On 18 October 2019, RedHill announced a strategic investment and in-licensing deal with Cosmo Pharmaceuticals, a European specialty GI pharma and diagnostics company (sales of €66m in 2018). RedHill will receive an exclusive licence for the US rights to a branded antibiotic, Aemcolo (rifamycin), which was approved by the FDA for the treatment of traveller’s diarrhoea in November 2018. In return, RedHill will pay Cosmo the stock equivalent of $12m upfront, a royalty percentage on net sales in the high 20s and commercial milestone payments up to $100m. Cosmo has also agreed to make a $36.3m investment in RedHill at $7/ADS (a 13.5% premium to the prior close; 20% stake after investment). The deal expands RedHill’s specialty GI drug portfolio in the US and strengthens its balance sheet ahead of the expected launch of TALICIA (PDUFA date: 2 November 2019). Our valuation is $556m or $15.8/ADS.

Strategic fit, new largest shareholder

The specific structure of the deal seems to be a strategic fit both companies. Following the transaction RedHill will have cash of $59m (no debt), which provides a higher degree of comfort given it is preparing for a potential launch of TALICIA for H. pylori infection. The newly in-licensed drug, Aemcolo (rifamycin 194mg delayed-released tablets), is a minimally absorbed antibiotic that the FDA approved for traveller’s diarrhoea, so it is a good fit for RedHill’s GI-focused drug portfolio. The drug has not yet been launched in the US, but consensus expects sales of $152m in 2024 (EvaluatePharma). For Cosmo, which is now the largest shareholder, RedHill appears to be the right partner with the right commercial capacity in the US.

Now all eyes are on PDUFA date of 2 November 2019

RedHill is approaching a milestone event with the FDA due to release its assessment of the company’s most advanced, internally developed combination therapy, TALICIA. Based on the data released, we assign a 90% probability of FDA approval due to the clean dataset from the Phase III trials. From a commercial perspective, RedHill is ready with a US salesforce in operation since mid-2017. Please see our previous reports for more detail on the market opportunity.

Valuation: $556m or $15.8 per ADS

Redhill Biopharma Ltd (NASDAQ:RDHL) is a research client of Edison Investment Research Limited

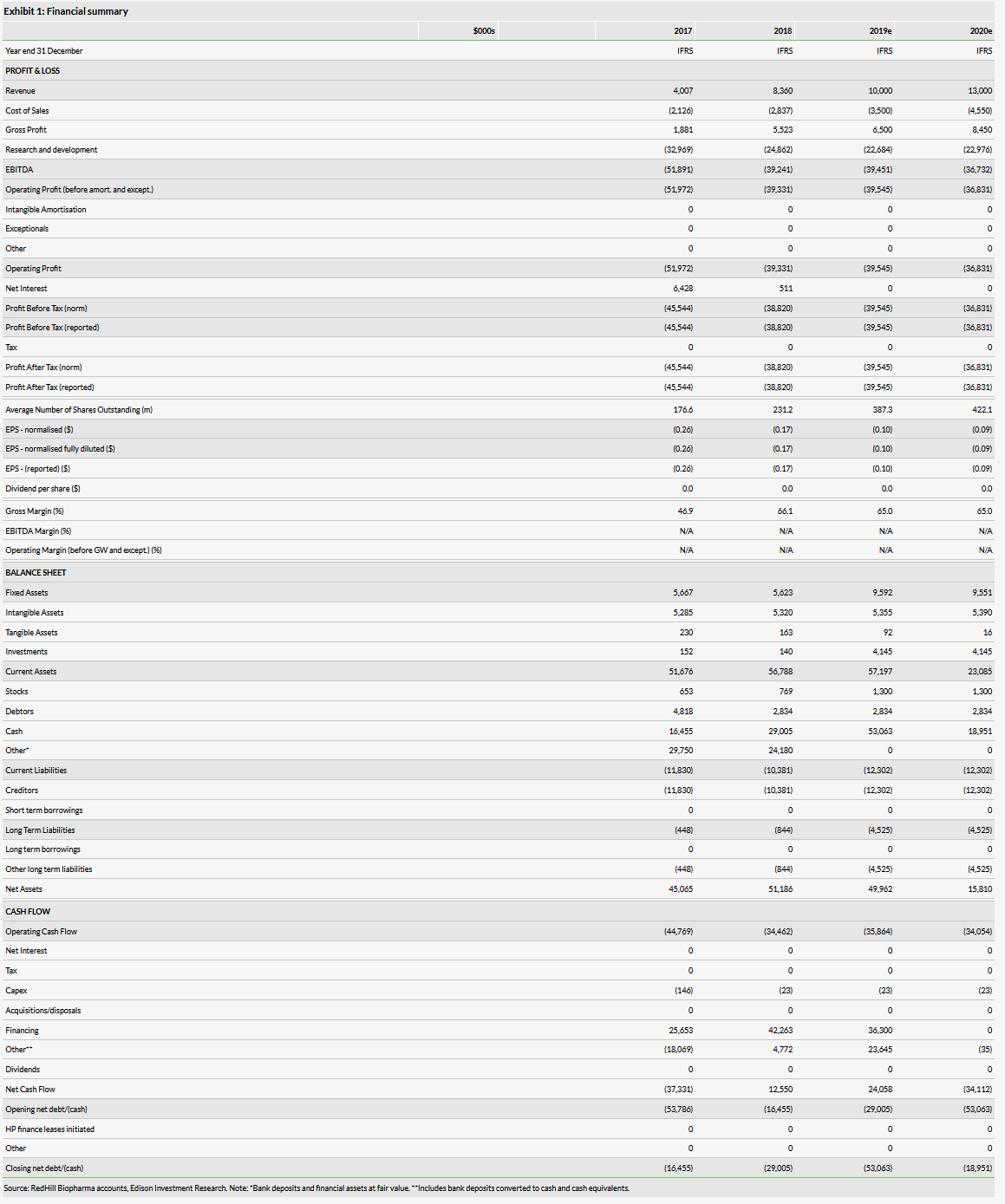

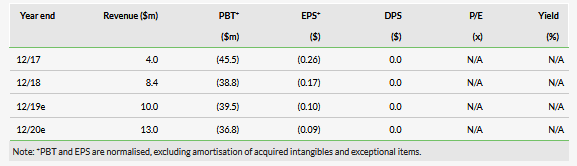

Our RedHill valuation is $556m or $15.8 per ADS, versus $518m or $18.3 per ADS previously. Our absolute valuation is higher because we have included the new investment and rolled our model forward. The valuation per share is slightly lower due to a dilution effect, as our pre-issue valuation per share was higher than the market value. For the time being we make no other changes to our estimates.

Business description

RedHill Biopharma is a speciality company with an R&D pipeline focusing on gastrointestinal (GI) and inflammatory diseases; earlier-stage assets also target various cancers. The most advanced products are TALICIA for H. pylori infection, RHB-104 for Crohn’s disease (CD), RHB-204 for nontuberculous mycobacteria (NTM) infections and BEKINDA for gastroenteritis and IBS-D.