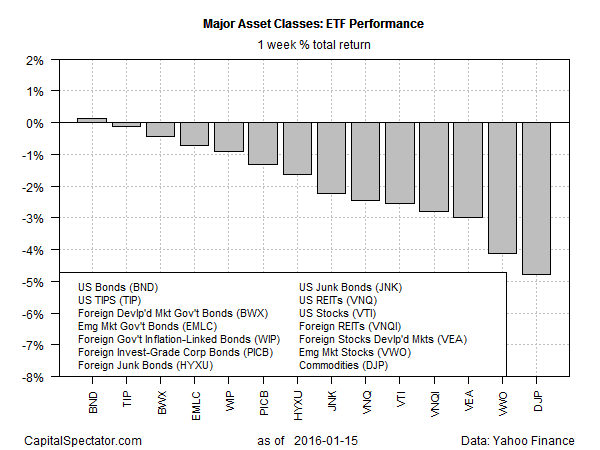

Last week’s selling wave pushed most of the major asset classes into the red for the five trading days through Jan. 15, based on a set of proxy ETFs. For the one-year trailing period, everything has lost ground. Negative momentum, in other words, is in high gear.

Swimming against last week’s red-ink tide: US investment-grade bonds. The Vanguard Total Bond Market ETF (N:BND) inched higher for the five days through Jan. 15, gaining 0.1% on a total return basis. Otherwise, losses in varying degrees prevailed across the board.

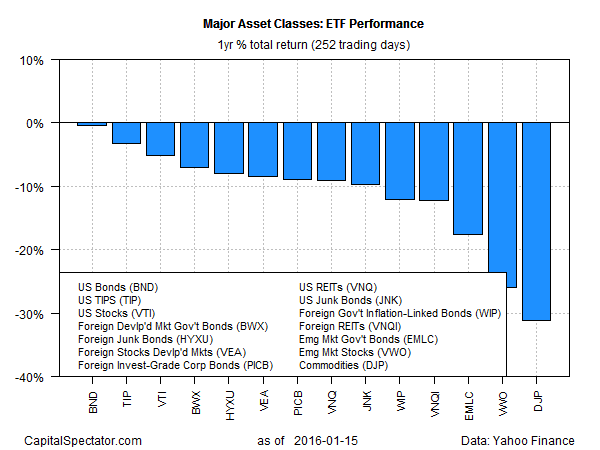

Meanwhile, all the major asset classes have slipped below zero in the total-return column for the trailing one-year period (252 trading days) through Jan. 15. Even the US investment-grade bond space via BND is suffering with a slight loss for this trailing window. The last time BND’s one-year total return was under water: the spring of 2014.

The sight of losses in all the major asset classes for the one-year period is a reminder that asset allocation alone has limits as a risk-management tool at times. It’s a crucial part of portfolio design, but like everything else it’s not perfect. That’s not the same as saying that asset allocation has failed—far from it. But expecting that asset allocation in isolation will provide all your risk-management solutions at all times is expecting too much.

The one exception to that caveat: investors (and institutions) with truly long time horizons and the discipline to look past the periodic volatility spikes in the short term. But that’s an elite club with just a handful of card-carrying members. For everyone else, recent events serve as a wake-up call–again–that asset allocation works best when used as part of a multi-faceted risk-management toolkit.