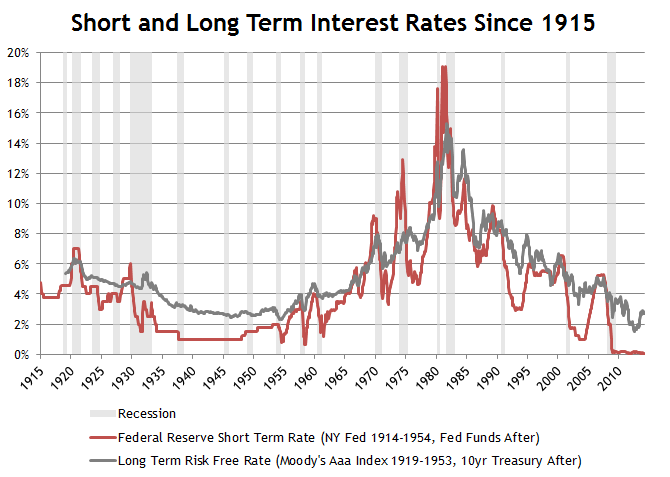

In the past an inverted yield curve has been one of the best indicators of an impending recession. An inverted yield curve occurs when short term interest rates exceed long term interest rates. For the last 50 years, almost every time that the yield curve has inverted, a recession started shortly thereafter, and there has not been a recession without an inverted yield curve over that time frame.

The yield curve is not inverted today, which is one reason that some have said that a near term recession is unlikely. However, the current economic expansion has lasted longer than every expansion except for five others, so it shouldn’t be crazy to think that a recession could happen sooner rather than later.

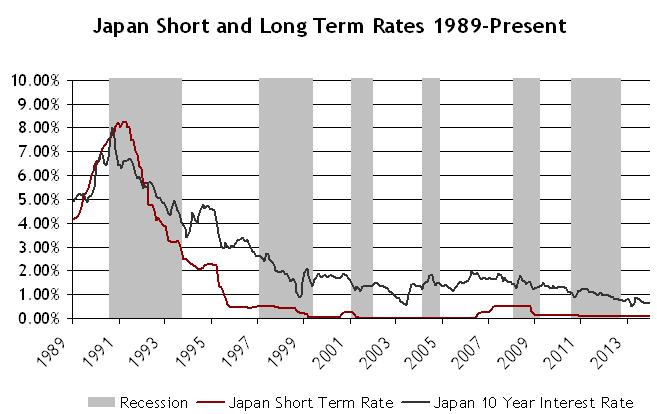

Importantly, looking at history, recessions have happened without inverted yield curves in the past. Japan has had five recessions in the last 20 years without an inverted yield curve, and the US had six recessions without an inverted yield curve between 1935 and 1965.

The common denominator between all of these non-inverted-yield-curve recessions is that they happened at low interest rates. That implies that central banks have the power to prevent the yield curve from inverting, but low rates do not appear to be in and of themselves enough to prevent recession.

As the Fed looks like it will raise rates in 2015, it’s worth noting that at low interest rates, there does appear to be a tendency for recessions to start when short term rates are raised. That’s not always the case though. The US did have recessions in 1937 and 1945 without raising short term rates and two of Japan’s five recessions at ZIRP came without any change to short term rates as well.

A note on the data series: I’ve combined two data sets for each US interest rate series. The long term series is the Moody’s Aaa index from 1919-1953, because the Fed doesn’t have a data set for treasury yields which goes back that far. The spread between Moody’s Aaa and the 10 year yield is small up through the 80s though, so I think it’s a good proxy for long term risk free rates. The short term data set combines the effective fed funds rate (1954-present) with the NY Fed’s rediscount rate (1914-1954). The FOMC was established in 1935. Prior to that short term rates were set regionally by individual Fed branches. Up until that time the New York Fed was viewed as the most powerful regional bank and set the tone for the rest of the regions, so its interest rate was effectively the short term interest rate.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.