Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) announced disappointing results from a phase III study, NURSERY Pre-term on suptavumab (REGN2222), an antibody to respiratory syncytial virus (RSV).

The study was initiated in 2015 and completed enrolling patients in the first quarter of 2017. The double-blind, placebo-controlled global study enrolled 1,149 healthy pre-term infants. Patients were randomized in a 1:1:1 ratio to one of the three study groups: suptavumab 30 mg/kg as a single dose; suptavumab 30 mg/kg administered as two doses 8 weeks apart; or placebo. Pre-term infants in the study had a gestational age of less than 36 weeks and were 6 months old or younger at the beginning of the study.

The study did not meet its primary endpoint of preventing medically-attended RSV infections in infants.

The FDA granted Fast Track designation to suptavumab for the prevention of serious lower respiratory tract disease caused by RSV. However, Regeneron plans to discontinue further clinical development of this antibody given the dismal results from the NURSERY study.

We remind investors that the company relies heavily on funding from Sanofi (NYSE:SNY) for its immuno-oncology research and development programs. However, Sanofi had earlier decided not to continue the co-development of fasinumab, suptavumab, and trevogrumab.

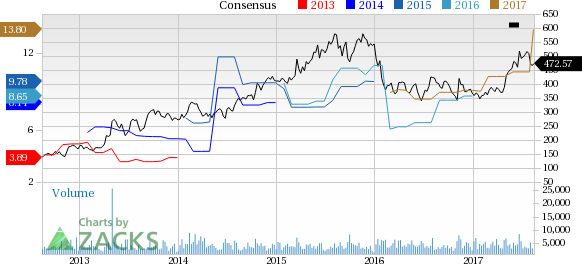

Regeneron’s stock has gained 28.7% year to date outperforming the industry’s 7.1% rally.

Meanwhile, Regeneron’s second-quarter results were impressive as both earnings and sales beat estimates on the back of strong Eylea sales which grabbed additional market share. Regeneron’s key growth driver, Eylea, continues to drive revenues and the company is expanding the drug's label for additional indications. The increase in guidance was also encouraging.

Regeneron has co-developed Eylea with the HealthCare unit of Bayer (DE:BAYGN) AG (OTC:BAYRY) . The FDA’s approval of Dupixent was a major boost to the company’s portfolio and the company is working to expand its label.

Zacks Rank

Regeneron currently carries a Zacks Rank #1 (Strong Buy). Another top-ranked stock in the healthcare sector is Gilead Sciences. Inc. (NASDAQ:GILD) which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rankstocks here.

Gilead’s earnings per share estimates increased from $7.93 to $8.53 for 2017, over last 30days following strong results in the second quarter. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 8.18%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Sanofi (SNY): Free Stock Analysis Report

Bayer AG (BAYRY): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Original post

Zacks Investment Research