with my overall macro theme for 2011, which I believe could be similar to 2003 and 2009 for risk-assets, I encourage you to watch a recent interview I did at the NASDAQ Live. The segment can be viewed at http://www.ndtv.com/video/player/nasdaq-live/us-stocks-rise-on-strong-economic-data-greek-bailout-news/224105 around the 10 minute 30 second mark.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

REITs Weakening on Obama Tax Hike Proposal?

Published 02/26/2012, 12:37 AM

Updated 07/09/2023, 06:31 AM

REITs Weakening on Obama Tax Hike Proposal?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.