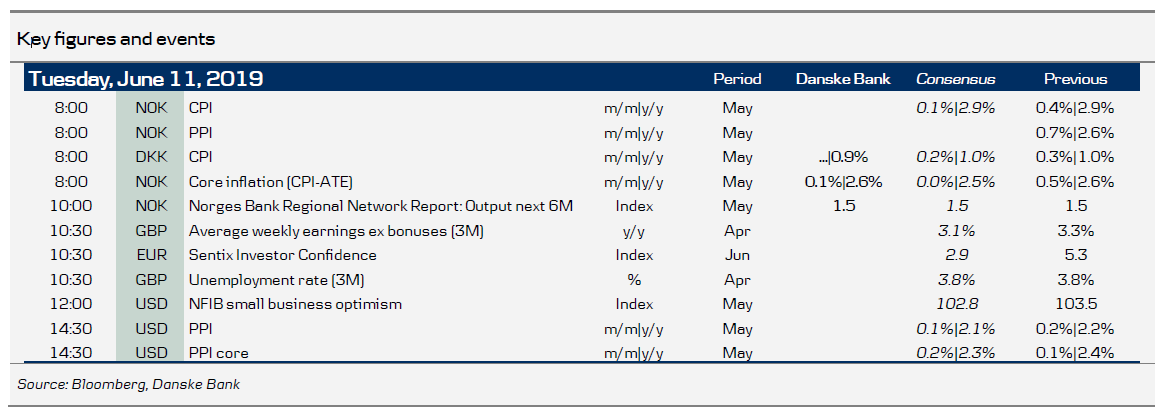

Market movers today

We have a very busy day ahead of us in our core markets with both Norwegian and Danish CPI inflation data out. In Norway, we also get the very important Regional Network Report, which is a key growth indicator for Norges Bank. For more details see the Scandi section overleaf.

The Fed has entered its blackout period ahead of the June meeting but has in our view opened the door for rate cuts in H2 19. We have re-affined our Fed call and now expect a total of 75bp cuts during H2 19. For more details see FOMC Preview: Cutting like it is the 90's to be published later this morning.

In the US, we will monitor the NFIB Small Business Optimism Index for any impact of the escalated trade war on US business confidence; the index has improved in recent months but the recent setback in trade talks may have taken its toll.

In the UK, the montly jobs report is due out. Given the macro data have started to weaken, it is interesting whether there has been an impact on the labour market as well.

Selected market news

Markets shrugged off renewed trade woes between the US and China (more below) as the Trump administration meanwhile announced that it would hold off imposing tariffs on imports from Mexico as the two countries continue to work on an immigration deal. Both Europe and the US were closed for holiday yesterday, but futures moves pointed to mixed trading while sentiment cheered up in the Asian session with notably the Shanghai composite up almost 1.9% at the time of writing. US Treasury yields edged higher across tenors with notably the long end selling off and slightly steepening the curve; the 10Y benchmark yield rose towards the 2.15% level and thus showed further signs of bottoming out. Oil prices may also have troughed for now with Brent crude steady above the USD60/bbl mark. USD has stuck with its weakening trend initiated by an intensified call for Fed to cut rates amid a slowing global economy; EUR/USD holds firm around 1.13.

While Mexican progress may have helped support risk assets, Trump did re-fuel the US-China trade strains as he warned that a new tariff round could result if China's premier Xi fails to meet him around the G20 meeting in Japan late June. The remarks came after Trump over the weekend once again lashed out at the Fed, noting that Chinese politicians have an unfair advantage as they control monetary policy. Separately, USD/CNY jumped yesterday above the 6.93 level after People's Bank of China (PBoC) said there were no 'red lines' for the currency, fuelling speculation that the cross would soon 'crack seven'. Overnight however the PBoC did guide the yuan markedly stronger with the daily fixing.

Last night, we published our updated global view in The Big Picture . Re-escalation of the trade war between China and the US is weighing on global economic outlook and we have lowered our projections for global growth to 3.2% in 2019 and 3.4% in 2020. A modest recovery is projected on the back of a US-China trade deal in H2 2019 and further stimulus by global central banks. But global risks are now clearly skewed to the downside.

Scandi markets

Busy day in Norway, as Norges Bank's regional network report as well as inflation figures are published. The aggregated output index in the RNS has held around 1.5 since the beginning of 2018, pointing to underlying growth in mainland GDP of close to 3%. The positive trend in oil-related industries looks set to continue given the growing optimism seen in the oil investment survey and elsewhere, while traditional exporters should start to feel the effects of the global slowdown. On balance, we expect the aggregated output index to be somewhere between 1.4 and 1.6, corresponding to growth well above trend for the rest of this year. Core inflation has surprised on the upside in recent months and base effects would suggest a further increase in May but we also estimate a clear correction in airfares, leaving core inflation unchanged at 2.6% y/y.

Fixed income markets

Yesterday, global bond yields rose on the back of the trade deal between the US and Mexico. The spread between 10Y Italy and Germany tightened even though most of the EUR government yield curves ‘bear steepens’. However, the Italian curve ‘bear flattens’. The decline in both core- and semi-core EU government bond yields has driven Japanese investors out of French government bonds and into US Treasuries as shown by the investor flow data from Japan, see more in Japanese Investor Flows into Foreign Sovereign Debt for April 2019, 10 June 2019.

However, we doubt that the trade deal between the US and Mexico will make it easier for the US and China to strike a deal. Furthermore, key economic data are still weak, and there is still an abundance of EUR liquidity that needs to be placed in the market. Hence, the hunt for yield is still on, and thus we look for continued spread compression between the periphery and core-EU markets.

In Scandinavia, the focus is on Norway given the release of the regional survey as well as inflation data. The domestic economy is strong, and until recently the interest rate spread between Norway and EU (govts and swaps) have been widening to a historically high level. However, as global central banks have changed their views on global economy this has also affected Norway where we have seen a modest tightening in interest rate spreads to Euroland, despite the strong domestic Norwegian economy. We still believe in a rate hike, and strong data today is expected to lead to wider interest rate spreads to Euroland.

FX markets

It is a very important day for NOK FX as we get the final two key releases ahead of the Norges Bank meeting next week. Domestic data has shown little signs of weakness despite weaker global growth impulses and we expect today’s inflation and regional network survey to show both higher than expected inflation (vs NB’s forecast) and a continued above-trend growth outlook. This in turn should confirm both a rate hike next week (only priced slightly more than 50%) and a continued hiking bias (only slightly more than one full accumulative hike priced for the coming years). If we are right in our calls today, this should underpin higher NOK rates and a moderately stronger NOK. For more on NOK FX and why Norway is ‘different’, see FX Strategy - Why is the NOK so weak?, 28 may 2019.

Our bearish view on the SEK rests to a large extent on the inflation outlook and our dovish take on the Riksbank. The May inflation numbers (this Friday) are likely to bolster this view, given that our inflation estimates are 0.1-0.2 percentage points below the Riksbank and consensus. If we are right, it will weigh on the krona, see inflation preview. Besides data, the SEK will take direction from global risk sentiment, where ’good news’ have tended to be bad news for the krona as it is used as a funding currency.

A string of weak data is becoming a headwind for GBP: yesterday, the monthly tracker for quarterly GDP came in at 0.3% 3m/3m, and industrial production is now at -1.0% y/y. EUR/GBP went higher to now stand around 0.892, and clearly shows that there is now more to the pound than just Brexit news. We expect there could still be some adjustment for macro expectations in the coming month(s).