Reinsurance Group of America, Incorporated (NYSE:RGA) reported second-quarter 2017 operating income of $2.95 per share. The bottom line surpassed the Zacks Consensus Estimate of $2.44 by 21% and improved 5% from the year-ago quarter.

The company’s Traditional business in the EMEA and Asia-Pacific region performed well in the quarter.

Moreover, the quarter experienced solid top-line growth on improved U.S. mortality claims and robust organic growth across most regions, particularly Asia and EMEA.

Reinsurance Group's operating revenues of $3 billion climbed 3% year over year.

Net premiums of $2.5 billion rose 6% year over year.

Investment income rose 2% from the prior-year quarter to $518.5 million. The average investment yield was down by 11 basis points (bps) to 4.60% due to lower return on new money and reinvested assets.

Total benefits and expenses at Reinsurance Group increased 4% year over year to $2.8 billion. Higher claims and other policy benefits, interest credited, interest expenses, as well as collateral finance and securitization expenses resulted in the overall increase in costs.

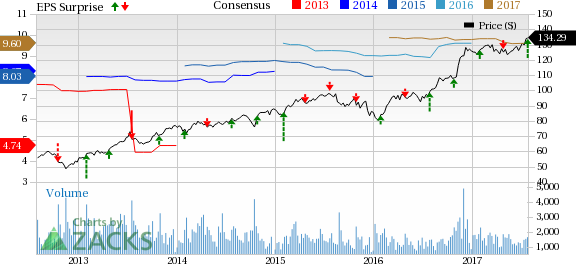

Reinsurance Group of America, Incorporated Price, Consensus and EPS Surprise

Quarterly Segment Update

U.S.and Latin America: Total pre-tax income declined 11% to $161.1 million in the quarter under review.

The Traditional segment reported pre-tax net income of $91.2 million, down 19% year over year. The downside was attributable to unfavorable group results, somewhat mitigated by favorable claims. Net premiums grew 2% from the year-ago quarter to $1.3 billion.

The Asset Intensive segment’s pre-tax operating income declined 8% to $49.8 million. Favorable investment spreads offset by unfavorable payout annuities led to the downside. Financial Reinsurance business reported pre-tax operating income of $19.9 million, compared with $14.8 million in the prior-year quarter owing to new businesses.

Canada: Total pre-tax operating income declined 17% to $35.6 million.

The Traditional segment’s pre-tax operating income fell 24% to $31.1 million. Net premiums were down 8% to $221.4 million. The decline can be mainly attributable to reduction in creditor business.

The Financial Solutions segment’s pre-tax income surged 110% year over year to about $4.4 million on favorable longevity experience.

AsiaPacific: Total pre-tax operating income was $55.9 million up 96% from the prior-year quarter.

Pre-tax operating income of the traditional segment surged 54% to $53.3 million during the quarter due to strong premium growth and favorable claims in Asia supported by profits earned in Australia. Premiums jumped 18% to $537.4 million on strong growth in Asia and new treaties in Hong Kong and Japan, offset by decline in premiums in Australia. The Financial Solutions segment’s pre-tax operating income of $2.6 million compared favorably with pre-tax operating loss of $6 million incurred in the year-ago quarter owing to capital losses.

Europe, Middle East and Africa (EMEA): Total pre-tax operating income surged $37.8 million, 96% up from the prior-year quarter.

The Traditional segment reported pre-tax operating income of about $11.4 million, up 66% from the previous year.

The improvement was mainly driven by solid overall mortality experience across the region. Premiums improved 15% to $330.9 million, mainly owing to the impact of new treaties.

The Financial Solutions segment’s pre-tax operating income grew 2% to $26.5 million on the back of favorable experience in the longevity businesses.

Corporate and Other: Pre-tax operating loss of $9.5 million was narrower than $12.7 million incurred in the year-ago quarter.

Financial Update

As of Jun 30, 2017, Reinsurance Group had assets worth $58.1 billion, up 8% from 2016-end.

As of Jun 30, 2017, Reinsurance Group’s book value per share, excluding Accumulated Other Comprehensive Income (AOCI), grew 11.6% year over year to $97.68.

Dividend Update

The board of directors approved a 22% hike in dividend. The raised dividend of 50 cents is payable on Aug 29, 2017 to shareholders on record as of Aug 8, 2017.

Zacks Rank

Currently, Reinsurance Group has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings so far, the bottom line at Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc. (NYSE:FNF) beat the Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) missed the mark.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post

Zacks Investment Research