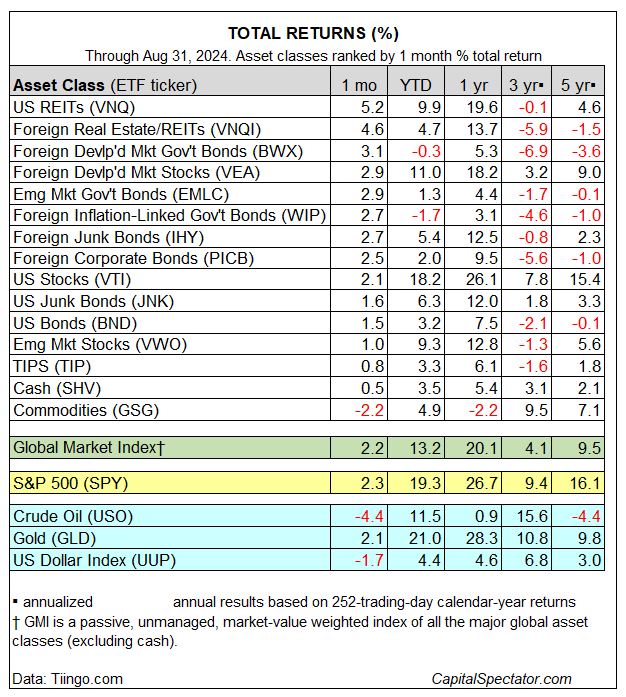

US real estate investment trusts led global markets higher for a second straight month in August, based on set of ETFs representing the major asset classes.

Another performance redux: commodities were the outlier, posting the only monthly loss, echoing the setback in July.

The best performer: Vanguard Real Estate ETF (NYSE:VNQ), which rallied 5.2% in August, building on a strong gain in the previous month.

As a result, the fund has rebounded sharply from its slump that had left it trailing most markets earlier in the year. A similar recovery is unfolding for global property shares (VNQI), which once again posted the 2nd best monthly gain.

August witnessed widespread gains, including a solid 2.1% increase for US stocks (VTI) and a 1.5% advance in US fixed income (BND). The lone case of red ink last month: commodities (GSG), which declined 2.2%.

Reviewing year-to-date results continues to show US shares (VTI) with a wide lead of 18.2%. The second-best performance for 2024: developed-markets stocks ex-US (VEA) via an 11.0% rise. Only two of the major asset classes are nursing year-to-date losses: foreign-developed markets ex-US bonds (BWX) and foreign inflation-indexed bonds (WIP)—the latter is the worst performer this year with a 1.7% setback.

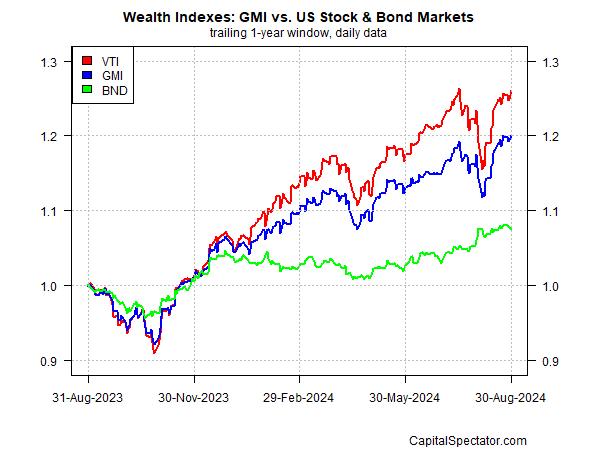

The Global Market Index (GMI) posted its fourth straight monthly gain, advancing 2.3% in August. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

Year to date, GMI is up a strong 13.2% — exceeded in 2024 only by the rally in US stocks (VTI). For the one-year window, GMI continues to reflect a middling performance relative to US stocks (VTI) and US bonds (BND).