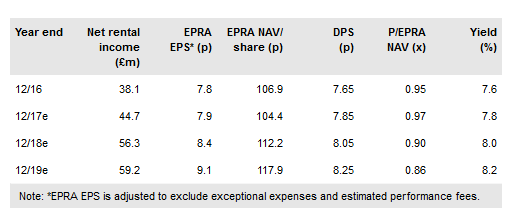

Regional REIT's (LON:RGLR) acquisition of two property portfolios, first announced in early December, for an aggregate consideration of £93.4m including costs, completed just before Christmas. This followed the closing of a capital issue that raised £73m (gross) in new equity at 101p per share. The group has also completed a major refinancing programme, simplifying the debt structure and extending maturity, at no additional cost. We reinstate our estimates, including the acquisitions, which add immediately to earnings, and the capital increase. We also take a slightly more cautious approach to 2018 and have trimmed our previously above consensus position.

Further portfolio growth and diversification

The two portfolios acquired are significant in scale and bring an immediate £7.8m uplift to the gross contracted rent roll (end-September 2017: £55.9m), offer significant asset management potential, and further diversify the portfolio. RGL estimates an ungeared 8.6% net initial yield off an overall 87% occupancy, with a reversionary yield above 10%. We have also assumed that the additional “pipeline investment”, an office property in Portsmouth included in the December announcement, proceeds to completion by end Q118, adding a further £400k to gross rent roll for a £4.9m investment.

To read the entire report Please click on the pdf File Below: