RedHill Biopharma (NASDAQ:RDHL) RDHL announced data from a preclinical in vivo study, evaluating its COVID-19 drug Opaganib in kidney inflammation and fibrosis. Data from the study demonstrated that Opaganib achieved efficacy in significantly reducing renal fibrosis in patients with chronic kidney disease (“CKD”) in a well characterized unilateral ureteral obstruction model.

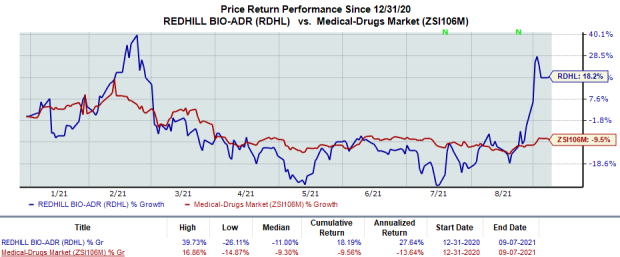

Shares of RedHill have rallied 18.2% so far this year against the industry’s 9.6% decline.

Image Source: Zacks Investment Research

In CKD patients, renal fibrosis is a progressive process that may result in end-stage renal failure. COVID-19 and long COVID patients also have a high risk of kidney damage.

More than 20% of hospitalized COVID patients experience acute renal failure. Acute kidney injury –- a potential consequence of COVID-19 –- results in the inability of the kidneys to be repaired properly. Opaganib inhibits the sphingosine kinase-2, a key enzyme that is part of the process that prevents the kidney from repairing itself and replicating the COVID-19 virus.

It is to be noted that Opaganib, an oral pill drug candidate with dual anti-inflammatory and antiviral activity, is currently being evaluated in a phase II/III study in hospitalized patients with COVID-19. This study has completed treatment and follow up phase, with top-line results expected shortly.

The company recently announced positive preliminary results from a new preclinical study on Opaganib. The drug demonstrated strong inhibition of delta variant of the COVID virus in a human bronchial epithelial cells model, adding to prior data demonstrating potent inhibition of all COVID-19 variants tested to date.

Zacks Rank & Stocks to Consider

RedHill currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the biotech/drug sector include Ironwood Pharmaceuticals IRWD, Regeneron (NASDAQ:REGN) Pharmaceuticals REGN and Repligen (NASDAQ:RGEN) Corporation RGEN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ironwood’s earnings per share estimates for 2021 have increased from $1.00 to $1.18 in the past 60 days. The same for 2022 has risen from $1.18 to $1.72 over the same period. The stock has rallied 10.3% in the year so far.

Regeneron’s earnings per share estimates for 2021 have increased from $49.51 to $54.15 in the past 60 days. The same for 2022 has risen from $41.30 to $44.11 over the same period. The stock has rallied 38.4% in the year so far.

Repligen’s earnings per share estimates for 2021 have increased from $2.26 to $2.76 in the past 60 days. The same for 2022 has risen from $2.56 to $3.02 over the same period. The stock has rallied 54.6% in the year so far.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ironwood Pharmaceuticals, Inc. (IRWD): Free Stock Analysis Report

Repligen Corporation (RGEN): Free Stock Analysis Report

Redhill Biopharma Ltd. (RDHL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research