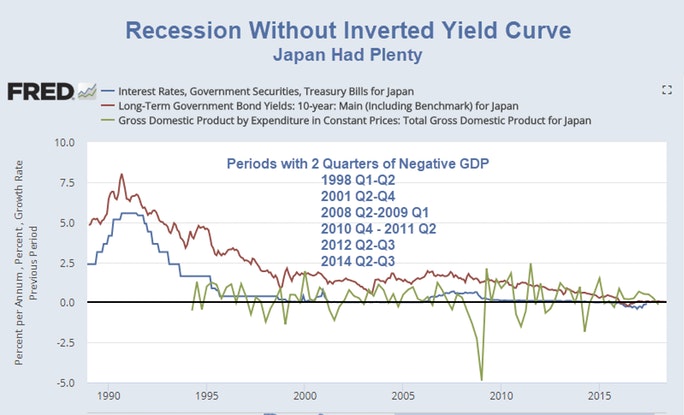

Japan had six consecutive recessions without an inverted yield curve. There is no reason it can't happen here.

The above chart shows the last six recessions. I do not believe any points of the curve inverted but I only show short-term rates and the 10-year rate. I believe portions of the yield curve did invert in the 1989-1990 recession when the Japanese stock market bubble burst.

On My Radar

I received an "On My Radar" email from Steve Blumenthal at CMG Wealth on the Risks Inherent at the End of a Long-Term Debt Supercycle. Here's the pertinent clip.

“One last thing – as for this debate about the yield curve needing to invert to warrant a recession call, the reality is that at the ultra-low levels of rates, bloated central bank balance sheets that are in the process of gradually unwinding, and in the face of record volumes of debt outstanding, you do not need to see curve inversion. Japan is the template – each of its last four recessions occurred with the yield curve still positively sloped!

The U.S. bubble is not in real estate credit this cycle, but the chart of corporate debt to GDP today looks a whole lot like the chart of mortgage debt/GDP just over a decade ago. There will be a price to be paid, in a tightening Fed policy environment, for creating a bubble condition such that half of the investment-grade corporate bond market today is one notch away from being downgraded to junk.

According to Moody’s, leveraged loan covenants are now the weakest they have ever been. Expect to hear the terms “fallen angels” and “destruction of value” in the next year or two (perhaps why having some dry powder on hand right now is going to pay off big time as the credit cycle shifts into reverse).”

The source of that quote is actually David Rosenberg, “Breakfast with Dave” (July 26, 2018).

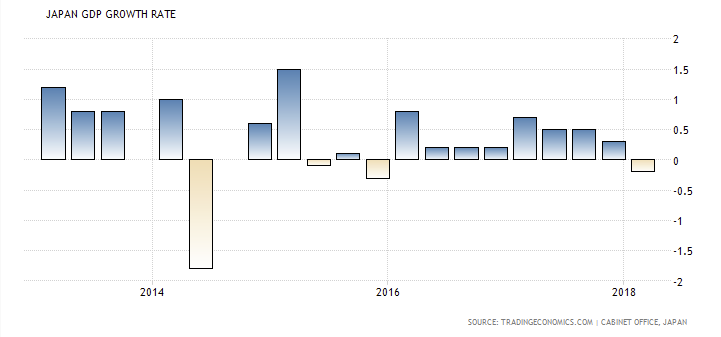

Japan Nearing Recession Again

In the first quarter of 2018, Japanese GDP was -0.2%.

Don't think that cannot happen here.