Redhill Biopharma's (NASDAQ:RDHL) strategy to diversify into commercial specialty pharma business has born first fruits with initial sales booked in Q217, in line with previously guided timelines to initiate the marketing activities.

The US organisation is now fully set up and markets two GI products: Donnatal (co-promoted with Concordia Healthcare) and EnteraGam (exclusive licence to sell from Entera Health). We now include the two products in our RedHill valuation, which is increased to $414m or $23.4/ADS. Notably, RedHill recently added a third product, Esomeprazole Strontium, to its US portfolio, which we could potentially add to our valuation assuming successful initiation of promotional activities in coming weeks.

Timely start of the commercial operations

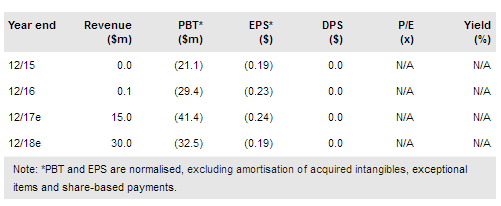

With its Q217 financial results RedHill reported the first sales of $483k from the newly set up US commercial business. This only corresponds to the last two weeks in June, when the company started the marketing activities, therefore we take it as a good start. Gross profit margin was 44%, but it is too early to see whether this is a representative level. Q217 R&D expenses of $8.4m were largely in line with our expectations. G&A costs came in at $1.9m, up from $740k a year ago, while S&M spend was $3.4m, up from $424k. The y-o-y increase in both items was related to the new US business, which is now fully established with all necessary hires.

To read the entire report Please click on the pdf File Below: