Investing.com’s stocks of the week

The USDA projects corn use for the 2015/16 season to increase by 138 million bushels from last year to 13.76 billion bushels, which would be a record if realized. Total corn production for 2015/16 was reduced by 586 million bushels from last year's record. Corn and soybean yields forecasts were brought down to trend line averages and below last year's record output as the USDA is assuming average weather over the growing season this summer.

Little weight into the favorable planting season thus far by the USDA. Although farmers have experienced favorable weather during spring planting, July moisture and temperatures cause 90% of the yield variability in corn.

Corn

U.S. corn production for the 2015/16 crop was projected at 13.63 billion bushels, a decrease of 586 million bushels from last year; the decrease was due to two factors, lower planted area and yield. The average corn yield estimate was 166.8 bushels per acre, compared to last year's record 171.0 bushels per acre. Harvested corn acres for 2015/16 was dropped by 1.4 million acres from last year.

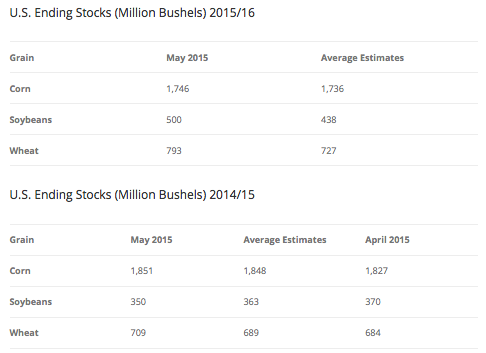

U.S. corn use in 2015/16 was estimated at 13.76 billion bushels, a record if realized. Growth in world demand was estimated to raise exports in 2015/16 by 75 million bushels compared to 2014/15. Corn ending stocks for 2015/16 were estimated at 1.746 billion bushels, a 105 million bushel reduction from last year. The projected season-average price range for corn in 2015/2016 was projected at $3.20 to $3.80 per bushel.

World corn production for 2015/16 was projected at 989.8 million tons, a decrease from last year due to the expected smaller U.S. crop. Global corn consumption was estimated at a record 990.4 million tons with increases from China, Brazil, Saudi Arabia, Argentina, Egypt, Canada, India, Indonesia, Iran and Mexico.

Soybeans

U.S. soybeans production for 2015/16 was estimated at 3,850 million bushels, a reduction of 119 million bushels from last year due to lower yields. Soybean average yield is projected at 46.0 bushels per acre, a 1.8 bushel drop from last year. Soybean exports for the 2015/16 marketing year are projected to drop by 25 million bushels from 2014/15 due to competition from South America.

Ending stocks for 2015/16 were estimated at 500 million bushels, an increase of 150 million bushels from last year. The U.S. season-average price forecast for soybeans in 2015/2016 was projected at $8.25 to $9.75 per bushel.

Global soybean production was projected at 317.3 million tons for 2014/15, a slight increase from last month. Brazil was expecting to produce a record 97.0 million tons, a 2.5 million ton increase from last month.

Wheat

U.S. wheat ending stocks for 2015/16 were increased by 84 million bushels to 793 million, the highest level since 2010/11. Increases in exports, feed and residual use, and food use were more than offset by a sharp increase in production. Wheat exports were increased from last year, but were still well below their five-year average due to increased supplies in other major global exporters.

Global wheat production for 2015/16 was reported at 718.9 million tons, the second highest level on record, but foreign wheat production was 9.2 million tons. Reductions reported from the EU, India, Russia and Ukraine more than offset increases reported from China, Turkey, Morocco, Australia, Iran and Syria. Continued conflict in eastern Europe has caused major planting delays in Ukraine. Projected 2015/2016 season-average price was reported at $4.50 to $5.50 per bushel.

Outlook

Farmers have shown early confidence in the 2015/16 crop. The dry spring weather allowed farmers to get into their fields ahead of schedule and start planting as many as three weeks earlier than last year. The USDA reported corn, soybean and wheat planting progress have continued to extend their lead on the five-year averages for their respective Crop Progress estimates.

The 90-day forecast from the National Oceanic and Atmospheric Association shows average precipitation and temperature over the major crop growing areas of the U.S. If this holds true, yield expectations for the 2015/16 season should continue to increase. It is still too early in the season to make a judgment on the true potential of 2015/16 crop, but the early confidence should cause further downward pressure on grain prices in the short-term.