Though the current reporting cycle is drawing to a close, results are still pouring in from the real estate investment trust (REIT) industry. In fact, on Aug 9, Starwood Property Trust, Inc. (NYSE:STWD) , Hospitality Properties Trust (NASDAQ:HPT) , Medical Properties Trust, Inc. (NYSE:MPW) and Starwood Waypoint Homes (NYSE:SFR) are slated to release their quarterly figures.

In the broader market, the bulk of Q2 earnings is already over, and so far the results have revealed broad-based growth, reaching double-digit level for the second quarter in a row, witnessing record earnings tally, an abundance of positive surprises and favorable trends on the revisions front. (Read more: Q2 Earnings Season Brings All Around Strength)

Nevertheless, performances have been mixed, so far, from the REIT industry’s point of view, with results from some of the top notch REIT stocks either matching estimates or beating and a few falling shy of expectations.

No doubt, the rate hike issue and the cautious approach of investors have affected gains from this industry so far this year. However, rather than entirely focusing on the rate factor, investors need to keep in mind that the operating performance of this special hybrid asset is highly determined by the dynamics of the individual asset categories. A number of asset categories displayed strength in second-quarter 2017, with the economy and the job market showing signs of recovery.

In fact, defying concerns about supply in the market, the residential real estate market is back with a bang, driven by robust demand levels. This helped occupancy to remain high at 95.0% as of mid-year. Notably, job formation and checked move-outs for buying homes acted as the catalyst.

Moreover, the office and industrial asset categories hogged the limelight for experiencing high demand, with the economy and job market displaying signs of recovery, ecommerce gaining strength and manufacturing environment remaining healthy. Nonetheless, dwindling mall traffic and store closures amid aggressive growth in online sales kept retail REITs on tenterhooks in second-quarter. However, growth in cloud computing, Internet of Things and big data drove demand for the data center REITs.

Therefore, not all players in the REIT space are equally poised to excel this time around. To predict that, we rely on the Zacks methodology, combining a favorable Zacks Rank – Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 (Hold) – and a positive Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Per our proprietary methodology, Earnings ESP shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Research shows that with this combination of rank and ESP, chances of a positive earnings surprise are as high as 70% for the stocks.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Let’s have a look at what’s in store for these four REITs set to release second-quarter results on Wednesday:

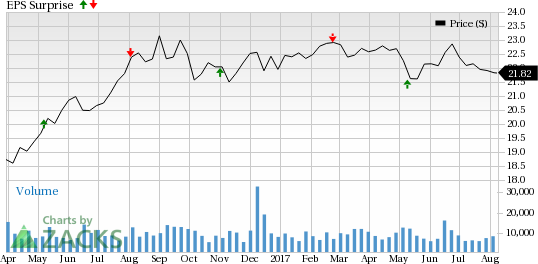

Greenwich, CT-based Starwood Property Trust is a commercial mortgage REIT in the U.S. The company focuses on originating, acquiring, financing and managing commercial mortgage loans, and other commercial real estate debt and equity investments.

Currently, Starwood Property Trust has an Earnings ESP of 0.00%. In addition, it has a Zacks Rank #4. Therefore, this stock lacks the right combination required for an earnings beat prediction.

However, over the trailing four quarters, the company posted an average beat of 3.72%, having beaten the Zacks Consensus Estimate in two quarters and missing in the other two. This is depicted in the chart below:

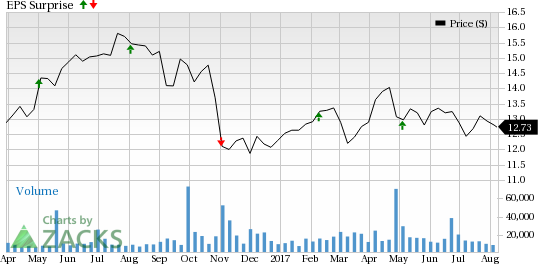

Newton, MA-based Hospitality Properties Trust is a lodging and travel center REIT with properties located in 45 states, Puerto Rico and Canada.

Presently, Hospitality Properties Trust has an Earnings ESP of 0.00%. Although, a Zacks Rank #3 increases the predictive power of ESP, we need to have a positive ESP to be confident of an earnings beat.

Over the trailing four quarters, the company surpassed estimates on two occasions, met in another and missed in the other. This resulted in an average positive surprise of 1.62%. The graph below depicts the surprise history of the company.

Birmingham, AL-based Medical Properties Trust is a healthcare REIT engaged in acquisition and development of net-leased healthcare facilities. These include acute care hospitals, inpatient rehabilitation hospitals, long-term acute care hospitals, and other medical and surgical facilities.

Medical Properties presently has an Earnings ESP of 0.00% and a Zacks Rank #3. Though a favorable Zacks Rank increases the predictive power of ESP, the company’s zero ESP makes our surprise prediction difficult.

Over the trailing four quarters, the company surpassed estimates in one occasion, met in two and missed in the other. This resulted in an average positive surprise of 0.03%. The graph below depicts the surprise history of the company:

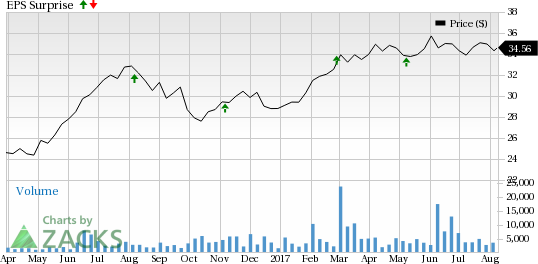

Scottsdale, AZ-based Starwood Waypoint Homes is engaged in company acquiring, renovating, leasing, maintaining and managing single-family homes.

Starwood Waypoint Homes has an Earnings ESP of +2.27%. This is a meaningful and leading indicator of a positive surprise in the quarter. However, the stock currently carries a Zacks Rank #4, which actually reduces the predictive power of ESP.

However, Starwood Waypoint Homes surpassed estimates in three of the trailing four quarters, witnessing an average positive surprise of 4.76%. The graph below depicts this surprise history.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

STARWOOD PROPERTY TRUST, INC. (STWD): Free Stock Analysis Report

Colony Starwood Homes (SFR): Free Stock Analysis Report

Hospitality Properties Trust (HPT): Free Stock Analysis Report

Medical Properties Trust, Inc. (MPW): Free Stock Analysis Report

Original post

Zacks Investment Research