Investing.com’s stocks of the week

Which countries are to blame for the glut of steel and aluminum imports flooding American shores? Sure, the usual suspect – China – looms front and center, but another culprit lurks just in its shadow. (We set the stage in Part One of this article; read here if you missed it.)

The wild card is South Korea, specifically if we look at oil country tubular goods (OCTG) imports. According to the EPI report, Korea’s capacity for producing OCTG – which is entirely for export; they use none of it – increased 21.1% from 2010 and 2012, which enabled 47.4% for export, over 90% of which was US-bound.

As for aluminum, other than the spike in Russian imports, Canada took the biggest piece of the pie (as it has for many years); but the second-largest exporter to the US for the first two months of 2014, according to USGS data: the United Arab Emirates. Since power supply is cheap in the Middle East, primary producers have been ramping up smelter capacity, and of course, there’s nowhere for the excess metal to go – except the US.

What do record steel and aluminum imports have in common? China, Korea, India and other countries’ governments essentially shun economics and unfairly subsidize these industries in myriad ways, creating a huge oversupply bubble.

Price Effect

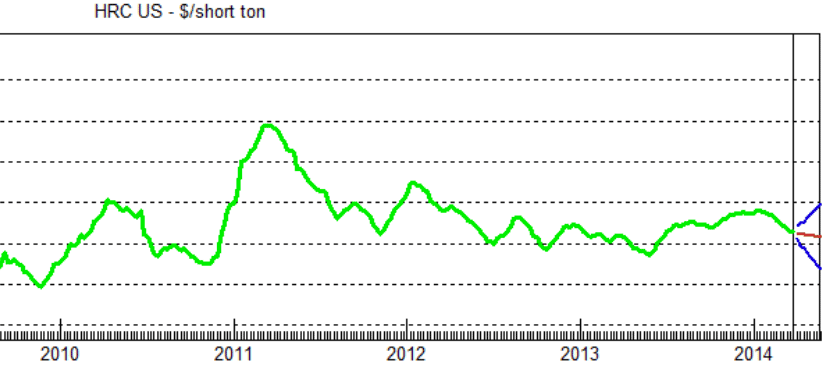

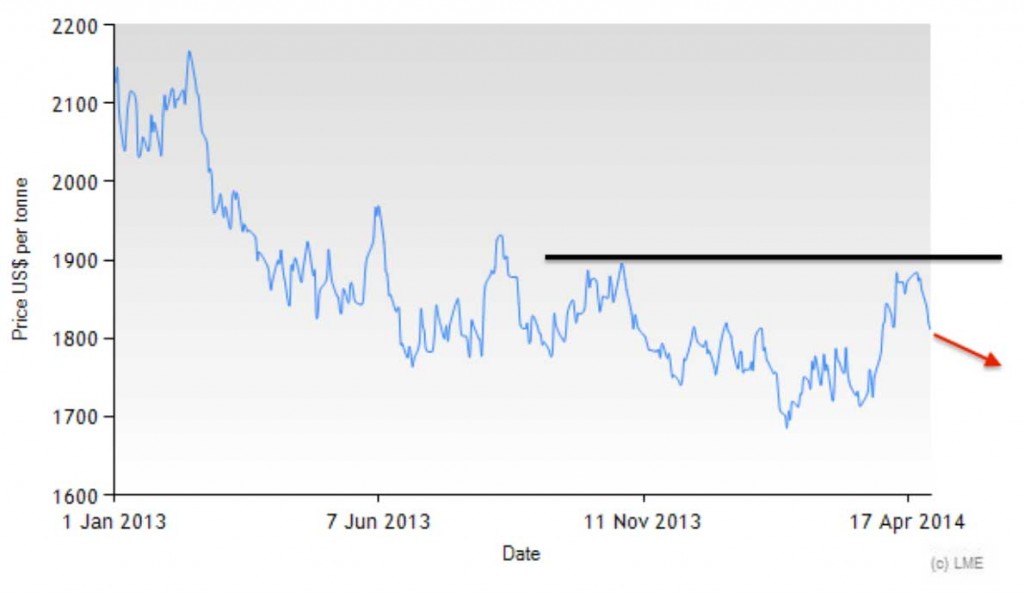

No need to look further than the tale of two charts:

A long-term downtrend affecting US Hot-Rooled Coil (HRC) steel prices since early 2011, threatening to bring prices back down to post-recession levels. Graph by MetalMiner; price from MetalMiner IndX.

The LME aluminum price has also been in a long-term downtrend. Graph: MetalMiner analysis using LME data.

Remedies?

Of course, taking recourse through the International Trade Commission (ITC), US Commerce Department and the World Trade Organization (WTO) to impose stricter duties and tariffs is the main way for US companies to say “We Mean Business.” But even then, it’s not a sure thing; especially since China and others will continue to over-produce as they’re incentivized to do, harming global prices. Not only that, but Commerce/ITC/WTO case determinations take months, and the latest verdicts aren’t due until later this summer – at the earliest.

There’s also hope through the Trans-Pacific Partnership (TPP) negotiations, which MetalMiner has covered extensively before…but that’s also a sticky wicket, as US manufacturers, producers and their attorneys may have a hard time enforcing foreign governments to lessen incentives for their state-owned enterprises through draft language in the trade agreements. For a sense of how strongly some feel about the TPP, look no further than this recent comment from ‘China Watcher’ on the CPA Trade Reform site:

“Doesn’t [excess capacity, primarily in Asia] suggest that a prime objective of the TPP and any other preferential trade arrangement should be to develop and implement effective disciplines on subsidies on manufactured goods? I’m not privileged to know what’s in the TPP drafts, of course. But I’d be willing to bet that there is nothing — not a word — that would improve on the pathetically weak, proven failure that the WTO subsidy rules are. If this is what the administration thinks a 21st century trade agreement is — a perpetuation of proven failure — count me out.”

In the Meantime

Here’s a theoretical question to post to steel and aluminum purchasing organizations: would you – should you – pay a higher price for domestic steel or aluminum, simply to stand in solidarity with the US industry? (US Senator Sherrod Brown [D-Ohio], a proponent of tariffs, has “said U.S. manufacturers should accept slightly higher prices for domestic steel,” according to the WSJ.)

A follow-up question here would be, if the same part or material is available for a US manufacturer to buy, all things being equal, do you decide on price alone, or are there other total-cost considerations (material quality, etc.)?

Tell us what you think – what will you be doing until all these pending trade cases are resolved?

by Taras Berezowsky