The bulk of business headlines this week will deal with the “will they or won’t they” issue. Specifically, some folks expect the United States Federal Reserve to finally begin reducing the size of its money printing program to an amount less than $85 billion per month. Others, myself included, believe that the Fed will not take action in 2013. Indeed, I would be surprised if tapering one month — December, January or March — is not followed by an increase in electronic money creation in another — June, July or August. That’s because Chairwoman Yellen will likely feel compelled to push rates back down and asset prices back up at the first sign of an economic soft patch.

My expectations notwithstanding, another debate seems to be raging about which equity type(s) benefits the most from higher interest rates. According to Bernstein Research, energy is the only sector to demonstrate statistically positive results to increases in rates over the previous 40 years. Meanwhile, financial stocks have fared the weakest of all sectors. The findings directly contradict the notion that banks benefit the most from rising rates since it should allow them to charge more for their services. Alas, financial companies may be able to increase profit margins, but research suggests that the performance of corporate stock shares may actually be harmed by higher interest rates.

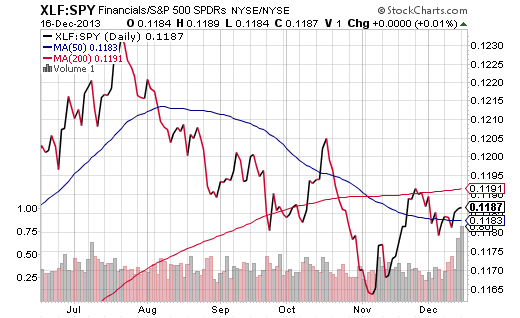

During the last six months in which the tapering conversation has been in play, the technical evidence also appears somewhat bleak for diversified financial services. SPDR Select Sector Financial (XLF), with holdings like JP Morgan Chase (JPM), Wells Fargo (WFC) and Bank of America (BAC), has demonstrated relative weakness against the S&P 500 SPDR Trust (SPY) throughout the 2nd half of 2013. In fact, it is worth noting that the XLF:SPY price ratio has declined rapidly enough for its 50-day moving average to cross below its 200-day trendline.

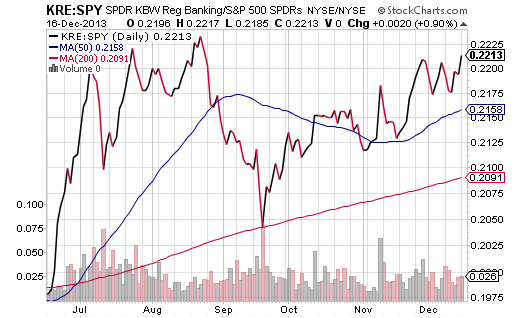

Diversified financials in SPDR Sector Select Financials (XLF) may not have been able to thrive during the tapering uncertainty, yet regional banking demonstrated relative strength in the same time period. Perhaps surprisingly, SPDR KBW Regional Banking (KRE) recently showed up on a proprietary “Buy List.” In addition, KRE is near an all-time high. Moreover, the price of the KRE:SPY price ratio is above its 50-day and its 200-day.

So why do under-the-radar smaller banks (a.k.a. regional players) seem to be doing so well in an environment of rate uncertainty whereas the larger banks seem to be struggling? Several possibilities may play a role, including the reality that large-company financial peers are dealing with monstrous legal payments, greater government oversight and regulation, as well as more exposure to government bonds that have been declining in value. Others would argue that the loan growth and loan quality at the regional level are more beneficial to shareholders than the slower loan growth and questionable loan quality at larger institutions.

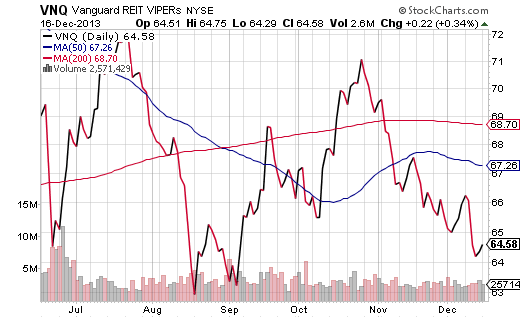

Of course, it is not just a large bank versus small bank story here. SPDR Select Sector Financials (XLF) also has exposure to real estate investment trusts (REITs), a classification that has been decimated by rising interest rates. In a world where the prospect of rising rates may have a unique impact on different industries with the financial sector, it may be prudent to stick with the industries that have been stronger than the S&P 500, not weaker. Without a doubt, REITs have been much weaker.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Regional Banking ETFs Stronger, Diversified Financial Sector ETFs Weaker

Published 12/17/2013, 02:18 AM

Regional Banking ETFs Stronger, Diversified Financial Sector ETFs Weaker

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.