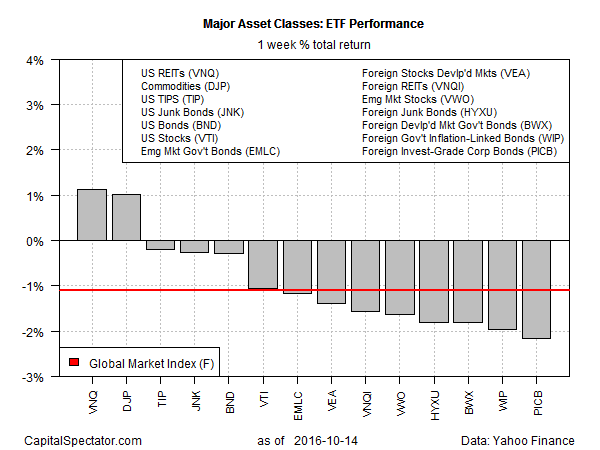

US real estate investment trusts (REITs) posted the first weekly gain since mid-September for the five trading days through Oct 14. Commodities (broadly defined) gained ground last week too. But everything else was in the red among the major asset classes, based on a set of proxy ETFs.

Vanguard REIT climbed 1.1% last week, offering a respite from the downside trend that’s been in force for the asset class since early August. In close pursuit: iPath Bloomberg Commodity (DJP) added 1.0%, marking the ETN’s fourth consecutive weekly gain.

Otherwise, all the major asset classes lost ground last week. The biggest loss was posted by foreign corporate bonds via PowerShares International Corp Bond (PICB), which tumbled 2.2%.

Last week’s negative bias weighed on an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F shed 1.1% over the five trading days through Friday.

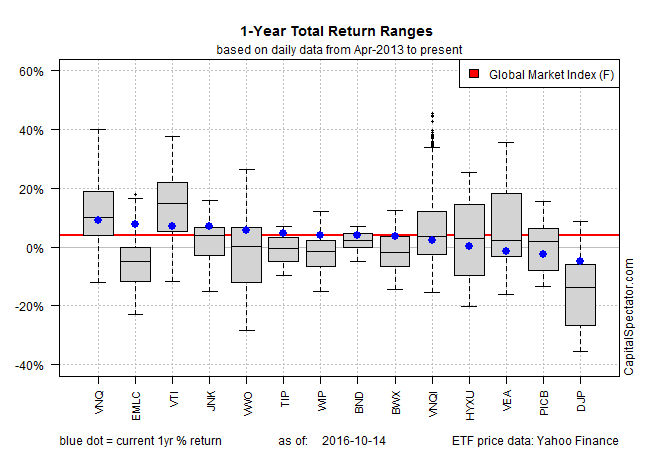

Turning to the trailing one-year column, REITs continue to hold on to the top spot, posting a 10.5% total return as of last Friday vs. the year-earlier level. But in contrast with recent history, the return premium for REITs relative to the rest of the field has narrowed sharply.

Meanwhile, the recent uptrend in commodities still has a long way to go to turn the red ink into a gain for the one-year change. The iPath Bloomberg Commodity (DJP) is down 5.3% for the year through Oct. 14, the steepest loss among the major asset classes over the trailing 252 trading days.

Meanwhile, GMI.F’s one-year performance continued to slip. The benchmark is still in the black for the one-year window, but the 12-month change ticked lower last week to a modest 3.9% total return through Oct. 14.