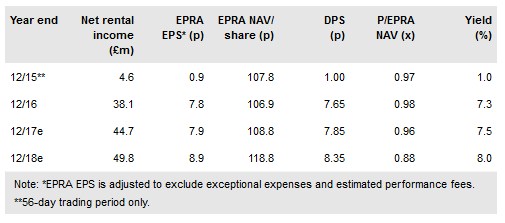

Regional REIT Ltd (LON:RGLR) is trading in line with management’s expectations, is seeing a good level of interest in both its office and industrial properties, and has continued to be active in letting since 30 June. As a result, it expects occupancy rates to increase across the portfolio in the near term, supporting income from the growing portfolio (c £650m in assets). Lettings since the end of September indicate progress towards the 85% occupancy rate that we target for end-2017 and then towards 90% by the end of 2018. On this basis, RGL’s highly attractive and growing dividend is fully covered by forecast earnings, while its regional focus should prove more resilient to macroeconomic headwinds than London real estate.

Letting progress towards targets

RGL says that it continues to see good performance in regional UK industrial and office occupancy markets and that it remains confident of its growth prospects, with active asset management underpinning income. Although occupancy (by value) was actually slightly lower at 30 September than at mid-year (82.8% versus 83.3%), subsequent lettings already agreed represent, we estimate, c 1.4% in occupancy improvement towards the 85% we target by year-end. While H217 will benefit from a full-period contribution from earlier acquisitions, the successful letting of major refurbishment projects expected to complete promises to be a significant driver of rental income growth.

To read the entire report Please click on the pdf File Below: