On Jul 4, 2016, we issued an updated research report on Reinsurance Group of America Inc. (NYSE:RGA) .

Reinsurance Group’s Australia business has been underperforming for quite some time, due to competitive direct and reinsurance markets, complex product designs, weakening claims experience and increasing legal activity. Going forward, management expects to witness a certain degree of volatility in its Australia business.

Also, the evolving capital requirement with respect to the introduction of Solvency II could result in significant consolidation in the European insurance market. This would in turn affect the dynamics of the life reinsurance market overall, hurt reinsurance demand and put pressure on life reinsurance margins. However, in the short term, there should be increased demand for reinsurance.

Regulatory compliances will also affect the company as it will have to keep an increased amount of capital aside that could be invested in business.

The company is exposed to the adverse effect of forex as it derives more than one-third of its premiums from international operations in Europe, the Middle East and Africa and the Asia Pacific.

Nonetheless, Reinsurance Group boasts a leadership position in the U.S. Latin American traditional market with market leading services, capabilities, expertise and innovation offering stable earnings and capital generation. Also, product-line expansion contributes to risk diversification.

The company derives more than one-third of its net premiums from international operations. With significant presence in Asia, the insurer expects pre-tax operating income growth rates of 15–20% and premium growth rate of 10–15% by 2016.

Reinsurance Group has also been effectively deploying its capital via share buybacks and dividend payments. The company has $300 million worth shares remaining under its buyback authorization. It also deployed capital in some small in-force transactions. With excess capital of around $500 million, the company has been able to maintain financial flexibility, which will allow it to continue with healthy capital management, thereby boosting profitability. The company expects to deploy $300 million to $400 million of excess capital, on average, annually.

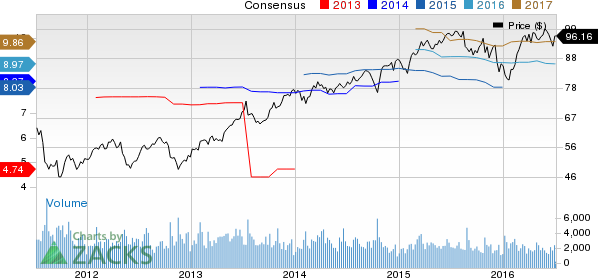

The company is scheduled to release second-quarter earnings on Jul 28. The Zacks Consensus Estimate for the second quarter is currently pegged at 2.35, translating to a year-over-year increase of 21%. However, our proven model cannot conclusively state if the bottom line will beat estimates because a Zacks Rank #4 (Sell) coupled with an Earnings ESP of -2.98% makes prediction difficult.

Stocks to Consider

Some better-ranked life insurers include Manulife Financial Corporation (NYSE:MFC) , Sun Life Financial Inc. (TO:SLF) and Universal American Corp (NYSE:UAM) . While Manulife sports a Zacks Rank #1 (Strong Buy), Sun Life and Universal American carry Zacks Rank #2 (Buy).

MANULIFE FINL (MFC): Free Stock Analysis Report

UNIVL AMERICAN (UAM): Free Stock Analysis Report

REINSURANCE GRP (RGA): Free Stock Analysis Report

SUN LIFE FINL (SLF): Free Stock Analysis Report

Original post

Zacks Investment Research