Market movers ahead

In the US, we expect manufacturing PMI to tick below 50. On the Fed, we will look out for the FOMC minutes and the Jackson Hole Conference.

In the euro area, the fragile manufacturing sector is not about to recover. We expect a further plunge in PMIs here. We will also watch the ECB minutes.

In Sweden, we will look out for the unemployment figures. We expect a sharp but probably temporary drop-back in unemployment.

In Norway, we expect the Q3 investment survey to confirm that oil investments will continue to boost the economy.

Weekly wrap-up

The US 10-year government bond yield fell below the two-year yield, leading to the first inversion of the yield curve in 12 years.

The US delayed the planned tariff increase on China from 1 September to 15 December, done mainly so as not to hurt Christmas sales.

Economic data was mixed this week. The German ZEW survey fell to the lowest level since 2011. On the other hand, US retail sales surprised on the upside.

Hong Kong protests escalated this week. Further escalation could trigger Beijing intervention, which could add to current market woes.

Market movers

Global

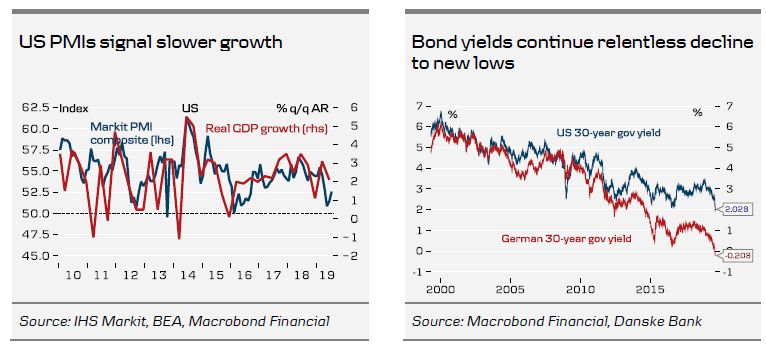

In the US, we have an interesting week ahead of us, as investors have grown increasingly concerned about the US macro outlook. On Thursday, the preliminary Markit PMIs for August and the leading index are due out. We expect the Markit manufacturing PMI to fall below the 50 threshold in line with the weakness seen in the manufacturing in the rest of the world but the service PMI is likely to hold up. Overall, it would signal US GDP growth is slowing.

On Wednesday, the FOMC minutes from the July meeting are due out. A lot has happened since the meeting so the minutes may seem hawkish in the current context. There are not scheduled any Fed speeches (it seems as if they may be on summer holiday) but the Jackson Hole conference (Thursday-Saturday) is interesting. The theme is ‘Challenges for Monetary Policy’ which suggests it will focus on the same things as in the FOMC review of the current monetary policy framework. The agenda has not been published yet, unfortunately.

In the euro area the most important data items next week are the PMI prints from Germany and the euro area on Thursday. In July, the already fragile euro area manufacturing sector continued to plunge to 46.5 (a 6.5 year low) while the service sector held broadly steady at 53.2. Weak external demand and geopolitical risks still haunt the manufacturing sector while domestic demand underpins the service sector, albeit companies have become more cautious about investment and also started to reassess staff levels. Since none of these factors have faded since July, but actually turned worse, we expect the manufacturing PMI’s to continue to fall to 46.2 and see scope for a small deterioration in the service sector print to 52.9.

The ECB minutes on Thursday will also gain attention. The discussion of the new policy measures will be scrutinised, but we doubt much flavour in terms of operational details will be revealed as ‘tasked committees’ are working on this.

On Friday, we get the German Ifo print. We expect both the current situation print to fall, in line with the weak macro data, and the expectations component to fall on the back of the ongoing geopolitical uncertainties.

In the UK, we have a quiet week ahead of us without any really interesting data releases. Focus remains on Brexit and whether the anti-hard Brexiteers can find a common way forward to block PM Boris Johnson from delivering a no deal Brexit.

In Japan, we have several key figures published next week. On Monday, July export figures tick in. Exports recovered slightly in June but have generally been weak for more than a year now. PMIs are not indicating any immediate relief here and new export orders remained weak in July, pointing to another tough month for Japanese exporters. On Thursday, we will know more, when the July flash PMIs tick in – not just for the manufacturing sector but also the new flash service PMIs. Reflecting continued solid domestic demand, service PMIs have hovered around 52 this year.

Then on Friday, we get July inflation figures. CPI excluding fresh food stood at 0.6% y/y in June. Reductions in mobile charges by Japan's major mobile carriers will weigh heavily on inflation in the year to come and lower energy prices will create further downward pressure.

There are no market movers released in China next week. The focus will continue to be on the US-China trade war, but we do not expect any big news on this front on this side of the planned face to face talks in Washington scheduled for early September.

Scandi

Denmark’s central statistics bureau, Statistics Denmark, is scheduled to publish figures for wage earner employment in June on Wednesday. The first half of the year generally saw employment grow, but the latest figures showed signs of weakness and negative growth for the first time since March 2013. Whether this is because we are approaching full employment, because the global slowdown is beginning to affect the Danish labour market, or the dip was a one-off event, will become clearer when the new figures arrive.

August’s consumer confidence figures are due on Thursday. Again the latest figures here painted a slightly disconcerting picture, as they fell to 2.9, which was the lowest level since 2012. The Danish economy still appears robust, so the low level of expectations is very probably due to the prevailing global uncertainties that will likely also have an effect going forward. We expect August’s consumer confidence to correct slightly from last month’s very large fall and come in at around 3.5, which would continue to reflect the global uncertainty but also that the Danish economy, despite everything, remains in fine shape.

Swedish July unemployment is the focal point of the week. We expect a sharp but probably temporary drop-back in unemployment to 5.7 %, down from 7.6 % in June.

The seasonally adjusted unemployment rate will show a more modest decline to 6.2 % from 6.6 % in June. Should this not materialise it is probably a sign of a faster and more significant deterioration of the labour market. Note that the seasonally adjusted employment level has been declining over the past six months, the first time since the 2008-09 financial crisis. Both the activity and the employment rates have turned down from record high levels and there are abundant signs that employment will continue to fall going forward, such as falling jobs vacancies and plunging overtime hours (the latter actually shows a bigger drop than during the 2008-09 crisis).

In Norway, much of the reason why the economy seems to have coped so well with the global downturn to date is the strong contribution to demand from oil investment on the Norwegian continental shelf. The Q2 investment survey back in May indicated growth of around 15% this year after allowing for the surge in late 2018. The outlook for 2020 is naturally much more uncertain, but the May survey at the very least did not signal a marked drop in investment next year and actually pointed to further growth. We do not anticipate any major changes to this picture in the Q3 survey, which should therefore confirm that oil investment will continue to boost the economy for the rest of this year and have a moderate positive effect next year too.

To read the entire report Please click on the pdf File Below..