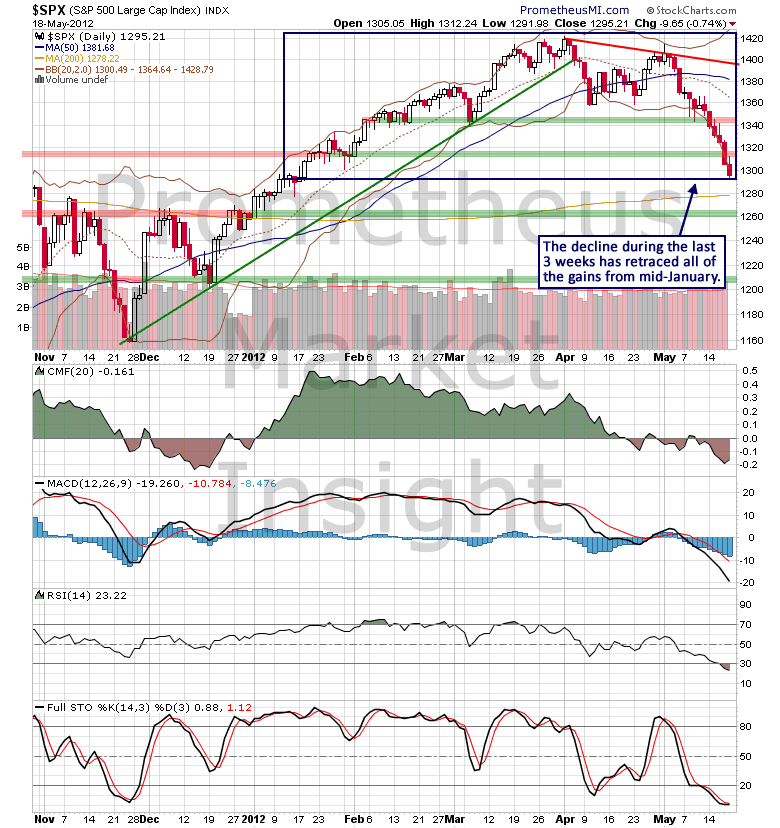

During the last three weeks, the S&P 500 index has declined 8.5 percent, retracing all of the gains since the middle of January.

As usual, the violent drop was unforeseen by the consensus view.

In March, the vast majority of mainstream analysts projected additional gains for stocks using common forecasting methodologies that rely on the Fed model and forward earnings estimates. Unfortunately, these techniques have a poor long-term performance history, especially near economic and market inflection points.

Only a few analysts, such as fund manager John Hussman, had been warning that stocks were poised for a violent decline. The following chart from a recent weekly commentary at the Hussman Funds web site displays time periods during which the stock market has carried a comparable amount of risk during the last 30 years.

Every time this high-risk syndrome has appeared since 1980, a violent decline has followed. For our part, in March, our computer models indicated that the risk/reward profile of the stock market had entered the worst one percentile of the past 80 years, suggesting that the outlook was poor from both long-term and short-term perspectives. The severe drop during the last three weeks is precisely the type of violent decline that we had been expecting.

As always, it is important to remember that there are no certainties when it comes to market forecasting. However, long-term success as a market participant does not require absolute certainty. If you are able to reliably identify the most likely possibilities, along with their approximate probabilities, your trades and investments will be consistently profitable.

A strategy of aligning yourself with the most likely scenarios, while protecting yourself from the least likely ones, will invariably produce long-term success. The key, of course, is the accurate identification of those possibilities and probabilities. Most mainstream analysts simply assume those popular, simplistic methodologies are reliable and fail to perform the necessary due diligence before trusting in their validity.

Every forecasting technique should be back-tested with as much historical data as possible in order to gauge its statistical accuracy. History does not repeat itself, but it certainly does rhyme due to the cyclical nature of economic development, so many market cycles should be analyzed when considering the relative merit of any given methodology.

For example, the computer models that we use to measure the health of the secular and cyclical trends in the stock market analyze a large basket of fundamental, internal, technical and sentiment data. After these models were designed, they were tested using market data going back to the 1920s, covering five secular trends and 16 cyclical trends. The back-testing process indicated that our long-term market forecasting methodology was highly reliable, as it correctly predicted every change in the secular trend and more than 90 percent of the changes in the cyclical trend since 1929.

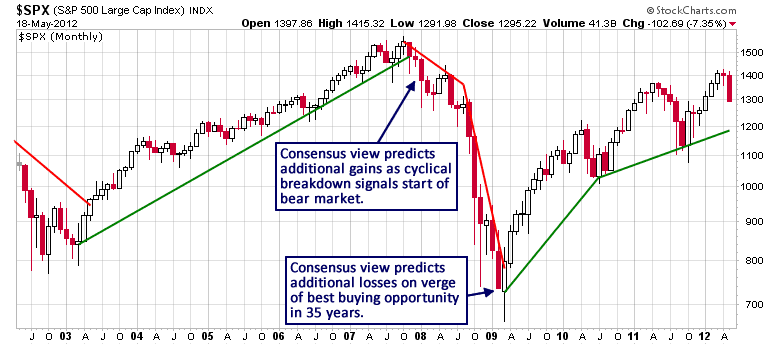

More importantly, that historical reliability has translated into accurate predictions during the last ten years. At the beginning of 2008, when the mainstream view predicted a continuation of the bull market from 2003, our computer models signaled the highly likely start of a severe bear market. One year later, when the mainstream view foresaw additional losses following the market crash, our analysis suggested that we were on the verge of the best cyclical buying opportunity in a generation.

Of course, it is much too early to conclude with a useful degree of statistical confidence that a new cyclical bear market is in progress, but it is important to note that the same mainstream methodologies that were forecasting additional strength in early 2008 and additional weakness in 2009 were predicting substantial additional gains in March of this year.

Granted, it is certainly not easy to maintain a contrarian view at likely long-term inflection points. When many highly intelligent people insist that you are wrong, it is natural to question your beliefs and outlook. That is precisely why it is critical to base your forecasts on a highly reliable methodology that has been tested with as much historical data as possible. A time-tested, proven system enables you to focus on the important data and resist the emotional impulses that encourage you to join the crowd at the worst possible times.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Recent Stock Market Plunge Was Highly Likely

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.