Reis, Inc. reports preliminary financial results for the quarter ended December 31, 2014.

Reis Inc (NASDAQ:REIS), a leading provider of commercial mortgage and real estate research and analytics, reported revenue of $10.7 million for the quarter ending December 31, 2014, up 16.5 percent from the same quarter a year ago. This was the 19th consecutive quarter of increased revenue,

REIS generated 100 percent of its revenue from subscriptions. and the continued strong revenue performance is due to that subscription revenue. 2014 TTM annual renewal rates were 87 percent overall, and 89 percent for institutional subscribers.

According to CEO Lloyd Linford, since January, 2011, EBITDA has grown at a CAGR of 14.3 percent and revenue has grown at a CAGR of 15.4 percent.

This earnings release follows the earnings announcements from the following peers of Reis, Inc. – TechTarget Inc (NASDAQ:TTGT), CoStar Group Inc (NASDAQ:CSGP), Blucora Inc (NASDAQ:BCOR), TheStreet Inc (NASDAQ:TST), and Thomson Reuters Corporation (NYSE:TRI).

Highlights

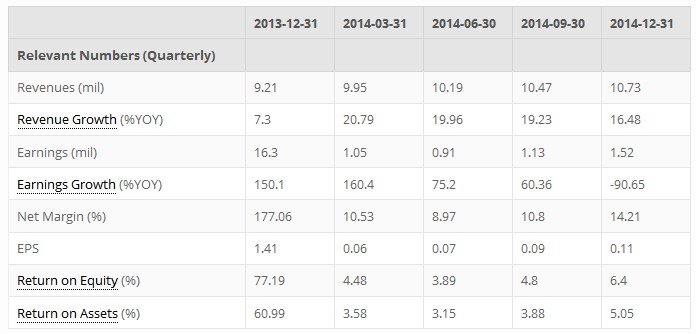

- Summary numbers: Revenues of USD 10.73 million, Net Earnings of USD 1.52 million, and Earnings per Share (EPS) of USD 0.11.

- Gross margins narrowed from 84.15% to 80.67% compared to the same quarter last year, operating (EBITDA) margins now 21.58% from 30.76%.

- Earnings decline largely a result of non-operational activity, pretax margins improved from 16.87% to 21.37%.

The table below shows the preliminary results and recent trends for key metrics such as revenues and net income growth:

Market Share Versus Profits

Companies sometimes focus on market share at the expense of profits or earnings growth.

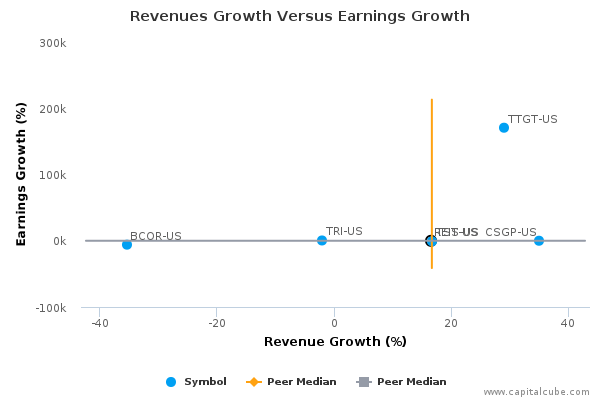

Compared to the same quarter last year, REIS-US's change in revenue of 16.48% surpassed its change in earnings, which was -90.65%. This suggests perhaps that REIS-US's focus is on market share at the expense of bottom-line earnings. However, this change in revenue is better than its peer average, pointing to perhaps some longer lasting success at wrestling market share from its competitors, and helping Capital Cube look past its weaker earnings performance this period. Also, for comparison purposes, revenues changed by 2.45% and earnings by 34.86% in the quarter ended September 30, 2014.

Earnings Growth Analysis

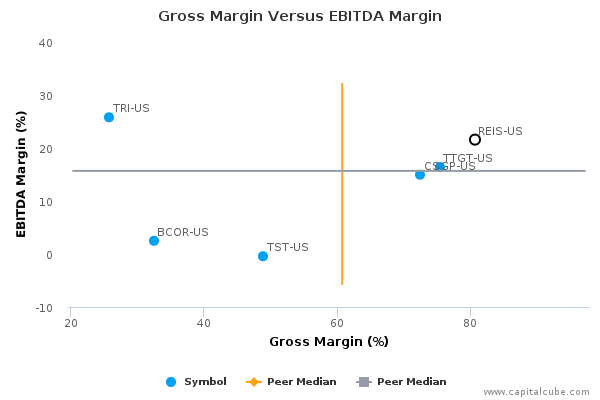

The company's year-on-year decline in earnings was influenced by a weakening in gross margins from 84.15% to 80.67%, as well as issues with cost controls. As a result, operating margins (EBITDA margins) went fro 30.76% to 21.58% in this time frame. For comparison, gross margins were 85.45% and EBITDA margins were 30.91% in the quarter ending September 30, 2014.

Margins

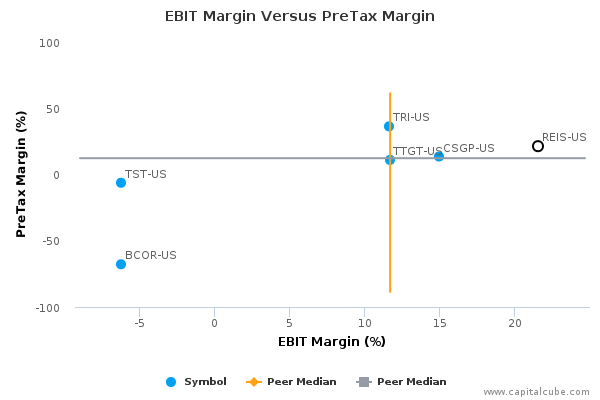

The company's earnings decline is largely a result of non-operational activity. As a matter of fact, the company showed increases in operating (EBIT) and pretax margins. EBIT margins improved from 17.15% to 21.58% and pretax margins widened from 16.87% to 21.37%.

Company Profile

Reis, Inc. provides commercial real estate market information and analytical tools to real estate professionals through its subsidiary Reis Services LLC. It maintains a proprietary database containing detailed information on commercial properties in metropolitan markets and neighborhoods throughout the U.S. The database contains information on apartment, office, retail, warehouse/distribution, flex/research & development, self storage and seniors housing properties, and is used by real estate investors, lenders and other professionals to make informed buying, selling and financing decisions. The company currently provides its information services to many of the lending institutions, equity investors, brokers and appraisers. Its product portfolio features: Reis SE, its flagship delivery platform aimed at larger and mid-sized enterprises; ReisReports, aimed at prosumers and smaller enterprises; and Mobiuss Portfolio CRE, aimed primarily at risk managers and credit administrators at banks and non-bank lending institutions. Reis was founded on January 8, 1997 and is headquartered in New York, NY.

DISCLAIMER: CapitalCube does not own any shares in the stocks mentioned and focuses solely on providing unique fundamental research and analysis on approximately 50,000 stocks and ETFs globally.