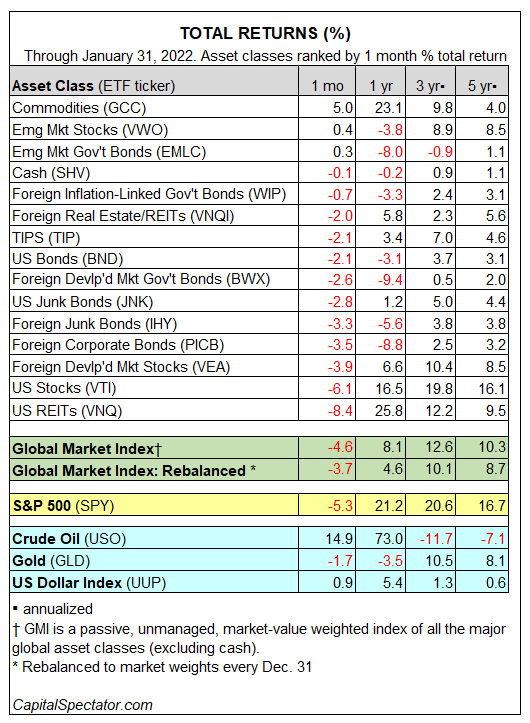

Red ink flowed like wine for most of the major asset classes in January, with some notable exceptions, based on a set of ETFs.

Commodities were the upside outlier last month, offering substantial ballast to sliding prices elsewhere for most of the world’s markets. WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose 5.0% in January.

Stocks (VWO) and bonds (EMLC) in emerging markets also sidestepped January’s selling with modest gains for the month: 0.4% and 0.3%, respectively.

Otherwise, markets tumbled far and wide. The biggest monthly loss for the major asset classes: US real estate investment trusts (REITs) via Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ), which fell 8.4% in January, reversing most its sharp gain in the previous month.

The latest declines have infected one-year results: about half of the major asset classes are now under water for the past 12 months.

The Global Market Index (GMI) was also caught in the selling. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, shed a hefty 4.6% last month – a stark reversal after setting a record high in December.

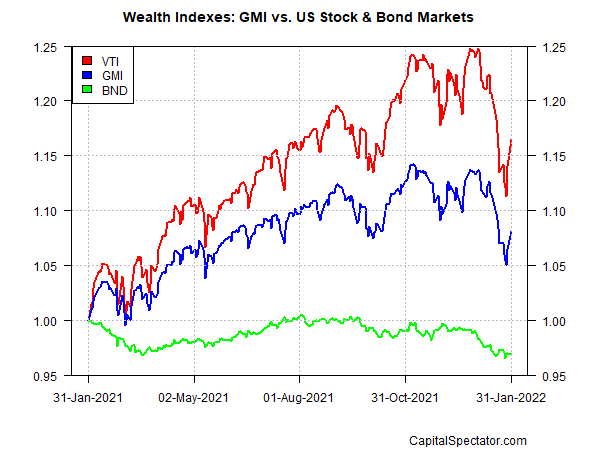

Reviewing GMI’s performance relative to US stocks and bonds over the past year continues to reflect a solid middling performance for this multi-asset-class benchmark (blue line in chart below). US stocks (VTI) earned nearly 17% for the trailing one-year window. By contrast, a broad measure of US bonds—Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND)—fell 3.1%. GMI earned 8.1% for the year ended Jan. 31.