We are in the heart of the Q2 earnings season and the real estate investment trust (REIT) space is buzzing with activity. Notably, Jul 31 will mark the beginning of another busy week, with a deluge of earnings releases. Among others, Vornado Realty Trust (NYSE:VNO) VRO, Alexandria Real Estate Equities (NYSE:ARE) , Brixmor Property Group (NYSE:BRX) and New Residential Investment Corp. (NYSE:NRZ) will release their quarterly numbers on Jul 31.

Admittedly, rate hike and restrained investments by investors have resulted in lower gains for the industry, so far, this year. However, with underlying asset categories and the location of properties playing a crucial role in determining the performance of REITs, not all players in the space have equally excelled or fallen behind.

In fact, a number of asset categories displayed strength in second-quarter 2017, with the economy and the job market showing signs of recovery. Per a study by the commercial real estate services’ firm CBRE Group Inc. (NYSE:CBG), the overall U.S. industrial real estate market remained upbeat in the second quarter, with the industrial availability rate contracting 10 basis points to 7.8%.

In addition, the U.S. office vacancy rate remained steady at 13% in the quarter amid a balanced demand-supply environment. Moreover, growth in cloud computing, Internet of Things and big data are also increasing demand for data center REITs. Additionally, defying concerns about supply in the market, the residential real estate market is back with a bang, driven by encouraging demand levels.

However, dwindling mall traffic and store closures amid aggressive growth in online sales have kept retail REITs on tenterhooks. Also, for healthcare REITs, rising supply of senior housing units is expected to have put pressure on pricing in some markets.

For predicting the earnings beat potential of a stock, we rely on the Zacks methodology. Per the model, in order to be confident of an earnings beat, a stock needs to have the right combination of two key ingredients — a Earnings ESP ESP and a Zacks Rank #3 (Hold) or better.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

The Earnings ESP shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Research shows that with this combination of rank and ESP, chances of a positive earnings surprise are as high as 70%.

Let’s have a look at what’s in store for these four REITs set to release quarterly results on Jul 31:

NY-based Vornado Realty Trust has been aggressively disposing its assets. Though such efforts to streamline its business are commendable, the earnings dilutive effects of these moves cannot be bypassed. Also, the company faces intense competition from developers, owners and operators of office properties, and other commercial real estate in its markets. Amid this, Vornado’s pricing power and occupancy gains are likely to remain limited. (Read more:Vornado Realty to Post Q2 Earnings: What's in Store?)

Vornado has an Earnings ESP of +0.79%. However, it currently has a Zacks Rank #5, which actually reduces the predictive power of ESP.

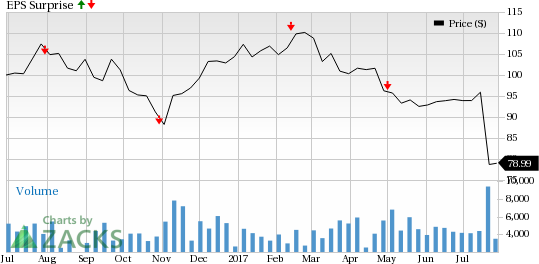

Over the trailing four quarters, the company missed the Zacks Consensus Estimate, with an average negative surprise of 8.4%. This is depicted in the graph below:

Pasadena, CA-based urban office REIT Alexandria Real Estate Equities is anticipated to benefit in the to-be-reported quarter from its assets in high barriers to entry and exit markets, with limited supply of available space.

In the second quarter too, the company is likely to enjoy high occupancy, driven by high demand for its properties in premium locations. Furthermore, it is likely to record healthy internal and external growth, solid cash flow and witness decent balance-sheet strength. However, a substantial development pipeline, currency fluctuations and stiff competition are expected to dent Alexandria’s bottom-line growth in the quarter under review. (Read more: Alexandria to Post Q2 Earnings: What's in the Offing?)

Alexandria has an Earnings ESP of 0.00% and a Zacks Rank #3. The combination makes surprise prediction difficult for us. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

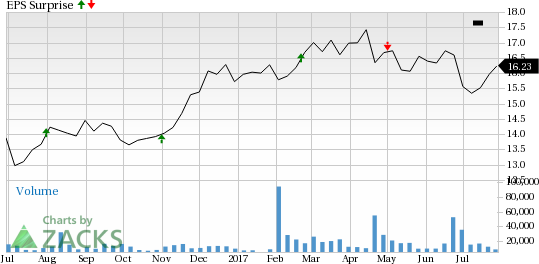

Over the trailing four quarters, Alexandria beat the Zacks Consensus Estimate in two occasions and missed in the other two, generating an average beat of 0.17%. This is depicted in the graph below:

Alexandria Real Estate Equities, Inc. Price and EPS Surprise

U.S.-based Brixmor Property Group Inc. is anticipated to benefit from strong demand in the transaction market for grocery-anchored community and neighborhood shopping centers. Although the company increased its disposal activities, exiting various markets, the earnings dilutive impact of such exits cannot be ignored.

Currently, Brixmor Property Group has an Earnings ESP of 1.96% and a Zacks Rank #4. So, we can’t conclusively predict an earnings beat.

Brixmor Property Group witnessed positive surprises in all of the trailing four quarters, resulting in an average negative surprise of 1.46%. This is depicted in the graph below.

Brixmor Property Group Inc. Price and EPS Surprise

Surprise prediction is difficult for New Residential Investment Corp. as well because it has an Earnings ESP of 0.00% and a Zacks Rank #4.

New Residential Investment witnessed positive surprises in three of the trailing four quarters and missed in another, resulting in an average negative surprise of 2.51%. This is depicted in the graph below.

New Residential Investment Corp. Price and EPS Surprise

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

New Residential Investment Corp. (NRZ): Free Stock Analysis Report

Brixmor Property Group Inc. (BRX): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Original post

Zacks Investment Research