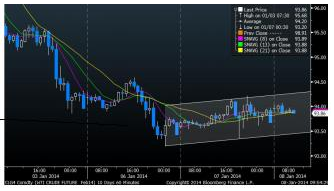

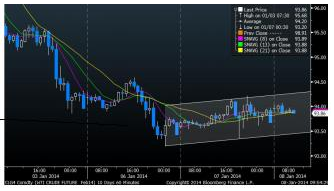

Crude oil price at the NYMEX trading platform finished on a marginal positive note yesterday with the prices recording most of its gains during the US trading hours as markets took positive cues out of US equities and led by severe winter. Lower temperatures pushed the case for a better demand for the commodity in very-short term. Oil prices moved in-line with our view wherein we had sold during the Asian and European hours while recommended to go long on declines. By the time of close, WTI Crude for most active February expiry was standing at $93.65 per barrel, higher by nearly 0.25%. On the otherside, local MCX Crude prices added 0.2% to Rs 5855 per barrel.

On one side US cues provided some support to oil prices in the late evening hours, it was continued to be weighed by concerns over increasing supply from the Middle-east and African region and particularly Libya. This capped any major gains in the commodity during the previous session and is likely to have a similar weight in coming sessions as well.

In other major oil related news form the US, post closure of NYMEX and MCX markets on Tuesday, the private sector major API report its weekly crude inventory report for the period ended 3rd January. As per markets news, the agency said crude stocks fell by 7.3 million barrels last week though optimism over the same was negated by a similar rise in product related stocks. Gasoline inventories jumped by 5.6 million barrels distillate stocks too rose by 5.2 million barrels. It also showed a rise in stocks at the WTI delivery point, Cushing. Product inventories continue to rise as refiners further enhanced their utilization rate to 92.7% levels though off-take or demand continuesto be dim. However, despite the negative cues from the report, oil prices are marginally higher in Asian trade amidst better equities and lower temperatures in the US.

Today evening we have the more important reading from the US Department of Energy which is expected to show if not the same atleat a weekly inventory report on the same lines as reported by the API. The only surprising factor which could play out today evening is the update on the distillate stocks front wherein stocks show a lesser rise or even a decline ahead of anticipation of lower winter temperatures in the US. If that happens we could see some optimism coming back into crude prices in the latter half of trade otherwise overall trade would continue to be range-bound.

In other major global cues, it was a dollar story overnight when trade deficit unexpectedly narrowed. The USD index rose to 80.9. Today we have the ADP employment change number from US and likely that private payrolls may increase by another 200K while it had increased by 215K in the month of November. We believe some kind of response is already felt yesterday and the same scenario may live today.

Coming to crude oil, prices this morning are trading at $93.90 per barrel up by 0.25%. We hold a cautious view today ahead of the DOE weekly petroleum inventory numbers. We believe crude oil stocks might continue to decline while also said above, distillate stocks will be watched carefully. For the day we refrain from selling WTI oil futures contract while suggest taking intraday long positions with strict stop loss for small profits.

On one side US cues provided some support to oil prices in the late evening hours, it was continued to be weighed by concerns over increasing supply from the Middle-east and African region and particularly Libya. This capped any major gains in the commodity during the previous session and is likely to have a similar weight in coming sessions as well.

In other major oil related news form the US, post closure of NYMEX and MCX markets on Tuesday, the private sector major API report its weekly crude inventory report for the period ended 3rd January. As per markets news, the agency said crude stocks fell by 7.3 million barrels last week though optimism over the same was negated by a similar rise in product related stocks. Gasoline inventories jumped by 5.6 million barrels distillate stocks too rose by 5.2 million barrels. It also showed a rise in stocks at the WTI delivery point, Cushing. Product inventories continue to rise as refiners further enhanced their utilization rate to 92.7% levels though off-take or demand continuesto be dim. However, despite the negative cues from the report, oil prices are marginally higher in Asian trade amidst better equities and lower temperatures in the US.

Today evening we have the more important reading from the US Department of Energy which is expected to show if not the same atleat a weekly inventory report on the same lines as reported by the API. The only surprising factor which could play out today evening is the update on the distillate stocks front wherein stocks show a lesser rise or even a decline ahead of anticipation of lower winter temperatures in the US. If that happens we could see some optimism coming back into crude prices in the latter half of trade otherwise overall trade would continue to be range-bound.

In other major global cues, it was a dollar story overnight when trade deficit unexpectedly narrowed. The USD index rose to 80.9. Today we have the ADP employment change number from US and likely that private payrolls may increase by another 200K while it had increased by 215K in the month of November. We believe some kind of response is already felt yesterday and the same scenario may live today.

Coming to crude oil, prices this morning are trading at $93.90 per barrel up by 0.25%. We hold a cautious view today ahead of the DOE weekly petroleum inventory numbers. We believe crude oil stocks might continue to decline while also said above, distillate stocks will be watched carefully. For the day we refrain from selling WTI oil futures contract while suggest taking intraday long positions with strict stop loss for small profits.